Spreads

Spreads

Spreads

Spreads

Spreads

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.

On Wednesday, the stock market witnessed a downturn triggered by the Federal Reserve’s decision to maintain interest rates while signaling a looming rate hike. The S&P 500 and Nasdaq Composite both declined, with tech giants such as Microsoft, Nvidia, and Alphabet experiencing significant drops. The Federal Reserve’s cautious approach to rate hikes due to inflation concerns sent shockwaves through the markets, particularly impacting tech stocks that had been performing well earlier in the year. The increase in Treasury yields also raised concerns about the tech sector’s vulnerability to higher rates. Meanwhile, the US dollar had mixed movements in the currency market as the Fed’s hawkish stance influenced market sentiment but concerns about limited rate hike potential limited further gains.

On Wednesday, the stock market experienced a decline in response to the Federal Reserve’s announcement of leaving interest rates unchanged but hinting at an impending rate hike. The S&P 500 dropped by 0.94% to 4,402.20, while the Nasdaq Composite slid by 1.53% to 13,469.13. This decline was primarily driven by significant drops in tech giants like Microsoft, which saw a drop of over 2%, and Nvidia and Google-parent Alphabet, which both experienced declines of around 3%. The Dow Jones Industrial Average also lost 76.85 points, or 0.22%, closing at 34,440.88, with all three major indexes ending the day at session lows.

The Federal Reserve’s decision to keep interest rates steady, while expected, raised concerns among investors as the central bank indicated that one more rate hike is likely before the end of the year. The Fed’s economic projections suggested that after this increase, they would begin cutting rates next year, although rates would remain higher than previously signaled in June. Fed Chair Powell emphasized the need to proceed cautiously in raising rates further due to ongoing concerns about inflation. This news sent shockwaves through the markets, particularly impacting tech stocks, which had been performing well earlier in the year based on the expectation of a less aggressive monetary policy. Additionally, the increase in Treasury yields, with the 2-year yield reaching levels not seen since July 2006 and the 10-year yield hitting a high not seen since November 2007, raised concerns about the potential adverse effects of higher rates on the tech sector.

Data by Bloomberg

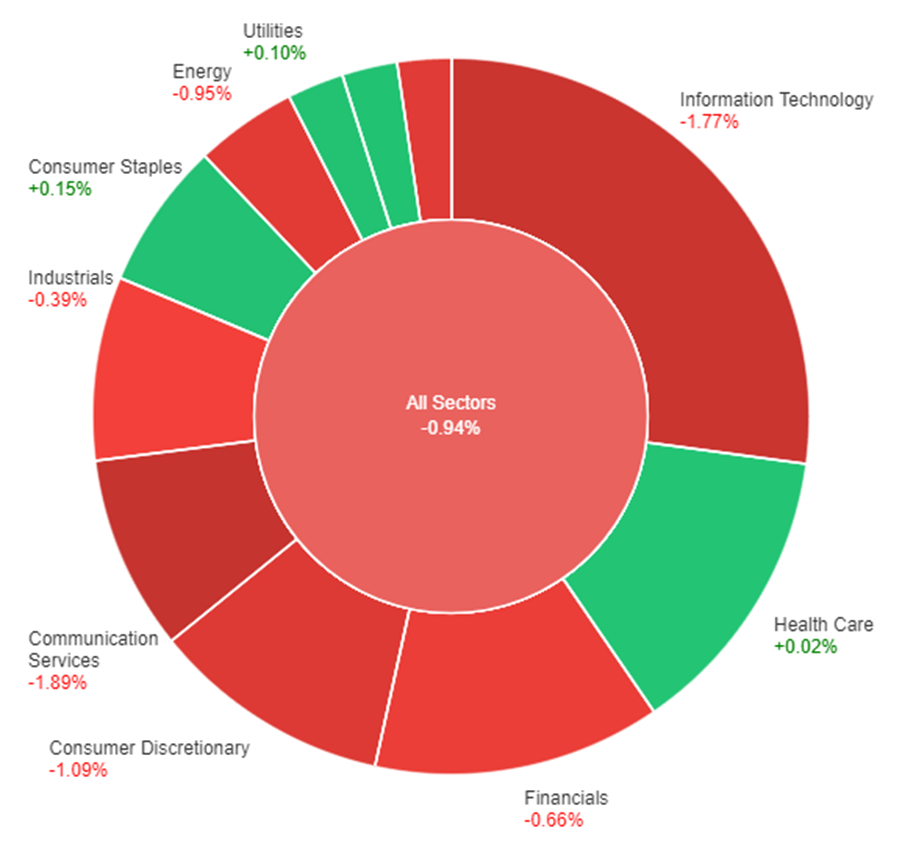

On Wednesday, across all sectors, the market experienced a decrease of 0.94%. Some sectors showed modest gains, with Consumer Staples up by 0.15%, Real Estate by 0.13%, Utilities by 0.10%, and Health Care by 0.02%. However, several sectors saw declines, including Industrials (-0.39%), Financials (-0.66%), Energy (-0.95%), Materials (-1.03%), Consumer Discretionary (-1.09%), Information Technology (-1.77%), and Communication Services (-1.89%).

In the latest currency market update, the US dollar experienced a day of mixed movements. Initially facing losses, the dollar index managed to stabilize as the Federal Reserve’s hawkish stance boosted market confidence. However, its ability to advance further was limited due to market consensus that there is limited room for the US central bank to raise rate expectations. The Fed’s dot plots indicated a preference for one more rate hike in the current year, reducing the median projection for rate cuts in 2024 from 100 basis points to 50 basis points. Federal Reserve Chair Jerome Powell emphasized the data-dependent nature of their decisions, noting that policy is already restrictive, and the full impact of previous tightening measures has yet to be felt. This announcement led to a sharp decline in the EUR/USD pair as 2-year Treasury yields rebounded to new highs for 2023.

Despite these developments, the dollar index is still grappling with overbought pressures that have arisen from its 6% increase since July. GBP/USD also saw fluctuations, initially dropping following below-forecast CPI data but rebounding ahead of the Federal Reserve’s announcement. To reverse the downtrend, GBP/USD would need to close above the 200-day moving average at 1.2434. Meanwhile, USD/JPY held relatively steady after the Fed events and briefly exceeded the 148 hurdle earlier in the day. The focus now turns to upcoming U.S. data releases and the Bank of Japan’s policy decisions, with potential tension between U.S. and Japanese officials regarding the timing of Japanese FX intervention. Overall, high-beta currencies like the Australian dollar retreated from their pre-Fed risk-on gains, stemming from expectations that major central banks’ tightening cycles are reaching their peaks.

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| CHF | SNB Monetary Policy Assessment | 15:30 | |

| CHF | SNB Policy Rate | 15:30 | 2.00% |

| CHF | SNB Press Conference | 15:30 | |

| GBP | Monetary Policy Summary | 19:00 | |

| GBP | MPC Official Bank Rate Votes | 19:00 | 7-0-2 |

| GBP | Official Bank Rate | 19:00 | 5.50% |

| USD | Unemployment Claims | 20:30 | 224K |

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.