Spreads

Spreads

Spreads

Spreads

Spreads

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.

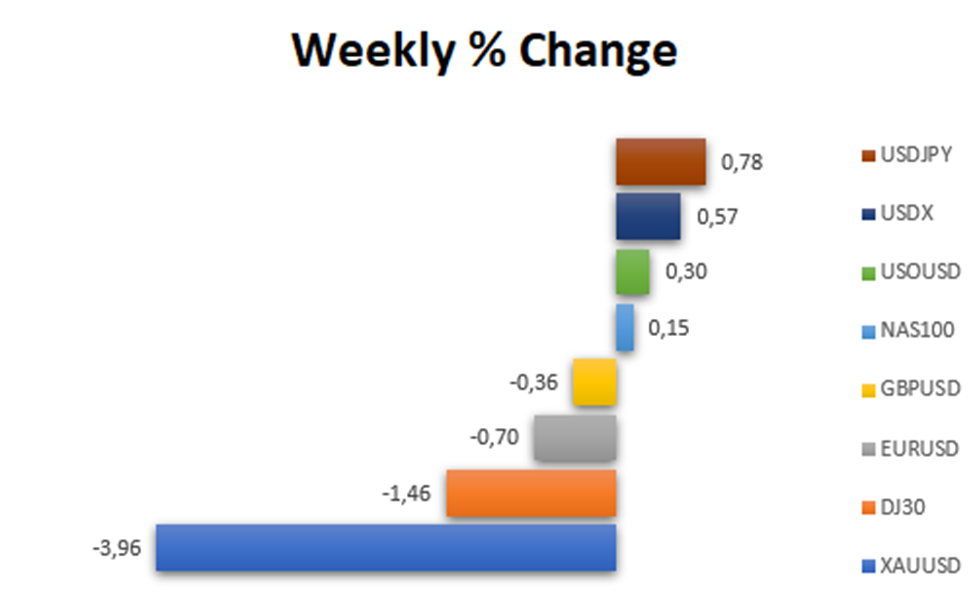

Last Week Market Pair Changes (All data is taken from the MT4 VT Markets)

Last week, the US dollar index experienced a slight pullback from its 10-month high but remained on track for a weekly gain. Investors were exercising caution due to the potential for yen intervention, as the yen continued to trade near 11-month lows against the US dollar. The strength of the dollar can be attributed to expectations of the US economy outperforming other economies and the likelihood of higher interest rates, as indicated by the Federal Reserve.

With global yields on the rise, the US dollar remains an attractive option for investors. US benchmark 10-year yields reached their highest level since 2007. While the dollar index saw a minor decline on Friday, it was still on course for its 11th consecutive week of gains.

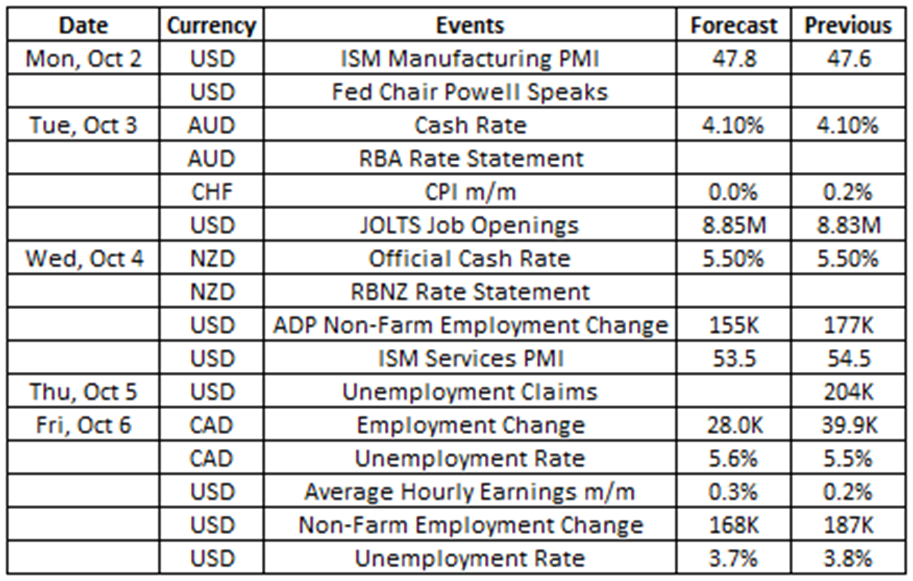

Source: VT Markets Economic Calendar

Several key economic releases are expected to impact the financial markets this week. Notably, attention will be on the US Jobs Report, the rate statement from the Reserve Bank of Australia (RBA), and the rate statement from the Reserve Bank of New Zealand (RBNZ). Given the potential for heightened market volatility, we advise traders to approach their trading activities with caution.

Here are some of the notable market highlights for this week:

The Reserve Bank of Australia (RBA) maintained its cash rate at 4.1% during its final meeting under Governor Philip Lowe in September 2023, extending the rate pause for the third successive month.

Under the new Governor Michele Bullock, analysts predict that the RBA will keep its cash rate at 4.1% following its next meeting on 3 October.

Takeaway: The interest rate statement decision from the RBA this week will create high volatility for the Australian Dollar. Market experts expect the central bank to maintain the interest rate, which could potentially weaken the currency.

The Reserve Bank of New Zealand (RBNZ) maintained its official cash rate (OCR) at 5.5% during its August 2023 meeting, extending its rate pause for the second consecutive month.

Analysts expect the OCR to remain at 5.5% following the central bank’s upcoming meeting on 4 October.

Takeaway: The upcoming interest rate statement by the RBNZ is anticipated to introduce significant volatility to the New Zealand Dollar. Analysts foresee the central bank opting to keep the interest rate unchanged, a move that might have the potential to exert downward pressure on the New Zealand Dollar’s value.

The US Institute of Supply Management (ISM) Services PMI jumped from 52.7 in July 2023 to 54.5 in August 2023, the largest growth in the services sector in six months.

Updated data will be released on 4 October, with analysts expecting the index to be lowered to 53.6.

Takeaway: The US ISM Services PMI will be the market mover for the US Dollar this week. This PMI data will provide information about the health of the US services sector. Based on the forecasted numbers, we can see that the services sector is still in expansion mode, which could potentially boost the US Dollar.

39,900 jobs were added to the Canadian economy in August 2023. Meanwhile, the unemployment rate held steady at 5.5%, maintaining its level from the previous month.

The figures for September are scheduled for release on 6 October, with analysts anticipating the addition of 17,000 new jobs. However, the unemployment rate is expected to rise slightly to 5.6%.

Takeaway: Based on the projected figures, there is a possibility that Canada’s employment data could potentially weaken the Canadian Dollar due to slower job additions and a higher unemployment rate.

187,000 jobs were added to the US economy in August 2023. However, the unemployment rate rose to 3.8%, the highest level since February 2022.

The figures for September 2023 are set to be released on 6 October. Analysts anticipate the addition of 163,000 jobs. Additionally, the unemployment rate is expected to decrease slightly to 3.7%.

Takeaway: The US Jobs report is approaching, and it holds significant importance for the US Dollar. This report provides insights into job numbers, unemployment rates, and wages in the US. Based o forecasts, there is potential for the US Dollar to strengthen.

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.