Spreads

Spreads

Spreads

Spreads

Spreads

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.

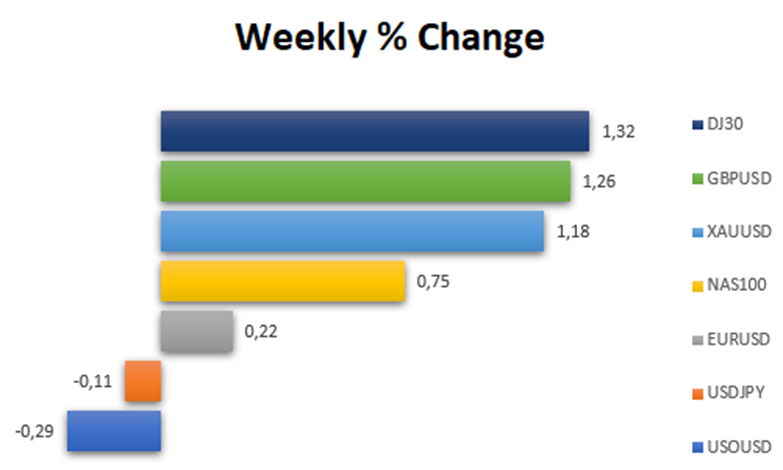

The dollar concluded the shorter week on a weaker note owing to the Thanksgiving holiday in the US. The US dollar index experienced a decline following the emergence of weaker data, sparking speculation about a potentially more dovish stance from the Fed. Analysts anticipate the possibility of an interest rate reduction by the middle of next year, which could drive gold prices above $2,000. Current market forecasts suggest that the Fed might hold rates steady in December but could contemplate a cut by May. This implies a relatively stable outlook for the dollar until clearer indications regarding significant rate reductions aligned with inflation targets become apparent.

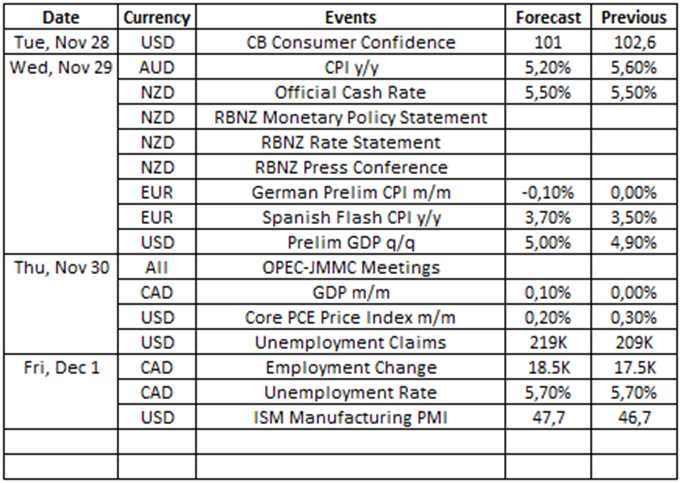

Source: VT Markets Economic Calendar

Several key factors are expected to impact the financial markets this week, including the Reserve Bank of New Zealand’s Rate Statement and the US Core Personal Consumption Expenditure (PCE) Price Index. Given the potential for significant market movements, we advise traders to exercise caution when undertaking any trading activity.

Australia’s Consumer Price Index (29 November 2023)

The monthly CPI in Australia increased by 5.6% in the 12 months leading up to September 2023, reaching its highest level in five months.

Analysts forecast a growth rate of 5.2% in the figures for October 2023, which are due to be released on 29 November.

Takeaway: Considering the forecasted figures, there might be a slight weakening of the Australian Dollar.

Reserve Bank of New Zealand Rate Statement (29 November 2023)

During its October meeting, the Reserve Bank of New Zealand (RBNZ) held its official cash rate (OCR) steady at 5.5%, marking the third consecutive meeting without a change in the rate.

Analysts anticipate that the RBNZ will maintain its OCR at 5.5% following its upcoming meeting on 29 November.

Takeaway: The Reserve Bank of New Zealand’s interest rate decision this week is expected to create significant volatility for the New Zealand Dollar. Market experts anticipate that the central bank will hold the interest rate steady, which could potentially lead to a weakening of the New Zealand Dollar.

Canada’s Gross Domestic Product (30 November 2023)

The Canadian economy experienced no change in August 2023, a downward revision from preliminary estimates of a 0.1% growth rate.

The September data for Canada’s GDP is set to be released on 30 November and is expected to reflect no change from August’s figures.

Takeaway: The release of Canada’s GDP data will provide traders with information about the country’s current economic conditions. According to the forecasted figures, it seems that the Canadian economy has stagnated, which could potentially result in a downward trend for the Canadian Dollar.

US Core PCE Price Index (30 November 2023)

The US core PCE prices, which exclude food and energy, rose by 0.3% in September 2023, the highest increase in four months.

The next set of data will be released on 30 November, with analysts expecting a growth of 0.2%.

Takeaway: The forecast suggests that spending might grow, which could make the US Dollar stronger.

Canada’s Employment Change (1 December 2023)

The Canadian economy added 17,500 jobs in October 2023, marking the third consecutive month of workforce expansion. Meanwhile, the unemployment rate increased to 5.7% in the same period, up from 5.5% in the previous month, reaching its highest level since January 2022.

The figures for November 2023 are scheduled to be released on 1 December, with analysts expecting the creation of 14,000 additional jobs and a rise in the unemployment rate to 5.8%.

Takeaway: According to the projected figures, there is a possibility that Canada’s employment data will potentially weaken the Canadian Dollar due to slower job additions and a higher unemployment rate.

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.