Spreads

Spreads

Spreads

Spreads

Spreads

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.

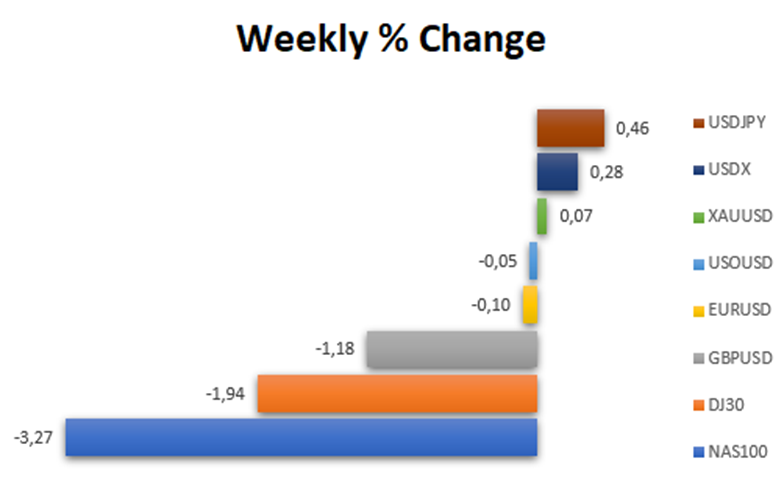

The US Dollar (USD) is gaining strength as the US Federal Reserve Chairman Jerome Powell’s recent announcement revealed a more hawkish stance, with the Fed indicating interest rates above 5% for most of 2024. This unexpected shift caused a significant increase in the 2-year US Treasury yield, leading to a 16-year high and boosting the value of the US Dollar.

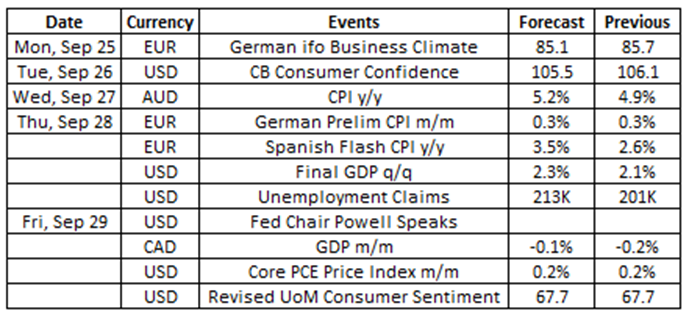

Source: VT Markets Economic Calendar

As we approach the last week of September, two crucial economic indicators for the US will be released: the final Gross Domestic Product (GDP) and the Consumer Price Index (CPI).

These can strongly affect currency values, so we recommend traders to be cautious and stay informed about the latest news to make wise trading decisions this week.

Here are some notable market highlights for this week:

The Ifo Business Climate indicator for Germany declined for the fourth consecutive month to 85.7 in August 2023, the lowest level since October 2022.

Analysts expect a reading of 85.2 for the upcoming data, which will be released on 25 September.

Takeaway: We are anticipating the release of Germany’s Ifo Business Climate Index, which will provide us with the latest updates on business conditions in the country. Based on the forecasted data, we expect Germany’s currency (Euro), to weaken if the business index is lower.

Australia’s CPI increased by 4.9% in July 2023, slowing from a 5.4% gain in June.

The next CPI data will be released on 27 September, with analysts predicting a 5.2% increase.

Takeaway: Australia’s CPI data will also be out, giving us information about how prices are changing. This could affect decisions made by the RBA in their next meeting. Looking at the predicted numbers, the Australian Dollar might strengthen.

Consumer prices in Germany rose by 0.3% month-over-month in August 2023, maintaining the same pace as in the previous two months.

The CPI data for September will be published on 28 September, with analysts predicting a 0.4% increase.

Takeaway: The forthcoming German Prelim CPI data release is expected to notably impact the Euro, considering Germany’s position as one of the biggest countries in the Eurozone. This CPI data will offer insights into the present inflation conditions in Germany. The forecast numbers indicate a higher in inflation, which could potentially result in heightened fluctuations for the Euro.

The US economy grew at an annualised rate of 2.1% in Q2 2023 compared to the first quarter’s expansion of 2%.

The US final GDP for Q3 2023 will be published on 28 September, with analysts predicting a 2.3% growth rate.

Takeaway: We’re waiting for the US Final GDP numbers to come in. This tells us about how the economy is growing and could have a big impact on the US Dollar. The forecast suggests that the economy might grow more, which could make the US Dollar stronger.

Core Personal Consumption Expenditures (PCE) prices in the US, which exclude food and energy, increased by 0.2% in July 2023, maintaining the same pace seen in June.

Analysts expect another 0.2% increase in the figures for August 2023, set to be released on 29 September.

Takeaway: We’re waiting for the US PCE Price Index numbers to come in. This tells us about how much people are spending and could have a big impact on the US Dollar. The forecast suggests that spending might growing, which could make the US Dollar stronger.

Canada’s GDP contracted by 0.2% in June 2023.

The next GDP data will be released on 29 September, with analysts anticipating a slower growth of -0.1%.

Takeaway: The release of Canada’s GDP data will inform traders about the current economic condition in the country. Based on the forecast numbers, it appears that the Canadian economy is slowing, which could potentially lead to a downward movement for the Canadian Dollar.

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.