Spreads

Spreads

Spreads

Spreads

Spreads

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.

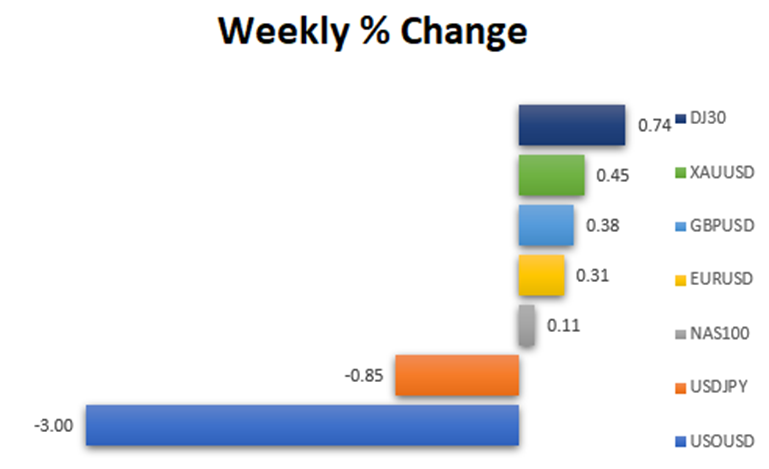

The market remained relatively flat during the last week of 2023, influenced by the Santa Claus rally impacting the stock market. As we enter the first week of 2024, the market anticipates clearer directions.

The US dollar is facing its first annual decline since 2020 against the euro and other currencies, largely due to expectations of upcoming rate cuts by the US Federal Reserve amid moderating inflation. There’s speculation about when the Fed will initiate these cuts—whether as a preemptive measure against dropping inflation or due to a slowdown in the US economy. The market has already factored in these potential cuts, causing a significant weakening of the dollar. The Fed’s recent dovish stance and the forecasted rate reductions have intensified the dollar’s decline.

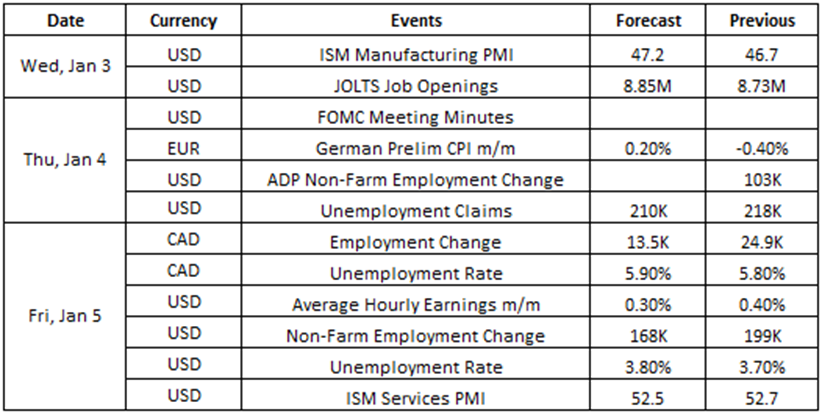

Source: VT Markets Economic Calendar

The first week of 2024 will revolve around several pivotal economic indicators, including the ISM Manufacturing and Services PMI from the US, as well as the German Preliminary CPI from the EU. However, the primary focus will be on the labor data releases from the US, alongside the Canada Employment Change figures. These data releases are expected to wield significant influence, particularly on major currencies, with the US Dollar poised to bear the most substantial impact.

Traders must be cautious and stay on top of the latest developments for a successful week of trading.

ISM Manufacturing PMI in the US remained unchanged at 46.7 in November 2023, consistent with the previous month’s figure.

The next set of figures is scheduled for release on 3 January 2024, and analysts anticipate the data will be released at 47.1.

Takeaway: US ISM Manufacturing PMI shows the latest condition regarding the manufacturing industry in the country. This positive forecast could have a positive effect on the US Dollar.

The Federal Reserve maintained the fed funds rate at 5.25%-5.5% for a third consecutive meeting in December 2023 but indicated a 75 basis points cut in 2024.

The meeting minutes from this December 2023 meeting will provide the latest updates from the Fed regarding their monetary policy. Policymakers stated that recent indicators suggest economic growth has slowed, job gains have moderated but remain strong, and the unemployment rate has stayed low. Inflation has eased over the past year but remains elevated.

Takeaway: FOMC Meeting Minutes will be released to provide clear information regarding the Fed decision from their last meeting. This meeting minutes release might hurt the US Dollar as the Fed has the potential to cut rates over 2024.

Consumer prices in Germany declined by 0.4% from the previous month in November 2023, following no growth in the previous period.

Analysts anticipate that the German Preliminary CPI, set to be released on 4 January 2024, will increase by 0.2%.

Takeaway: German Prelim CPI shows the inflation condition in Germany. This forecast may have a positive effect on the EURO.

In November 2023, employment in Canada increased by 24.9K, building on the 17.5K rise seen in October. However, the unemployment rate in Canada also rose to 5.8% from the previous month’s 5.7%, marking the highest rate recorded since January 2022.

The data for December 2023 is scheduled to be released on 5 January 2024. Analysts and surveys predict that employment in Canada will increase by 12K, while the unemployment rate is expected to rise to 5.9%.

Takeaway: Canada employment change showing the latest condition regarding the labor condition in Canada. This data is usually released together with the unemployment rate data. This forecast may have a mixed effect on the Canadian Dollar.

In November 2023, the US economy added 199,000 jobs, surpassing the 150,000 added in October. Meanwhile, the unemployment rate in the United States decreased to 3.7% from the previous month’s 3.9%, marking the lowest rate since July.

The data for December 2023 is expected to be released on 5 January 2024. Analysts and surveys predict that US non-farm employment will increase by 163,000 jobs, while the unemployment rate is expected to rise to 3.8%

Takeaway: US non-farm employment change showing the latest condition regarding the labor condition in the US. This data is usually released together with the unemployment rate data. This forecast may have a mixed effect on the US Dollar.

ISM Services PMI in the US rose to 52.7 in November 2023 from 51.8 in October, indicating stronger growth in the services sector.

Analysts anticipate a marginal decline to 52.6 in the December figures, set for release on 5 January 2024.

Takeaway: US ISM Services PMI shows the latest condition regarding the services industry in the country. This positive forecast could have a positive effect on the US Dollar.

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.