Spreads

Spreads

Spreads

Spreads

Spreads

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.

The stock market rallied as tech giants Microsoft and Nvidia drove significant gains, marking record highs amidst former OpenAI chief Sam Altman’s move to lead a new AI research team at Microsoft and Nvidia’s imminent earnings report. With the Dow Jones, S&P 500, and Nasdaq Composite all climbing, investors remained optimistic despite holiday closures. Lower-than-expected U.S. inflation data lessened concerns about rate hikes, reinforcing asset values but keeping a watchful eye on fiscal spending. Meanwhile, currency markets saw the U.S. dollar decline as risk-on sentiment grew, fueled by market anticipation of a potential Fed rate cut based on softer CPI data. Major currencies like the Euro and Sterling gained against the dollar, signaling changing market perceptions over traditional indicators like yield spreads. Ahead, crucial economic events and jobless claims data hold sway over market sentiments and currency movements.

The stock market surged at the start of the week, with tech giants like Microsoft and Nvidia leading the charge. Microsoft saw a 2% rise, hitting a new high, following the announcement of former OpenAI chief Sam Altman joining to spearhead a new AI research team. Simultaneously, chipmaker Nvidia climbed 2.3%, reaching an all-time high just before its earnings report. This drove the Dow Jones Industrial Average up by 203.76 points, marking a 0.58% increase to close at 35,151.04. The S&P 500 also saw gains of 0.74%, finishing at 4,547.38, and the Nasdaq Composite surged 1.13% to close at 14,284.53, both marking their fifth straight day of growth.

The tech and communication services sectors notably drove these gains, witnessing increases of 1.5% and 1%, respectively. With Thanksgiving approaching, markets prepared for closure on Thursday and a shortened trading day on Friday. Despite historical choppiness around this holiday, November has consistently proven to be the S&P 500’s most successful month. Additionally, investors were buoyed by recent lower-than-anticipated U.S. inflation data, easing concerns about persistently high prices and suggesting the possibility of the Federal Reserve halting interest rate hikes. This trend further supported asset values, particularly with the concurrent drop in Treasury yields. However, market watchers remain vigilant about potential fiscal spending and deficit concerns, which could trigger upward pressure on yields. Wall Street is eagerly awaiting the release of the latest Fed minutes scheduled for Tuesday.

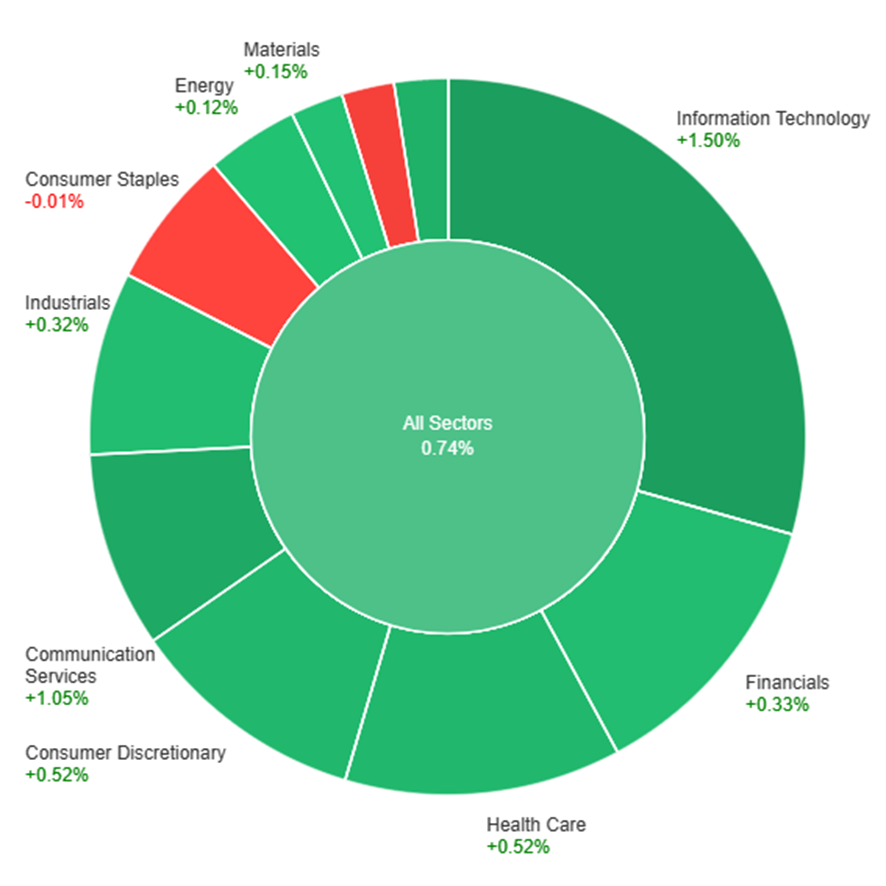

Data by Bloomberg

On Monday, the market saw a positive trend across most sectors, with a general increase of 0.74%. The standout performers were Information Technology and Communication Services, surging by 1.50% and 1.05%, respectively. Real Estate also demonstrated strength with a 0.79% rise, followed closely by Health Care and Consumer Discretionary, both gaining 0.52%. However, sectors like Utilities and Consumer Staples experienced slight declines of -0.31% and -0.01% respectively, while Energy and Materials showed marginal increases of 0.12% and 0.15%. Overall, the market exhibited broad positivity, particularly in the tech and communication sectors, driving the day’s gains.

The recent fluctuations in the currency market, particularly concerning the US dollar, have been influenced by various economic indicators and shifting market sentiments. The dollar index experienced a notable decline, dropping by 0.49% and breaching key levels, primarily due to increased risk appetite following heightened expectations of a Federal Reserve rate cut. This shift was triggered by softer-than-expected US CPI data, causing the dollar’s safe-haven status to wane as risk-on flows took precedence in determining its value.

Despite certain supportive comments regarding disinflation from Richmond Fed President Thomas Barkin and the adjustment in yield spreads favoring the dollar, the currency continued its downward trajectory post-soft CPI release. The market’s anticipation of more disinflationary US data adds weight to the likelihood of an earlier Fed rate cut, potentially moving from June-July expectations to a more imminent cut in May. This shift aims to mitigate the risk of a severe economic downturn and further diminishes the dollar’s safe-haven appeal, influenced significantly by market perceptions rather than traditional indicators like yield spreads.

Looking ahead, market attention is directed toward crucial economic events such as Tuesday’s US existing home sales and the release of Fed meeting minutes. However, the pivotal moment arrives with Wednesday’s jobless claims data, as an above-forecast figure could intensify the substantial sell-off of USD/JPY, possibly pushing it below crucial support levels. This recent market sentiment has seen other major currencies like the Euro and Sterling make gains against the dollar, influenced not just by traditional yield spreads but more prominently by the selling pressure on the dollar as equities rallied.

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| CAD | Consumer Price Index | 21:30 | 0.1% |

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.