Spreads

Spreads

Spreads

Spreads

Spreads

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.

As November draws to a close, U.S. stock futures indicate a favorable end to the month for major indexes, propelled by surges in Salesforce and Snowflake following stellar earnings. Despite marginal movements in the Dow and S&P 500, both remain near their year-to-date highs, while the Nasdaq holds close to its 2023 peak. November promises to break the three-month losing streak, with the S&P 500 up 8.5% and Nasdaq near 11%, marking their strongest performance since July 2022. Positive market sentiments contrast declines in Asia-Pacific markets, with the focus shifting to potential Federal Reserve rate cuts in 2024. In the currency market, the dollar rebounded on speculations of faster rate cuts, impacting forex pairs and stirring market uncertainties amidst varying economic indicators and central bank remarks.

In November’s final stretch, U.S. stock futures edged up, signaling a positive closure for the month across the major indexes. Wednesday’s after-hours trading saw Salesforce and Snowflake soaring due to better-than-expected earnings, with Salesforce marking an 8% surge and Snowflake climbing over 7%. Despite a marginal day for the Dow and S&P 500, both indexes hover just around 0.5% and 0.8%, respectively, from their year-to-date closing highs. Similarly, the Nasdaq Composite, though slipping 0.16% during the day, remains close to its 2023 closing high by about 0.7%.

November appears poised to end the three-month losing streak for the major indexes, with the S&P 500 marking an 8.5% gain and the Nasdaq nearly reaching an 11% increase. These figures represent their most robust monthly performance since July 2022. The Dow, up by 7.2% in November, is also on track for its best month since October 2022. Amidst higher interest rates, strategist Jay Woods remains optimistic about stocks holding onto their gains, citing positive price action and supportive economic data for the Fed’s stance on rates.

European stocks closed higher, reclaiming positive momentum as markets assessed Federal Reserve board members’ statements. The Stoxx 600 index closed 0.43% higher, with Germany’s DAX index maintaining gains above 1% following a report indicating a slowdown in German inflation for November, surpassing earlier forecasts. Meanwhile, Federal Reserve Governor Christopher Waller expressed growing confidence in the Fed’s policies to rein in inflation, hinting at potential rate reductions if inflation continues to ease in the next few months. However, despite a slight retreat in Wall Street’s earlier gains, the major U.S. indexes remained on course for significant gains in November, contrasting the overnight declines in Asia-Pacific markets, primarily led by losses in Hong Kong.

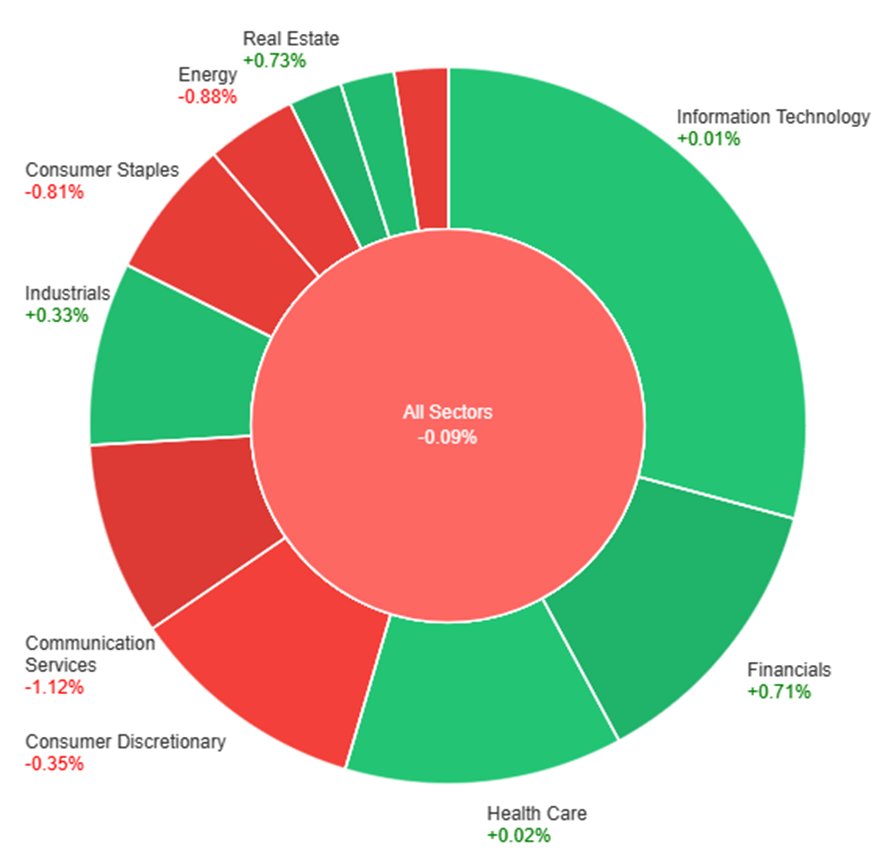

Data by Bloomberg

On Wednesday, the overall market experienced a slight decline of 0.09%. However, several sectors showed positive movements, with Real Estate leading the gains at +0.73%, followed closely by Financials at +0.71% and Materials at +0.38%. Industrials and Health Care also saw modest increases of +0.33% and +0.02%, respectively. Conversely, there were notable decreases in certain sectors, with Communication Services taking the biggest hit at -1.12%, followed by Energy at -0.88%, and Consumer Staples at -0.81%. Utilities and Consumer Discretionary also faced declines of -0.79% and -0.35%, respectively. Overall, while some sectors thrived, others encountered notable downturns during the trading day.

In the currency market, the dollar index experienced a rebound of 0.14% after reaching oversold levels, largely influenced by speculation surrounding faster Federal Reserve rate cuts in 2024. This sentiment emerged following comments from Fed’s Waller, leading to expectations of a rate cut as early as May, with futures indicating a potential 114 basis points of cuts by 2024. Concurrently, the Euro saw a decline against the dollar, notably influenced by below-forecast German CPI, fostering a 42% probability of an ECB rate cut in March with an estimated 110 basis points of cuts by the end of 2024. The EUR/USD pair retraced to 1.0960, marking a critical level in its July-October slide.

While the dollar’s trajectory was influenced by expectations around Fed rate cuts, the market remained attentive to upcoming data releases and central bank remarks. The discrepancy among Fed speakers regarding progress in the inflation fight juxtaposed against economic indicators like Q3 GDP revisions, softer Q4 data, and core PCE adjustments to 2.3% contributed to the uncertainty. The movement of key pairs like USD/JPY, impacted by tumbling Treasury yields and contrasting JGB yields, indicated potential challenges for hefty speculative dollar longs. Amidst these fluctuations, sterling rose as it retraced a significant portion of its previous decline, echoing the broader market sentiment awaiting U.S. data releases and Fed Chair Jerome Powell’s commentary. Additionally, the Aussie and Chinese yuan pairs experienced declines and rebounds, respectively, influenced by below-forecast inflation and fluctuations in Fibonacci retracement levels indicative of market sentiment shifts.

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| ALL | OPEC-JMMC Meetings | All Day | |

| CAD | GDP m/m | 21:30 | 0.0% |

| USD | Core PCE Price Index m/m | 21:30 | 0.2% |

| USD | Unemployment Claims | 21:30 | 219K |

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.