Spreads

Spreads

Spreads

Spreads

Spreads

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.

European stocks faced a subdued start as U.S. markets remained closed, and the Stoxx 600 index ended down 0.5%, with travel stocks climbing 0.9% and household goods falling 1%. The German economy contracted by 0.3% in 2023 due to factors like high inflation and weakened demand. Meanwhile, the World Economic Forum in Davos, themed “Rebuilding Trust,” brought together global leaders to discuss pressing issues. The currency market saw the US dollar strengthen, impacting the DXY and influencing the EUR/USD pair, while GBP/USD maintained a selling bias. The Japanese yen experienced a reversal, and AUD/USD faced downward pressure. USD/CAD registered gains amid risk-off sentiment. Geopolitical concerns supported modest gains in Gold and Silver. Tuesday’s focus includes Germany’s economic releases and critical Canadian inflation figures.

U.S. markets were closed on Monday, contributing to a subdued start for European stocks as investors geared up for the World Economic Forum in Davos, Switzerland. The Stoxx 600 index ended down 0.5%, with major bourses and most sectors in negative territory. Travel stocks, however, climbed 0.9% while household goods fell 1%. The German economy contracted by 0.3% in 2023, attributed to factors such as high inflation, rising interest rates, and weakened domestic and foreign demand, according to initial figures from the National Statistics Agency. Meanwhile, China’s market rebounded as the central bank kept its medium-term policy loan rate unchanged.

This year’s World Economic Forum, themed “Rebuilding Trust,” is scheduled from Jan. 14-19. The global summit in Davos will bring together business and political leaders to discuss pressing economic and geopolitical issues. Key topics expected to top the agenda include global trade, inflation, supply chains, technological change, and conflicts in the Middle East and Ukraine. Notable attendees include China’s second-in-command Li Qiang and French President Emmanuel Macron, both set to deliver special addresses during the event.

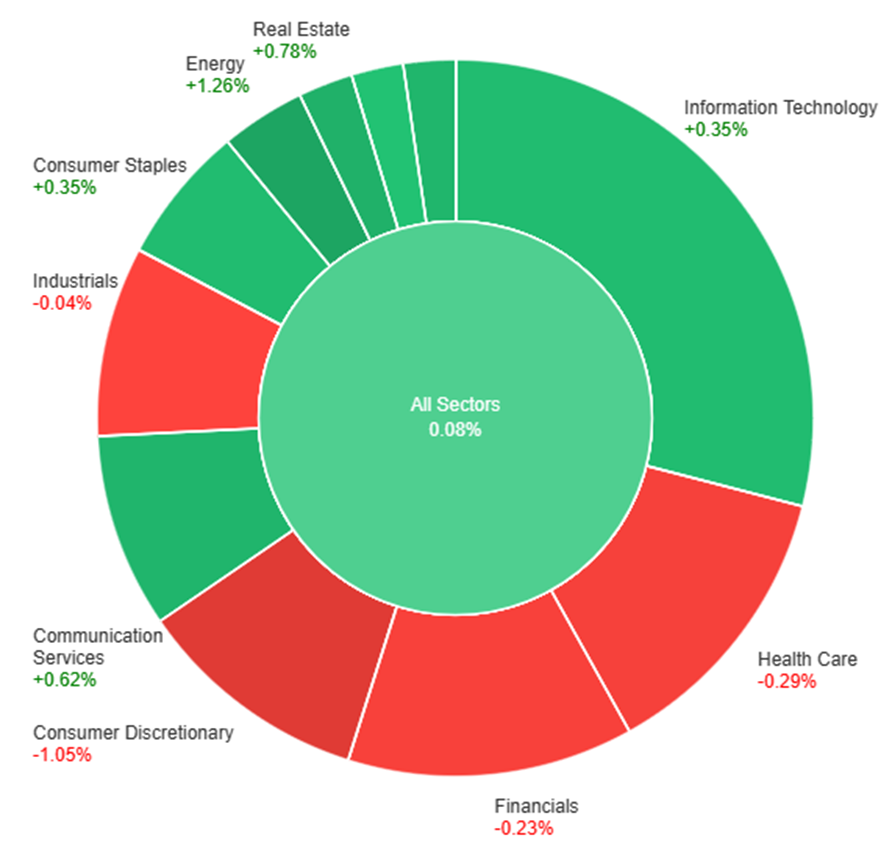

Data by Bloomberg

As the US market closed on Monday, the latest updates were from Friday, revealing a modest overall market increase of 0.08%. The Energy sector performed notably well with a gain of 1.26%, followed by Real Estate at 0.78%, and Communication Services at 0.62%. Utilities and Information Technology both contributed positively with increases of 0.59% and 0.35%, respectively. However, some sectors experienced declines, with Consumer Discretionary leading the losses at -1.05%, followed by Health Care at -0.29%. Industrials and Financials also dipped slightly with decreases of -0.04% and -0.23%, respectively. Overall, the market displayed a mixed performance across sectors on Friday.

The currency market experienced notable developments as the demand for the US dollar (USD) strengthened, propelling the USD Index (DXY) upward due to renewed risk aversion influenced by geopolitical concerns, particularly in the Middle East. The DXY continued its consolidative trend since the beginning of the year. Meanwhile, the EUR/USD pair saw a rebound from daily lows near 1.0930 to settle around 1.0950, supported by marginal gains and a recovery in German yields. ECB policymakers’ comments ruling out near-term rate cuts contributed to the bounce in the Euro. Germany’s upcoming releases of the final December CPI, Economic Sentiment by the ZEW Institute, and a speech by the Bundesbank’s J. Nagel are anticipated to play a pivotal role in the currency’s movements.

In contrast, GBP/USD maintained a selling bias amid a greenback rebound, with a focus on the impending key labor market report and a speech by BoE Governor A. Bailey. The Japanese yen (JPY) experienced a reversal in USD/JPY as it revisited the proximity of the 146.00 barrier after two sessions of losses. The Australian dollar (AUD/USD) faced persistent downward pressure, testing the crucial zone around 0.6650. In the Asian trading hours, Westpac’s release of the monthly gauge of Consumer Confidence for January is expected to impact the AUD/USD pair. USD/CAD registered its third consecutive session of gains, reaching a new five-week high near 1.3450, driven by the risk-off sentiment in the USD and the bearish tone in crude oil prices. The Canadian Dollar is anticipated to take center stage on Tuesday with critical inflation figures for December. Lastly, modest gains in Gold and Silver were supported by heightened geopolitical concerns and the resulting risk-off sentiment.

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| GBP | Claimant Count Change | 15:00 | 18.1K |

| CAD | Consumer Price Index m/m | 21:30 | -0.3% |

| USD | Empire State Manufacturing Index | 21:30 | -4.9 |

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.