Spreads

Spreads

Spreads

Spreads

Spreads

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.

The stock market witnessed a surge in major indices, with the Dow Jones, S&P 500, and Nasdaq all marking notable gains, signaling a widening positive trend across the market. However, the energy sector faced a slight decline due to OPEC’s postponed meeting on production cuts. Treasury yields experienced a significant drop, reaching a low not seen since September, influenced by the Federal Reserve’s persistent stance on monetary policy. Despite slight fluctuations and concerns over export restrictions on China impacting Nvidia’s shares, the market remains on track for monthly gains. Meanwhile, in currency markets, the US dollar strengthened against various currencies like the euro, yen, and pound, driven by positive US economic data and global market dynamics. The focus now shifts to upcoming flash PMI releases, which are anticipated to shape currency trajectories and impact key support levels.

The stock market saw a rise in indices as the Dow Jones Industrial Average gained 184.74 points to reach 35,273.03, marking a 0.53% increase. Similarly, the S&P 500 climbed 0.41% to 4,556.62, and the Nasdaq Composite advanced by 0.46% to 14,265.86. This broadening market rally was reflected in over half of the stocks on the NYSE showing gains, suggesting a widening scope for the positive trend. Notably, smaller cap stocks outperformed with a 0.7% and 0.6% rise for small and mid-cap stocks, respectively. However, the energy sector faced a 0.1% decline due to OPEC’s postponed meeting on production cuts, impacting companies like Marathon Oil, EOG Resources, and Devon Energy.

The Treasury yield for the 10-year briefly dropped to 4.369%, hitting its lowest since September, a significant decrease from October’s milestone of crossing the 5% mark for the first time in 16 years. The Federal Reserve’s notes from its recent meeting suggested a persistent stance on restrictive monetary policy, with no hint of imminent interest rate cuts. Despite this, investor optimism prevailed regarding the December meeting. Nvidia’s quarterly report revealed better-than-expected earnings and revenue but cautioned about the impact of export restrictions on China, leading to a 2.5% drop in its shares. Despite Tuesday’s slight decline, the major indices remain on track for monthly gains, with the Nasdaq rallying 11% in November, the Dow up nearly 7%, and the S&P 500 rising over 8%. The market sentiment leans towards the possibility of continued rally, especially with inflation trends and the likelihood of a “soft landing” from the Fed, as noted by Charlie Ripley, a senior investment strategist at Allianz Investment Management. The New York Stock Exchange closed for Thanksgiving and will have an early closure on Friday.

Data by Bloomberg

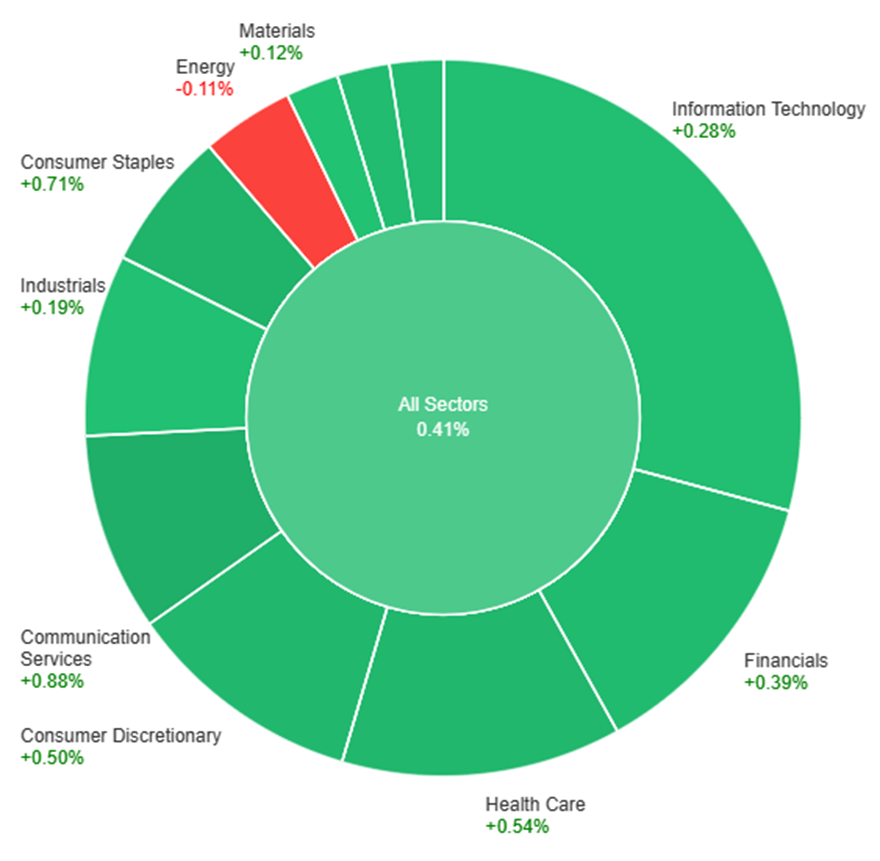

On Wednesday, across various sectors, the market generally saw positive gains, with the Communication Services sector leading the way with a rise of 0.88%. Following closely were Consumer Staples at 0.71% and Health Care at 0.54%. Sectors such as Financials, Real Estate, and Consumer Discretionary also experienced moderate gains, ranging from 0.37% to 0.50%. However, some sectors did not fare as well, with Energy being the only sector to experience a decrease, falling by 0.11%. Sectors like Information Technology, Industrials, and Materials saw gains ranging from 0.12% to 0.28%, contributing to the overall positive trend in the market for the day.

The recent updates in the currency markets have seen the US dollar gaining strength, primarily driven by positive data on U.S. jobless claims and Michigan sentiment, reinforcing the Federal Reserve’s stance against premature rate cuts. Treasury yields experienced an upsurge following a notable drop in initial claims during the job report survey week and a concurrent decrease in continued claims, supporting the dollar’s ascent. Despite below-forecast October durable goods orders, the upward revision in Michigan sentiment and a rise in 1-year inflation expectations propelled Treasury yields further, benefiting the dollar. Notably, EUR/USD faced a 0.3% decline, largely influenced by the widening gap between 2-year Treasury yields and bund yields.

Meanwhile, USD/JPY exhibited a rebound, erasing a significant portion of its previous dive, driven partly by Japan’s economic view being reduced for the first time in 10 months, following an unexpected drop in Q3 GDP. Sterling experienced a 0.4% decline amid the dollar’s broader resurgence and the announcement of fiscal stimulus plans by British Finance Minister Jeremy Hunt. The pound found support at the 1.2450 200-DMA, with the retreat in risk-sensitive cable partially offset by the rise in U.S. equities. Other currencies like the Aussie faced a 0.24% fall, encountering resistance at the 200-DMA amidst a backdrop of weakened Chinese markets and commodities.

The upcoming focus in the market lies on the November flash PMI releases, which are expected to serve as crucial indicators for major economies, potentially impacting the trajectory of currencies like EUR/USD and influencing key support levels, such as the 100-day moving average around 1.08. Additionally, USD/JPY’s movement is closely tied to the convergence of various DMAs in a specific range, indicative of potential future trends. These developments reflect a dynamic landscape in the currency market, shaped by economic data releases and geopolitical events impacting different currencies differently.

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| JPY | Bank Holiday | ||

| USD | Bank Holiday | ||

| EUR | French Flash Manufacturing PMI | 16:15 | 43.2 |

| EUR | French Flash Services PMI | 16:15 | 45.6 |

| EUR | German Flash Manufacturing PMI | 16:30 | 41.1 |

| EUR | German Flash Services PMI | 16:30 | 48.4 |

| GBP | Flash Manufacturing PMI | 17:30 | 45.0 |

| GBP | Flash Services PMI | 17:30 | 49.5 |

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.