Spreads

Spreads

Spreads

Spreads

Spreads

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.

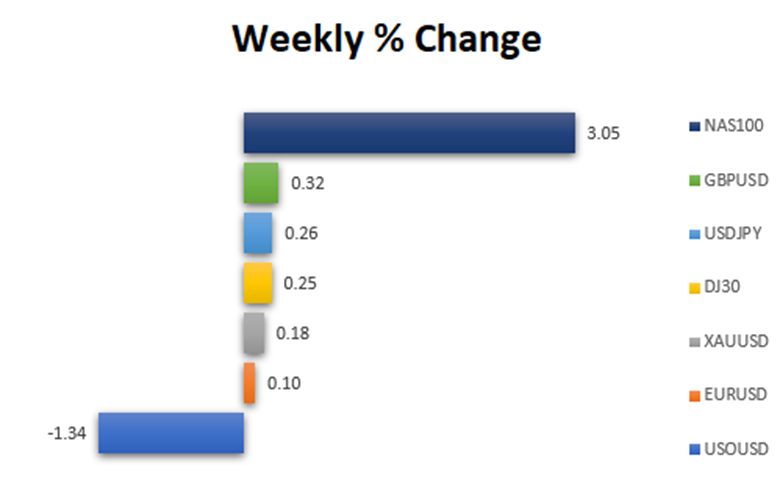

The Dollar Index experienced a retreat in its weekly gains as U.S. producer prices unexpectedly fell in December, raising speculation about an imminent U.S. rate cut. Despite the decline, the index saw a daily increase, driven by safety buying amid U.S. and British military actions in Yemen. The Producer Price Index for final demand recorded a 0.1% dip last month, reinforcing expectations of lower inflation ahead and prompting traders to augment their bets on an upcoming rate cut. Fed funds futures now indicate a 79% likelihood of a March rate cut, up from 73% the previous day. Traders maintained this stance despite Thursday’s consumer price inflation data surpassing economists’ expectations and a robust December jobs report, which revealed mixed underlying details. Closing the week, the Dollar Index concluded with a 0.19% gain.

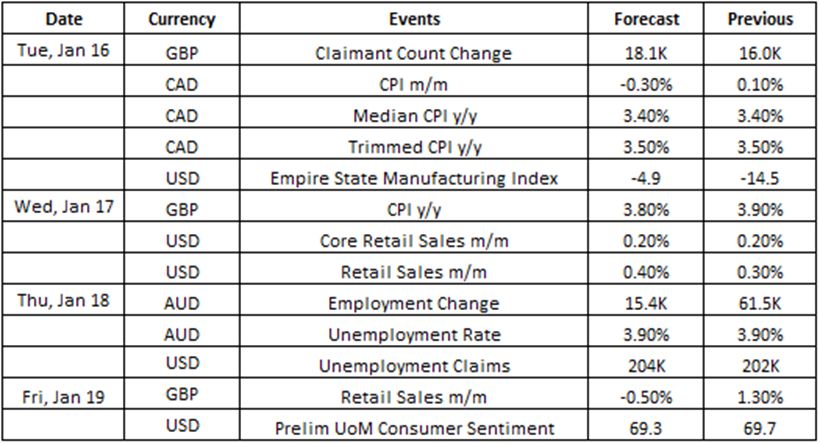

Source: VT Markets Economic Calendar

In the fast-paced world of trading, staying vigilant and well-informed is paramount for success. The upcoming week is filled with crucial economic events that traders should closely monitor to navigate the markets effectively. From employment figures in the UK to price trends in Canada and inflation rates worldwide, each data point narrates a compelling story. The canvas of our economic puzzle extends to include US retail sales and Australian employment statistics, offering valuable insights that guide our understanding of the global financial terrain.

Keep an eye on the UK Claimant Count Change, set to be released on January 16, 2024. After witnessing an increase from 8,900 to 16,000 in November, expectations are that the figure will rise further to 18,100 in the upcoming release.

Takeaway: UK’s Claimant Count Change reflects the current labor condition in the UK. This further increase forecast could potentially have a negative effect on the British Pound.

An additional event on January 16, Canada unveils its Monthly Consumer Price Index (CPI). In November 2023, consumer prices in Canada defied expectations by rising 0.1%, contrary to the anticipated 0.1% decline. However, the December 2023 data, expected to be released on January 16, 2024, forecasts a 0.3% decline in the monthly Consumer Price Index.

Takeaway: Canada’s CPI reflects the current inflation condition in Canada. This negative forecast could potentially have a negative effect on the Canadian Dollar.

On January 17, 2024, the focus turns to the UK Annual Consumer Price Index. After a slowdown to 3.9% in November 2023 from 4.6% in October, analysts anticipate a further decrease to 3.8% in the December 2023 data.

Takeaway: The UK annual CPI reflects the current inflation condition in the UK. This negative forecast could potentially have a negative effect on the British Pound.

Discover the trajectory of US retail sales on January 17. Following an unexpected 0.3% increase in November 2023, the upcoming release is projected to show a further uptick, with an expected growth of 0.4% in December 2023.

Takeaway: The US retail sales reflect the current economic condition in the US. This positive forecast could potentially have a positive effect on the US Dollar.

Turn your attention to Australia on January 18, as the Employment Change data unfolds. After a notable increase of 61,500 in November 2023, the forecast for December 2023 suggests a more modest rise, with expectations set at 18,000.

Takeaway: Australia’s employment change reflects the current labor condition in Australia. This positive forecast could potentially have a positive effect on the Australian Dollar.

As we approach January 19, anticipation builds for the release of UK Retail Sales data. Despite a robust 1.3% month-over-month growth in November 2023, December 2023 is expected to show a contraction of 0.5%.

Takeaway: The UK retail sales reflect the current economic condition in the US. This negative forecast could potentially have a negative effect on the British Pound.

Closing out the week, all eyes will be on the US preliminary consumer sentiment from the University of Michigan for January 19. Projections indicate a slight dip to 69.6 from the previous month’s 69.7 in December 2023, offering insights into the mood of the American consumer.

Takeaway: The US Prelim University of Michigan consumer sentiment reflects the preliminary consumer mood regarding the economic condition in the US. This slight drop forecast could potentially have no effect on the US Dollar.

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.