Spreads

Spreads

Spreads

Spreads

Spreads

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.

On Tuesday, stock markets faced a significant downturn due to surging Treasury yields, reaching levels not seen since 2007. This spike in yields raised worries about potential recession and housing market impacts, leading the Dow Jones Industrial Average to experience a 1.29% decline, the S&P 500 to slide by 1.37%, and the Nasdaq Composite to drop by 1.87%. Rising interest rates were driven by the Federal Reserve’s commitment to maintaining them. The surge in rates created uncertainty and potential downside for stocks, with various companies and tech giants experiencing significant losses. The US dollar strengthened against major currencies, but the situation remains uncertain, hinging on data and yield spreads. Upcoming economic indicators will set the tone for October, as the impact of these changes is felt across asset classes.

Stock markets experienced a significant downturn on Tuesday, primarily driven by surging Treasury yields, which reached their highest levels since 2007. This surge in yields raised concerns that higher interest rates could negatively impact the housing market and potentially push the economy into a recession. The Dow Jones Industrial Average suffered a loss of 430.97 points, representing a 1.29% decline and its worst performance since March. The index closed at 33,002.38. The S&P 500 also took a hit, sliding by 1.37% and reaching its lowest level since June before closing at 4,229.45. The Nasdaq Composite, known for its tech-heavy components, dropped 1.87% to finish at 13,059.47, with growth stocks particularly affected by the rise in interest rates.

This market turbulence led the Dow into negative territory for the year, down by 0.4%, while the broader S&P 500 remained up by 10% for the year 2023. The surge in Treasury yields, with the 10-year yield reaching 4.8% and the 30-year yield hitting 4.925%, is a significant concern. The rise in rates is attributed to the Federal Reserve’s commitment to maintaining higher interest rates for an extended period. Investors and experts expressed concerns about the impact of these rising rates on equities, with some suggesting that the stock market will need to find a balance in the bond market before it can stabilize. Seasonal market weakness in September and October is considered normal, but ongoing worries about higher interest rates add to the uncertainty and potential downside for stocks.

The stock market’s performance on this day closely followed movements in bond yields, with stocks dropping each time yields spiked. The release of the August job openings survey, indicating a tight labor market with 9.6 million open positions (surpassing the expected 8.8 million), was a recent catalyst for the surge in rates. Fear rippled through the market as the Cboe Volatility Index reached its highest level since May, reflecting growing concerns among investors about future market volatility. Companies that stand to lose the most from rising rates and a potential recession faced the largest losses, including Home Depot, Lowe’s, Goldman Sachs, and American Express. Big Tech giants like Nvidia and Microsoft also saw their stocks decline as higher interest rates diminished enthusiasm for growth stocks that rely on the promise of higher future earnings.

Data by Bloomberg

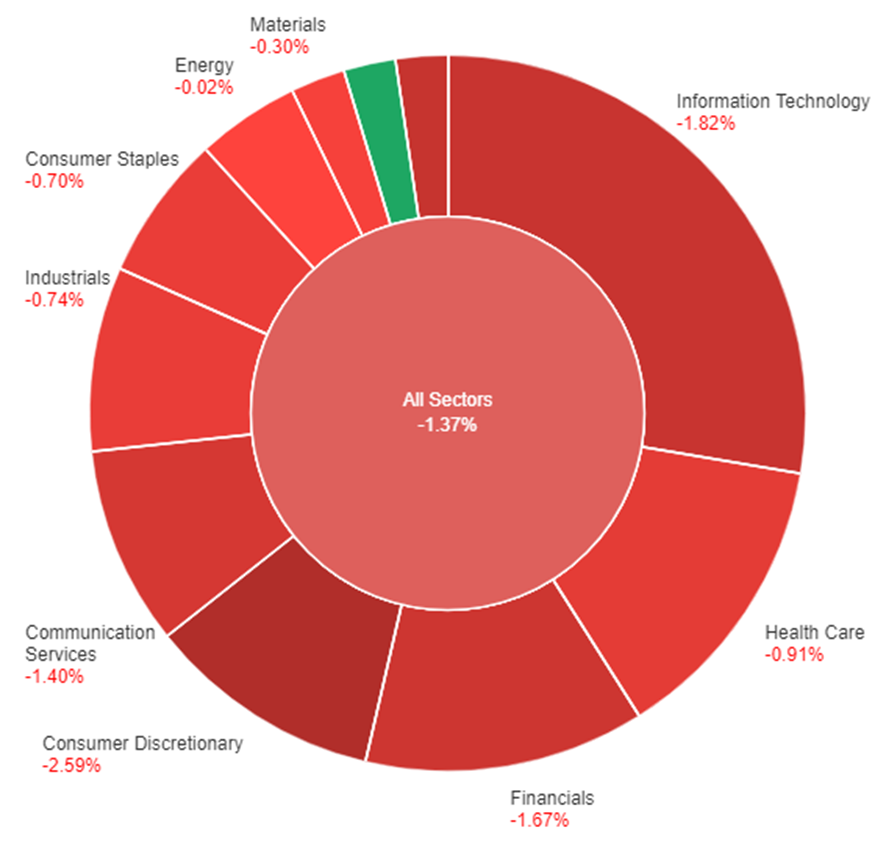

On Tuesday, various sectors experienced changes in their performance. Utilities saw a gain of 1.17%, while Consumer Discretionary had the most significant decline at -2.59%. The overall market, represented by “All Sectors,” was down by -1.37%, with Information Technology, Financials, and Real Estate showing substantial losses as well.

The US dollar experienced a surge in value against major currencies, reaching new trend highs due to an impressive August JOLTS report that exceeded expectations by 810k, coupled with a rise in Treasury yields to their highest level in 16 years. However, the dollar’s bullish momentum faced an unexpected setback as USD/JPY witnessed a sharp drop from just above 150 to 147.30, raising suspicions of potential intervention by the Japanese government. While a senior Japanese Ministry of finance official declined to comment on this intervention, the New York Federal Reserve remained silent on the matter. This sudden drop left traders uneasy, resulting in a 0.6% loss for USD/JPY, while EUR/USD remained relatively steady despite hitting a new trend low. Concerns that the dollar index may lose its winning streak if USD/JPY remains below 150, the situation hinges on the divergence between US and eurozone data and Treasury-bund yield spreads.

Amid these developments, it is essential to keep an eye on upcoming US economic indicators, such as the ISM non-manufacturing report, ADP releases, jobless claims, and the employment report, as they will set the tone for the month of October. While the Federal Reserve reiterated the need for elevated rates to combat inflation, there is also an acknowledgment that surging Treasury yields represent a form of monetary tightening. The impact of these changes is felt across various asset classes, with equities, riskier assets, and high-beta currencies experiencing significant declines. In addition, concerns have emerged regarding the US banking sector as the KBE index approaches its lows during this year’s banking crisis. Meanwhile, the British pound remained relatively flat, but fresh signs of inflation receding could reduce the necessity for further rate hikes by the Bank of England. The Australian dollar depreciated by 1% amidst global risk aversion and the Reserve Bank of Australia’s decision to hold rates steady, driven in part by rising Treasury yields, which are fostering risk-averse sentiment on a global scale.

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| NZD | Official Cash Rate | 09:00 | 5.50% (Actual) |

| NZD | RBNZ Rate Statement | 09:00 | |

| USD | ADP Non-Farm Employment Change | 20:15 | 154K |

| USD | ISM Services PMI | 22:00 | 53.5 |

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.