Spreads

Spreads

Spreads

Spreads

Spreads

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.

On Monday, the stock market rebounded, with the Dow Jones Industrial Average closing 0.59% higher and the S&P 500 and Nasdaq Composite also showing gains despite earlier uncertainties tied to the Israel-Hamas conflict. The conflict, along with concerns about inflation and interest rates, led to initial market declines and a surge in crude oil prices. Major oil and gas companies, as well as defense companies, saw significant gains. While investors reacted with some knee-jerk moves, small-cap stocks in the Russell 2000 index increased, boosting confidence in the broader economy. In the currency market, the US dollar’s performance was mixed due to risk-off sentiment and changes in Federal Reserve rate expectations, with the Japanese yen emerging as a strong performer. Attention now turns to upcoming economic data releases that will shape market expectations.

On Monday, the stock market rebounded despite earlier uncertainties linked to the Israel-Hamas conflict. The Dow Jones Industrial Average showed a notable recovery, closing 0.59% higher, gaining 197.07 points, and concluding at 33,604.65. The S&P 500 followed suit, with a 0.63% increase, ending at 4,335.66, and the tech-focused Nasdaq Composite climbed 0.39% to reach 13,484.24. Earlier in the day, all major indexes experienced declines, with the Dow shedding 153.89 points, the S&P 500 losing 0.6%, and the Nasdaq pulling back as much as 1.15% before rebounding. The Israeli-Palestinian conflict, which escalated over the weekend with Hamas launching an invasion and Israel responding, initially put pressure on the stock market. This geopolitical tension may impact the energy market, potentially causing a brief surge in crude oil prices, though the overall impact is expected to be limited. The conflict, combined with concerns about persistent inflation and higher interest rates, could lead to increased market volatility. On Monday, WTI crude oil futures increased by 4.3% to $86.38, while international Brent futures rose 4.2% to $88.15, marking their best performances since April 3. Gains were observed across all sectors, with energy and industrials leading, closing higher by 3.5% and 1.6%, respectively. Major oil and gas companies, as well as defense companies, also saw significant gains amid the conflict.

Lockheed Martin and Northrop Grumman, in particular, registered increases of 8.9% and 11.4%, respectively. Investors’ reactions to the conflict were initially marked by a rapid response, with the market closely monitoring the situation for more clarity on potential impacts. Analysts are keeping an eye on Iran, a major OPEC producer, to gauge crude oil movements as the conflict unfolds. Despite the initial uncertainty, some investors expressed confidence in the market’s ability to assess the impact of the attack over the weekend, and small-cap stocks in the Russell 2000 index increased by 0.6%, boosting confidence in the broader economy. With the bond market closed for Columbus Day, Wall Street awaits an update on interest rates until Tuesday. Additionally, investors are looking ahead to upcoming earnings reports, including those from companies like PepsiCo, Walgreens Boots Alliance, JPMorgan, and BlackRock, to gain further insights into the health of the broader economy.

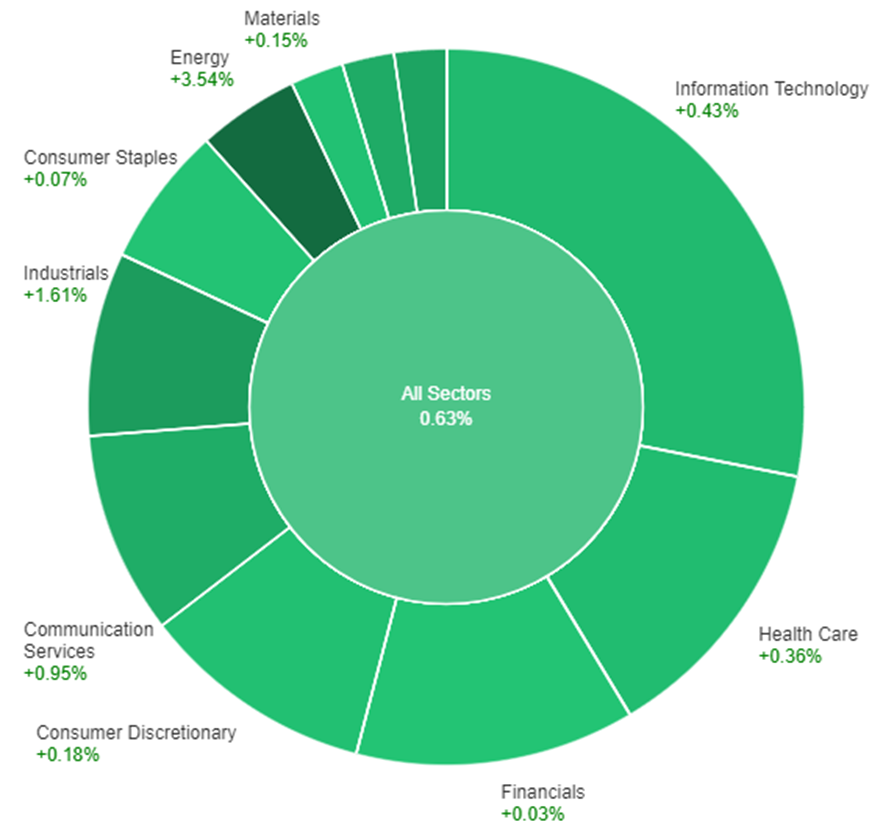

Data by Bloomberg

On Monday, across all sectors, the market experienced a positive trend with a gain of 0.63%. Notable sector performances included significant gains in the Energy sector, which increased by 3.54%, and positive growth in the Industrials, Real Estate, and Utilities sectors, rising by 1.61%, 1.30%, and 1.01%, respectively. The Communication Services and Information Technology sectors also saw modest gains of 0.95% and 0.43%, while Health Care, Consumer Discretionary, and Materials sectors experienced smaller increases of 0.36%, 0.18%, and 0.15%, respectively. The Consumer Staples and Financials sectors had more modest gains of 0.07% and 0.03%.

In recent currency market developments, the US dollar exhibited mixed performance. Initially, the dollar index saw a marginal increase, largely attributed to its role as a safe-haven currency during the ongoing conflict in Israel. However, as risk-off sentiment prevailed and Federal Reserve rate expectations took a significant dip, the dollar’s upward momentum waned. This shift was also influenced by a surge in energy prices, which benefited energy-exporting nations. The Japanese yen emerged as the strongest performer among G7 currencies, gaining against the dollar, euro, and sterling due to its status as a funding currency, supported by the Bank of Japan’s accommodative monetary policy. The USD/JPY pair saw a decline as Fed fund futures began pricing in a 17 basis-point reduction in the Federal Reserve rate by December 2024. This was driven by derisking flows and a perception that recent increases in Treasury yields reduced the necessity for further Fed tightening.

As investors closely monitored these developments, attention turned to upcoming economic data releases, particularly the US Producer Price Index (PPI) and Consumer Price Index (CPI) scheduled for Wednesday and Friday. These reports were deemed crucial for shaping market expectations regarding the Federal Reserve’s future monetary policy decisions and the support for the US dollar’s yield. The euro depreciated against the US dollar, with a potential bearish outlook if the sharp increases in crude and natural gas prices, which were driven by the escalating conflict in Israel, continued. Sterling managed to recover from its lows, influenced by risk-off sentiment and a drop in Fed rate pricing. Meanwhile, the Australian dollar rebounded after an initial risk-off slide, and the Canadian dollar also saw gains as oil prices rebounded, coupled with diminishing expectations of Federal Reserve rate hikes compared to the Reserve Bank of Australia and the Bank of Canada in the coming year. Notably, the Israeli shekel faced a significant devaluation of 2.65% despite the Bank of Israel’s announcement of selling up to $30 billion of foreign currency to stabilize the currency amid the ongoing war.

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.