Spreads

Spreads

Spreads

Spreads

Spreads

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.

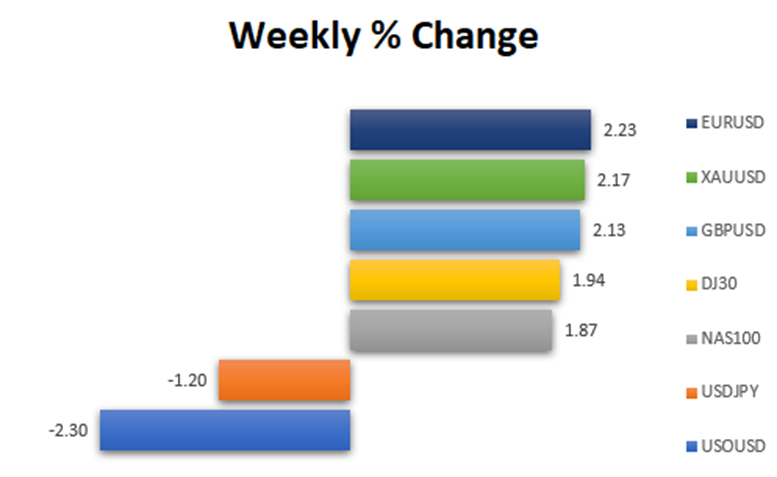

The US dollar faced its second-largest weekly decline against major currencies, driven by concerns about a global economic slowdown. New US inflation data heightened expectations for potential rate cuts by the Federal Reserve, contributing to the dollar’s weakening. Additionally, the dollar index dropped to September lows, while 10-year Treasury note yields hit a two-month low. Despite a brief uptick due to marginal growth in US homebuilding, the dollar remained subdued as inflation remained the primary market driver.

Conversely, the Euro strengthened as Eurozone inflation slowed, while the Yen surged past 150 against the dollar for the first time in weeks. Weak retail sales in the UK added to negative economic readings globally. Furthermore, market indications of future rate cuts by the Fed and the Eurozone have further weakened the dollar.

Meanwhile, European Central Bank (ECB) officials suggested a readiness to increase interest rates if needed, while ECB President Christine Lagarde highlighted the necessity of a capital markets union for the EU’s productivity and independence.

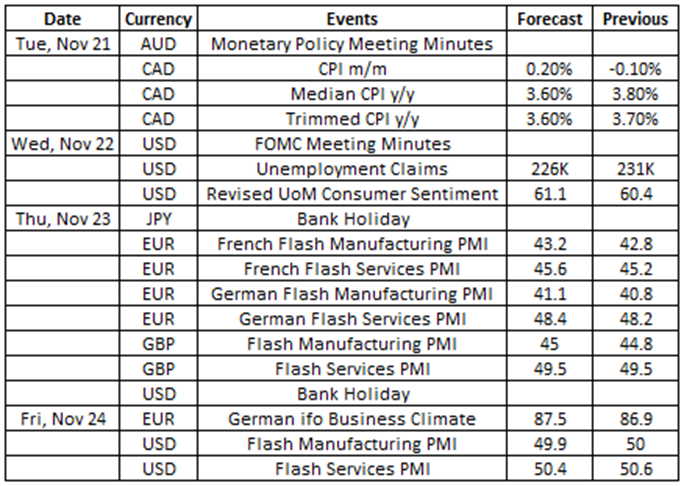

Source: VT Markets Economic Calendar

Various events look set to impact the markets this week. In addition to minutes from the Fed’s November meeting, market movements will likely also be shaped by the release of updated flash services and manufacturing PMI figures.

Traders should maintain caution and closely monitor the following developments for a successful trading week:

Canada’s Consumer Price Index (21 November 2023)

The consumer price index for Canada decreased by 0.1% in September 2023 compared to the previous month.

Analysts anticipate a 0.1% increase in the figures for October, which are set to be released on 21 November.

Takeaway: The upcoming Canada CPI release will offer insights into the state of inflation in Canada and is poised to be a substantial factor in shaping the movement of the Canadian dollar. Based on the anticipated figures, there is a potential for a strengthening of the Canadian dollar.

FOMC Meeting Minutes (22 November 2023)

The Fed kept the target range for the federal funds rate at 5.25–5.5% for a second consecutive time in November, reflecting policymakers’ dual focus on returning inflation to 2% while avoiding excessive monetary tightening.

At a press conference, Fed chair Powell stated that rate cuts have not been discussed and that the focus remains on potential hikes by the central bank.

Takeaway: The Fed will release their meeting minutes from their last meeting in November, revealing new information regarding their policies. Based on the latest updates, there is a potential for a weakening of the US dollar.

US Durable Goods Orders (22 November 2023)

New orders for manufactured durable goods in the United States surged by 4.6% month-over-month in September 2023, rebounding from a 0.1% contraction in August.

Analysts anticipate a 3.2% decrease in the figures for October, which are set to be released on 21 November.

Takeaway: Upcoming data on the US’ durable goods orders will provide information regarding purchase orders from manufacturers in the US. Based on the anticipated figures, there is a potential for a weakening of the US dollar.

Flash Manufacturing PMI for Germany and the UK (23 November 2023)

Germany’s manufacturing PMI increased from 39.6 to 40.8 between September and October 2023. Meanwhile, the UK’s manufacturing PMI increased from 44.3 to 44.8 during the same period.

New PMI figures will be released on 23 November. Analysts’ predicted manufacturing PMIs are 41.2 for Germany and 45 for the UK.

Takeaway: Upcoming manufacturing PMI data for Germany and the UK will provide insights into the current states of their respective manufacturing industries. Based on the projected data, we expect a potential weakening of their currencies, given that their manufacturing sectors have not shown signs of expansion.

Flash Services PMI for Germany and the UK (23 November 2023)

Germany’s services PMI declined from 50.3 to 48.2 between September and October 2023. Meanwhile, the UK’s services PMI increased from 49.3 to 49.5 during the same period.

New PMI figures will be released on 23 November. Analysts’ predicted services PMIs are 48.5 for Germany and 49.5 for the UK.

Takeaway: Upcoming services PMI data for Germany and the UK will provide insights into the current state of their service industries. Based on the projected data, we anticipate a potential weakening of their respective currencies, considering that their services sectors are currently slowing down.

Flash Services and Manufacturing PMI for the US (24 November 2023)

The US’ flash manufacturing PMI was 50 in October 2023, marking a slight increase from 49.8 in September. In the same period, the US’ flash services PMI rose from 50.1 to 50.6.

Analysts predict that the US’ manufacturing PMI for November 2023 will decrease to 49.8 while the US’ services PMI will also fall to 50.3.

Takeaway: Upcoming services and manufacturing PMI data for the US will provide insights into the current state of their manufacturing and service industries. Based on the projected data, we anticipate a potential flat movement of the US dollar.

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.