Spreads

Spreads

Spreads

Spreads

Spreads

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.

Stocks closed higher as the S&P 500 edged up 0.14%, nearing its all-time high from January 2022. The Dow Jones Industrial Average also hit a new closing high, while the Nasdaq Composite rose 0.16%, marking an eight-week winning streak. Analysts anticipate a potential ‘Santa Claus rally’ despite concerns over market over-optimism, cautioning investors about unexpected shifts as the Federal Reserve’s rate decisions loom. Additionally, the US Dollar weakened against major currencies, influenced by lower Treasury yields and economic data releases, while the commodity market saw Gold nearing record highs and Silver stabilizing.

Stocks closed higher, with the S&P 500 edging up 0.14% to nearly reach its all-time high from January 2022, ending at 4,781.58. The Dow Jones Industrial Average also hit a new closing high, while the Nasdaq Composite rose 0.16%. This climb marks an eight-week winning streak for the S&P, Dow, and Nasdaq, with the S&P nearing its record. Analysts anticipate a ‘Santa Claus rally,’ a period noted for market upswings at the end of one year and the start of the next, which historically sees an average increase of about 1.3% for the S&P 500.

Despite the overall positive market sentiment, concerns loom regarding potential over-optimism. Some experts worry that the market’s enthusiasm might lead to disappointment if the Federal Reserve delays rate cuts. While Fed funds futures indicate possible rate cuts as early as March, experts caution that the current bullish sentiment might expose investors to unexpected market shifts, especially with 90% of S&P 500 stocks trading above their 50-day moving average, suggesting a level of market “frothiness.” Analysts advise caution amidst this optimistic climate to guard against unforeseen market volatility.

Data by Bloomberg

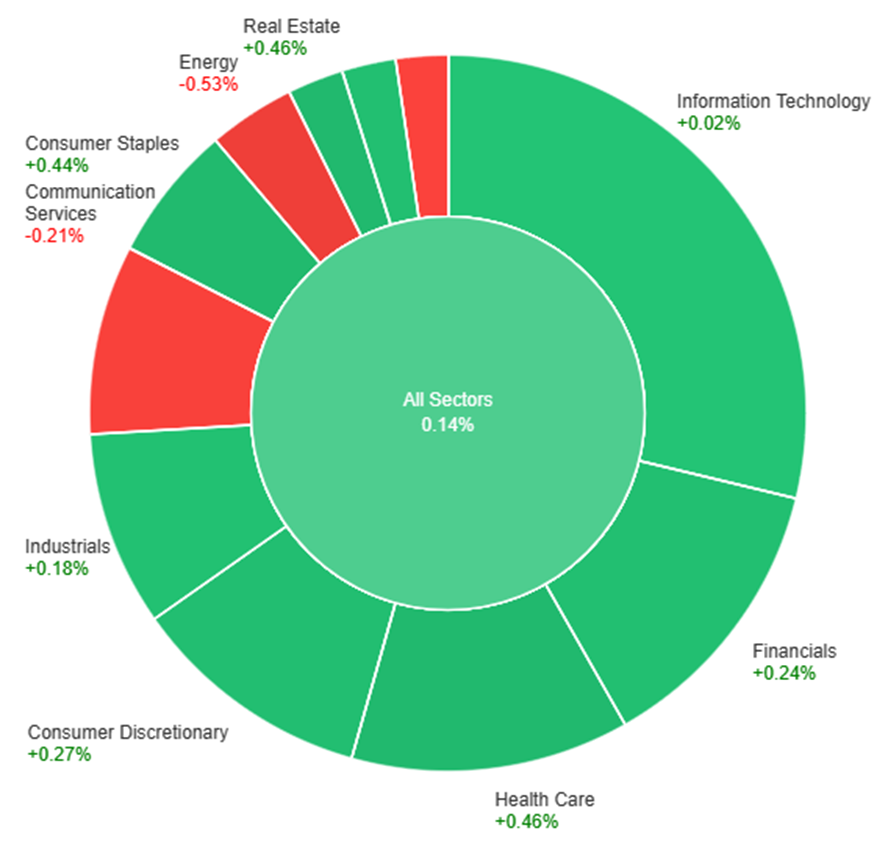

On Wednesday, across various sectors, the market showed a modest overall increase of 0.14%. Health care and real estate sectors led the gains, both surging by 0.46%, followed closely by consumer staples at 0.44%. Sectors like consumer discretionary and materials experienced moderate gains at 0.27% and 0.25%, respectively. However, there were declines in certain sectors, with energy facing the most significant drop of 0.53%, followed by communication services at -0.21% and utilities at -0.12%. Information technology saw the smallest change, with a marginal increase of 0.02%.

The currency markets saw a notable weakening of the US Dollar as the US Dollar Index (DXY) dropped below 101.00, marking its lowest point since July. This decline was attributed to a combination of factors, including the 10-year Treasury yield hitting a five-month low at 3.78%, coupled with the 2-year settling at 4.24%, the lowest since May. Amidst this, US stocks hovered near recent highs, especially the Dow Jones, which edged closer to an all-time high. However, the Dollar’s decline persisted due to increased risk appetite and the sustained pressure of lower Treasury yields. The release of economic data further exacerbated the situation, with the Richmond Fed Manufacturing Index dropping to -11 in December, reflecting worse-than-expected figures across shipments, new orders, and employment. The upcoming release of the weekly Jobless Claims report, trade figures, and November’s Pending Home Sales report could add to the market’s sentiment.

Meanwhile, the Euro (EUR/USD) surged past 1.1100 for the first time in five months, driven by the broad-based weakness of the Dollar. The Pound (GBP/USD) also witnessed a strengthening trend, reaching 1.2802, its strongest level since August, although it subsequently retreated slightly. The Japanese Yen outperformed amidst the Dollar’s decline, pushing USD/JPY below 142.00 and approaching December lows. Australian (AUD/USD) and New Zealand (NZD/USD) currencies remained in upward trajectories, facing resistance levels around 0.6850 and reaching the 0.6350 area, respectively, backed by a combination of risk appetite and lower yields. Conversely, the Canadian Dollar (USD/CAD) experienced a lag despite bottoming at 1.3175, its lowest since August, as it climbed back above 1.3200 by the end of the trading day. In the commodity market, Gold continued its upward trajectory, nearing a record close above $2,070, while Silver stagnated around $24.25, failing to follow Gold’s upward trend.

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.