Spreads

Spreads

Spreads

Spreads

Spreads

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.

The new year began with a mild downturn in the stock market, seeing the S&P 500 drop by 0.57% after an impressive 2023. Tech giants like Apple faced setbacks, while defensive stocks supported the Dow Jones. Despite this, the market enjoyed a bullish run in 2023 due to a strong economy and Fed signals. Analysts maintain optimism, anticipating a potential rebound during the earnings season. In currency markets, the dollar rebounded by 0.8% after a dovish Fed stance, influencing various pairs like EUR/USD and USD/JPY. The focus shifts to upcoming U.S. economic indicators and FOMC minutes for insights into potential market shifts.

The stock market kicked off the new year on a slightly bearish note, with the S&P 500 falling by 0.57%, marking its first decline after a strong 2023. The Nasdaq Composite experienced its worst day since October, dropping by 1.63%, while the Dow Jones Industrial Average managed a slight gain of 0.07%. Apple faced a significant setback, sliding over 3% due to a downgrade from Barclays, impacting the performance of the Magnificent Seven market leaders basket. However, defensive stocks like Johnson & Johnson and Merck supported the Dow’s positive momentum.

In 2023, the stock market saw a remarkable surge, with the S&P 500 climbing for nine consecutive weeks, ending the year on a high note—its best streak since 2004. The bullish run was fueled by a resilient economy, cooled inflation, the Federal Reserve signaling an end to rate hikes, and an anticipation of future rate cuts. Tech giants like Apple, Microsoft, and Nvidia led the charge, with the Nasdaq Composite registering its best year since 2020. Despite the initial decline in the new year, analysts like Hatfield remain optimistic about equities, foreseeing a potential rebound during the upcoming earnings season.

Data by Bloomberg

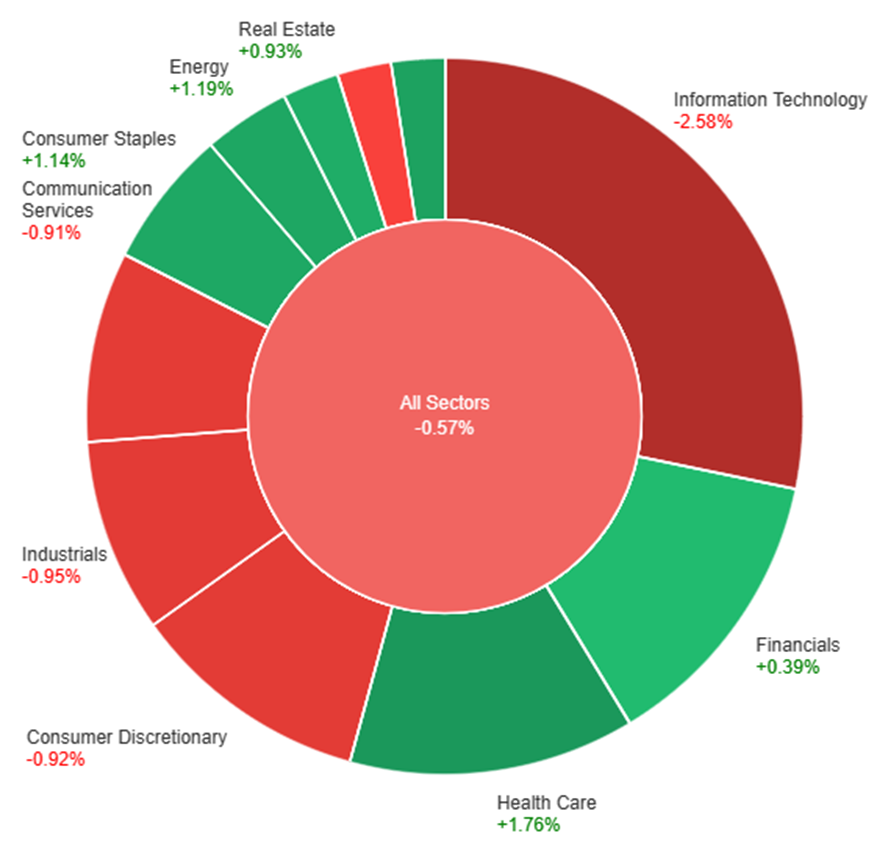

On Tuesday, across all sectors, the market experienced a slight decline of 0.57%. Health Care, Utilities, and Energy sectors showed positive gains, with Health Care leading at +1.76%, followed by Utilities at +1.38% and Energy at +1.19%. Conversely, Information Technology took a significant hit, dropping by -2.58%. Sectors like Consumer Discretionary, Communication Services, and Industrials also experienced declines ranging from -0.91% to -0.95%. Meanwhile, Financials and Real Estate showed modest gains, while Materials faced a small decrease of -0.20%.

The currency markets witnessed a resurgence of the dollar index by 0.8% following profit-taking on short trades that ensued after a more dovish stance from the Fed in mid-December. This unexpected turn led to a tumble in Treasury yields and rate expectations, prompting a surge in risk-taking behavior. The focus now hovers around the upcoming key U.S. labor market data, ISM releases, and the scrutiny of FOMC meeting minutes as market participants gauge the impact of these factors on the dollar’s recent slide and the potential for a reversal.

EUR/USD experienced an 0.82% decline, approaching the 50% retracement level of December’s surge, while USD/JPY rose 0.8%, seeking to breach resistance around 142 to push towards 143. Sterling mirrored the pressures faced by EUR/USD, dropping by 0.77%, largely influenced by lagging gilt treasury yield spreads. Concurrently, USD/CAD ascended by 0.63%, propelled by Canada’s PMI hitting a 3-1/2-year low at 45.4. Market sentiment hinges on upcoming crucial U.S. economic indicators that are expected to confirm a cooling labor market with receding inflationary pressures, yet still shy of the Fed’s 2% target. The interplay of these data releases will likely shape the trajectory of major currency pairs in the coming days.

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| USD | ISM Manufacturing PMI | 23:00 | 47.2 |

| USD | JOLTS Job Openings | 23:00 | 8.84M |

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.