Spreads

Spreads

Spreads

Spreads

Spreads

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.

In a week marked by mixed market performance, the S&P 500 soared to a new closing record, while the Nasdaq faced challenges due to Tesla’s post-earnings decline. Positive economic indicators, including robust U.S. GDP growth and encouraging inflation data, influenced market optimism. Despite the Federal Reserve’s interest rate hikes, a healthy balance of non-inflationary growth was observed. Notably, IBM’s stellar performance offset Tesla’s impact. In the currency market, the dollar index strengthened amid evidence of the U.S. outperforming Europe economically.

The stock market exhibited mixed performance as the S&P 500 rose for the sixth consecutive day, setting another all-time closing record at 4,894.16. The Dow Jones Industrial Average also climbed by 0.64%, reaching 38,049.13 points. However, the Nasdaq Composite only increased by 0.18%, hindered by a post-earnings decline in Tesla shares. Despite the overall positive trend, Tesla’s disappointing fourth-quarter results led to a more than 12% drop in its stock, impacting the broader market. The technology-heavy Nasdaq, nevertheless, outperformed with a 1.3% weekly gain, while the S&P 500 and Dow posted increases of 1.1% and 0.5%, respectively.

The market was influenced by positive economic indicators, including the U.S. economy’s robust 3.3% growth rate in the fourth quarter, surpassing economists’ expectations of 2%. Additionally, encouraging data on inflation, with a 2% gain in the personal consumption expenditures price index (excluding food and energy), contributed to market optimism. Despite the Federal Reserve’s interest rate hikes, the data reflected a healthy mix of non-inflationary growth. Notably, IBM’s strong performance, with a more than 9% jump in its stock after beating analysts’ predictions for adjusted earnings and revenue, counterbalanced the negative impact of Tesla’s decline on the overall market. With over one-fifth of S&P 500 companies reporting financials this earnings season, nearly 74% have surpassed Wall Street expectations, according to FactSet.

Data by Bloomberg

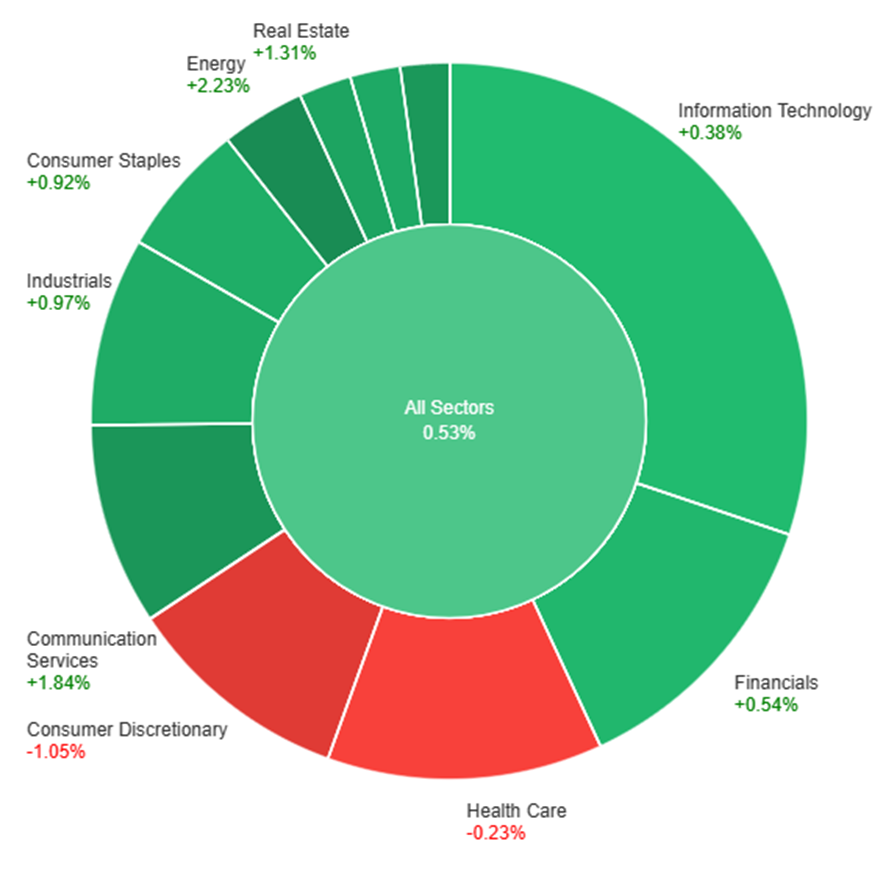

On Thursday, the overall market showed a positive trend with a gain of 0.53%. The Energy sector experienced the highest increase, surging by 2.23%, followed by Communication Services with a rise of 1.84%, and Utilities registering a gain of 1.79%. Real Estate also contributed to the upward movement, advancing by 1.31%, while Materials and Industrials increased by 1.09% and 0.97%, respectively. Consumer Staples and Financials showed modest gains of 0.92% and 0.54%, while Information Technology and Health Care had more conservative increases of 0.38% and a slight decrease of -0.23%, respectively. However, Consumer Discretionary recorded a decline of -1.05% on Thursday.

In the currency market updates, the dollar index demonstrated strength, advancing by 0.3% as fresh evidence emerged showcasing the robust performance of the U.S. economy compared to Europe’s. The U.S. Q4 GDP growth exceeded expectations at 3.3%, while Germany’s Ifo data hinted at a lingering recession, and the UK experienced a significant decline in retail sales. The EUR/USD pair fell by 0.43%, despite the European Central Bank (ECB) opting to delay a rate cut, providing no clear guidance on unwinding its substantial rate-hiking cycle. The lack of clarity on when the eurozone inflation downtrend will prompt a shift in ECB policy raises concerns, especially if the economic situation worsens.

Amidst the data-driven decisions of central banks, the focus on Friday will be on the Federal Reserve’s preferred core Personal Consumption Expenditures (PCE) update. As the ECB, Fed, and Bank of England (BoE) navigate their monetary policies based on economic data, the currency market is witnessing fluctuations. USD/JPY rose by 0.14% as the Bank of Japan (BoJ) meeting on Tuesday left the potential for a rate hike in April. However, the Federal Reserve’s March decision remains uncertain. Other economic indicators, such as Tokyo CPI and U.S. core PCE, are anticipated to influence market dynamics, while geopolitical factors continue to impact oil prices and European natural gas trends.

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| USD | Core PCE Price Index m/m | 21:30 | 0.2% |

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.