Spreads

Spreads

Spreads

Spreads

Spreads

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.

On Thursday, the stock market witnessed a rebound as Wall Street aimed to recover from recent losses. The Dow Jones Industrial Average and Nasdaq Composite posted gains of 0.35% and 0.83%, respectively, while the S&P 500 came close to reaching the 4,300 marks with a 0.59% increase. Despite the challenging month and quarter, optimism returned due to a decrease in Treasury yields from multiyear highs and positive economic data showing a resilient labor market. The US dollar also faced a decline, largely influenced by a rebound in the EUR/USD currency pair and evolving monetary policies from the European Central Bank and the US Federal Reserve. Amid these factors, concerns over fiscal difficulties and potential government shutdowns persist.

In the stock market update, on Thursday, stocks showed signs of recovery as Wall Street attempted to bounce back from the steep losses experienced earlier in the month. The Dow Jones Industrial Average rose by 116.07 points, or 0.35%, reaching 33,666.34, while the S&P 500 added 0.59%, just falling short of the key 4,300 level, closing at 4,299.70. The Nasdaq Composite saw a significant gain of about 0.83%, closing at 13,201.28. However, it’s worth noting that stocks have faced a challenging month and quarter, with the Dow expected to end September down 3% and the quarter down more than 2%. The S&P 500 is slated to finish the month with a 4.6% decline and the quarter with a 3.4% decrease, while the Nasdaq is on track to end both the month and quarter lower by 5.9% and 4.3%, respectively.

One key factor influencing market sentiment is the movement in Treasury yields, which have been rising. Investors have been concerned about the potential for higher interest rates and the impact on equities. However, on the positive side, Treasury yields eased from multiyear highs, providing some relief to the stock market. Additionally, positive economic data showing a resilient labor market with lower-than-expected jobless claims helped bolster market confidence. Investors are also keeping an eye on inflation metrics, particularly the personal consumption expenditures price index, which is the Federal Reserve’s preferred gauge of inflation. Moreover, political developments in Washington, specifically negotiations on a U.S. spending bill, are being closely monitored, as they could impact market dynamics in the near term.

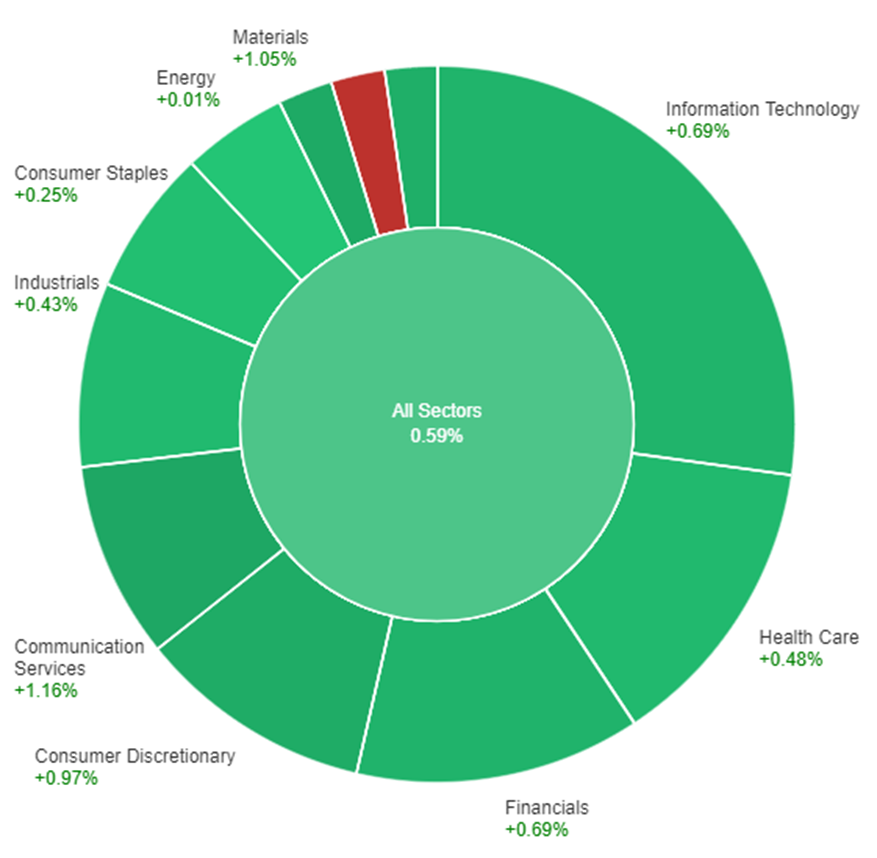

Data by Bloomberg

On Thursday, across all sectors, there was a modest increase in the market, with a gain of 0.59%. Notably, Communication Services, Materials, and Consumer Discretionary sectors saw even stronger performance, with gains of 1.16%, 1.05%, and 0.97% respectively. The Real Estate, Financials, and Information Technology sectors also experienced positive growth, with gains of 0.85%, 0.69%, and 0.69%. Health Care and Industrials sectors had more moderate increases, with gains of 0.48% and 0.43%. However, Consumer Staples saw a smaller gain of 0.25%. The Energy sector only saw a minimal increase of 0.01%. In contrast, the Utilities sector faced a significant decline, with a loss of -2.19% on Thursday.

In the latest currency market updates, the US dollar faced a notable decline, with the dollar index slipping by 0.37%. A significant contributor to this fall was the impressive 0.5% rebound in the EUR/USD currency pair, which had been deeply oversold. The pair found crucial support at the 1.0482 low from January 6, 2023, particularly toward the end of the month. This recovery was bolstered by a substantial rise in bund-Treasury yield spreads. Interestingly, the European Central Bank (ECB), despite German CPI figures coming in slightly below forecasts and reaching their lowest levels since the Russian invasion of Ukraine, indicated that it might not raise interest rates further. Instead, the ECB is in the process of unwinding its previous quantitative easing and bank-supportive policies, while fiscal policymakers in the region are grappling with rising costs. On the US front, concerns loom over potential fiscal difficulties, including the possibility of a government shutdown. The Federal Reserve’s commitment to maintaining higher interest rates for an extended period was also questioned by some, including Fed’s Austan Goolsbee. Though US jobless claims remained slightly below forecast, the pending home sales plummeted by 7.1% from July to August, hinting at a potential drop in September’s existing home sales, which could reach their lowest point in over a decade.

Moreover, in the context of the currency market, USD/JPY experienced a 0.2% decline due to a minor drop in Treasury-JGB yield spreads. Nevertheless, despite the promising yield spreads, the primary factor holding back USD/JPY’s advance is the fear of Japanese foreign exchange intervention. While most of the market’s attention is on the 150 level as a potential intervention trigger point, it could potentially break out above 2023’s channel top towards 2022’s 32-year high at 151.94, mirroring the scenario that triggered interventions in October 2022. Japanese officials have stated that they do not defend specific currency levels but rather respond to excessive volatility. However, recent price action has not been notably volatile. Additionally, the British pound rose by 0.46% following a recent low, which marked an 8% slide since its highs in July. This rebound was supported by the recovery of two-year gilts-Treasury yield spreads. Furthermore, the slight drop in Treasury yields, combined with a rebound in risk sentiment and pullbacks in both the dollar and oil prices, contributed to a 1.1% rise in AUD/USD and a 0.35% fall in USD/CNY. Upcoming data releases are set to include Tokyo CPI, Japan’s job market indicators, industrial production, and retail sales, as well as eurozone CPI figures, followed by the release of U.S. core PCE data, income and spending metrics, Michigan sentiment numbers, and Chicago PMI data.

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| CAD | GDP m/m | 20:30 | 0.1% |

| USD | Core PCE Price Index m/m | 20:30 | 0.2% |

| USD | Revised UoM Consumer Sentiment | 22:00 | 67.7 |

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.