Spreads

Spreads

Spreads

Spreads

Spreads

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.

On Wednesday, the Dow Jones Industrial Average fell by 0.20% as increasing Treasury yields and surging oil prices weighed on investor sentiment, with the S&P 500 approaching a critical support level. The energy sector outperformed, while concerns about inflation and disappointing economic data continued to impact the market. The US dollar strengthened, driven by a contrast in economic data between the United States and the Eurozone, posing challenges for EUR/USD speculators. The USD/JPY pair approached a significant level, with implications for foreign exchange interventions, while sterling and the Australian dollar faced their own challenges. Upcoming economic data releases are expected to maintain market volatility.

The Dow Jones Industrial Average experienced further losses, falling 0.20% on Wednesday, largely due to increased Treasury yields and rising oil prices, which negatively impacted investor sentiment. The Dow closed at 33,550.27, shedding 68.61 points, despite briefly surging by 112.77 points earlier in the session. On the other hand, the S&P 500 showed marginal gains of 0.02%, closing at 4,274.51, while the Nasdaq Composite ended the session 0.22% higher at 13,092.85. The increase in Treasury yields and a 3% spike in U.S. crude oil futures to $93.68 per barrel were key factors contributing to the market’s downward trajectory. The energy sector emerged as the best performer, rising by 2.5%, with notable companies like Marathon Oil and Devon Energy both posting gains of over 4%.

The recent market turbulence can be attributed to concerns regarding inflation, as rising rates and disappointing economic data have weighed on investor sentiment. The S&P 500 slipped below the crucial 4,300 level for the first time since June, and the Dow recorded its most significant one-day loss since March, closing below its 200-day moving average for the first time since May. September, known as a seasonally weak month for stocks, has seen the S&P 500 down by 5%, the Dow down by more than 3%, and the Nasdaq performing the worst, with a loss exceeding 6% for the month. Investors anticipate continued volatility in the coming weeks but remain hopeful for strong buying opportunities leading up to the year-end, particularly in October.

Data by Bloomberg

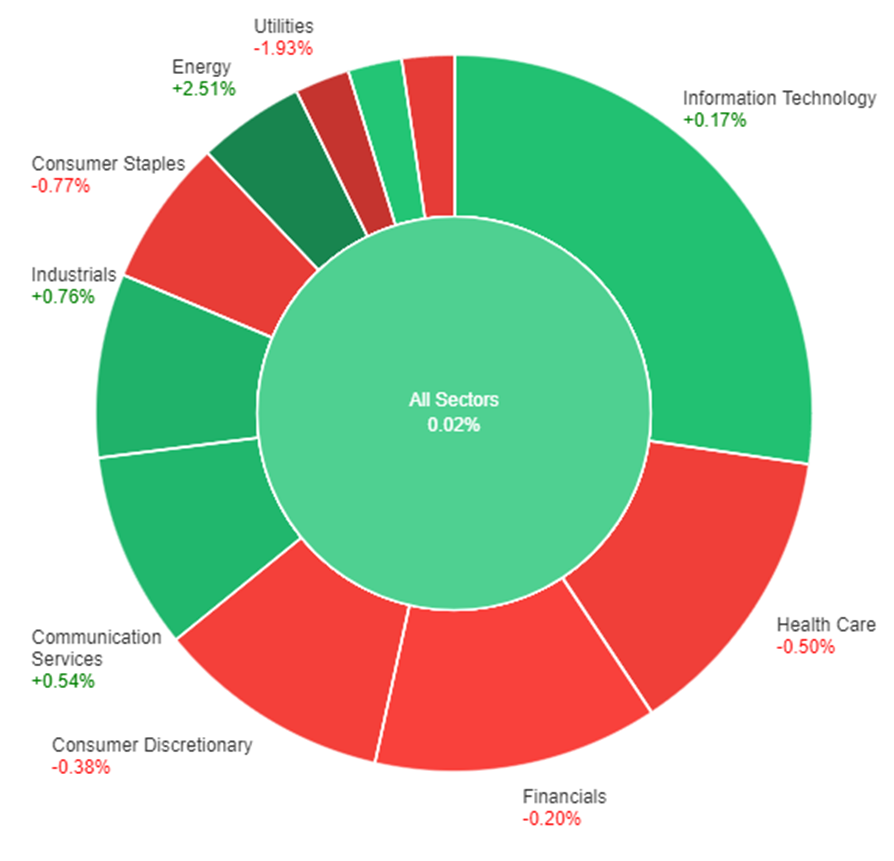

On Wednesday, across all sectors, the market saw a minimal increase of 0.02%. Energy performed exceptionally well with a substantial gain of 2.51%, while Industrials and Communication Services showed moderate increases of 0.76% and 0.54%, respectively. Information Technology also saw a slight gain of 0.17%. On the flip side, several sectors experienced declines, with Utilities being the most impacted, showing a significant decrease of 1.93%. Real Estate, Consumer Staples, and Health Care also had notable declines of 0.83%, 0.77%, and 0.50%, respectively. Financials and Consumer Discretionary had smaller losses of 0.20% and 0.38%, respectively.

The US dollar showed significant strength in the currency market, with the dollar index surging by 0.55% on Wednesday. This increase was driven by the EUR/USD pair falling by 0.75% below the 1.0500 mark and approaching the 2023 low of 1.0482. The dollar’s gains were primarily attributed to a contrast between better-than-expected economic data from the United States and rising concerns of a recession in the Eurozone, compelling short positions on the dollar to seek cover. Notably, Eurozone money supply contracted at a historic rate in August, with loans to households and businesses falling well short of forecasts. Additionally, deteriorating German consumer sentiment raised doubts about a recovery this year. The USD’s recent gains, totaling approximately 7% against the euro since July, are likely to be concerning for speculators who entered long positions earlier in the year, as the EUR/USD pair hovers near its 2023 low.

In the meantime, the USD/JPY pair is approaching the significant level of 150, which many speculate the Japanese Ministry of Finance might defend, either through verbal interventions or actual foreign exchange interventions. Surpassing 150 could lead to a defense of the 32-year peak reached last year at 151.94 on EBS, potentially signaling an overdue correction. The trajectory of 10-year Treasury yields in the United States, which rose by 7 basis points to levels not seen since 2007, is crucial for USD/JPY. While US yields surge, 10-year Japanese Government Bond (JGB) yields remain at a much lower level of around 0.75%, setting the stage for further developments in this currency pair. This currency market update also revealed that sterling fell by 0.35% due to concerns about the Bank of England’s ability to combat inflation effectively, with the pound inching closer to the 2023 low of 1.1805 after an almost 8% decline from its July highs. Other notable movements in the market include the Australian dollar (AUD/USD) falling by 0.9% due to risk aversion related to issues in China and limited expectations of an interest rate hike by the Reserve Bank of Australia (RBA). The US dollar also made gains against the Norwegian krone (USD/NOK) by 0.56% in response to rising crude oil prices, particularly as Brent crude approached the $100 mark. The market anticipates more economic data releases on Thursday, including German Consumer Price Index (CPI), US jobless claims, Q2 GDP revisions, and pending home sales, with a heavier slate of releases scheduled for Friday.

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| EUR | German Prelim CPI m/m | All Day | 0.3% |

| EUR | Spanish Flash CPI y/y | 15:00 | 3.5% |

| USD | Final GDP q/q | 20:30 | 2.2% |

| USD | Unemployment Claims | 20:30 | 214K |

| USD | Fed Chair Powell Speaks | 04:00 (29th) |

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.