Spreads

Spreads

Spreads

Spreads

Spreads

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.

On Wednesday, the U.S. stock market saw mixed performances, with the Dow Jones Industrial Average declining by 0.20% to 34,575.53, while the S&P 500 managed a slight uptick of 0.12%, and the Nasdaq Composite rose by 0.29%. These moves were in response to a surprising increase in August’s core inflation, which exceeded expectations, prompting concerns. In the currency market, the U.S. dollar initially gained strength due to the inflation data but later reversed course as core CPI figures aligned with forecasts. This led to a perception of disinflationary pressure and eliminated the possibility of an immediate Fed interest rate hike. Treasury yields attracted buying interest but fell short of this year’s peaks. Notably, EUR/USD declined, and the ECB meeting is closely watched with a 64% probability of an ECB rate hike priced in. USD/JPY showed resilience, and the Australian dollar remained flat, while the offshore yuan gained amid hopes of stabilizing financial and economic conditions in China.

On Wednesday, the Dow Jones Industrial Average experienced a decline of 70.46 points, equivalent to a 0.20% drop, settling at 34,575.53, marking its second consecutive day of losses. In contrast, the S&P 500 managed a slight uptick of 0.12%, reaching 4,467.44, while the Nasdaq Composite saw a more significant gain, rising by 0.29% to conclude the day at 13,813.59. Within the Dow, CNBC and 3M bore the brunt of losses, with a sharp drop of over 5.7%, followed by Caterpillar, which saw its shares dip by 2%. Meanwhile, Apple shares declined for a second consecutive day, falling by more than 1%. Conversely, the tech sector bolstered the S&P 500 and Nasdaq, with Tesla shares gaining 1.4% as billionaire investor Ron Baron expressed optimism about the electric vehicle maker. Amazon shares also surged, reaching their highest level since August 2022, with an increase of over 2.5%.

The market reaction came in response to a surprising increase in August’s core inflation print within the consumer price index. The core inflation, which excludes volatile food and energy prices, rose by 0.3%, surpassing expectations for a 0.2% increase, and stood at 4.3% year-on-year, meeting forecasts. Federal Reserve officials typically focus on the core inflation number as it offers a more reliable indication of long-term inflation trends. In contrast, the headline numbers, including all components, increased by 0.6% in the past month and were up 3.7% compared to the same period last year. Economists surveyed had anticipated smaller increases of 0.6% and 3.6%, respectively. Although the unsettling inflation report raised concerns, experts believe the Federal Reserve is unlikely to take immediate action, with market participants not expecting any moves until November. Currently, Wall Street appears to have factored in a pause in interest rate hikes, with a 97% probability of rates remaining unchanged at the Fed’s upcoming meeting, according to CME FedWatch Tool data.

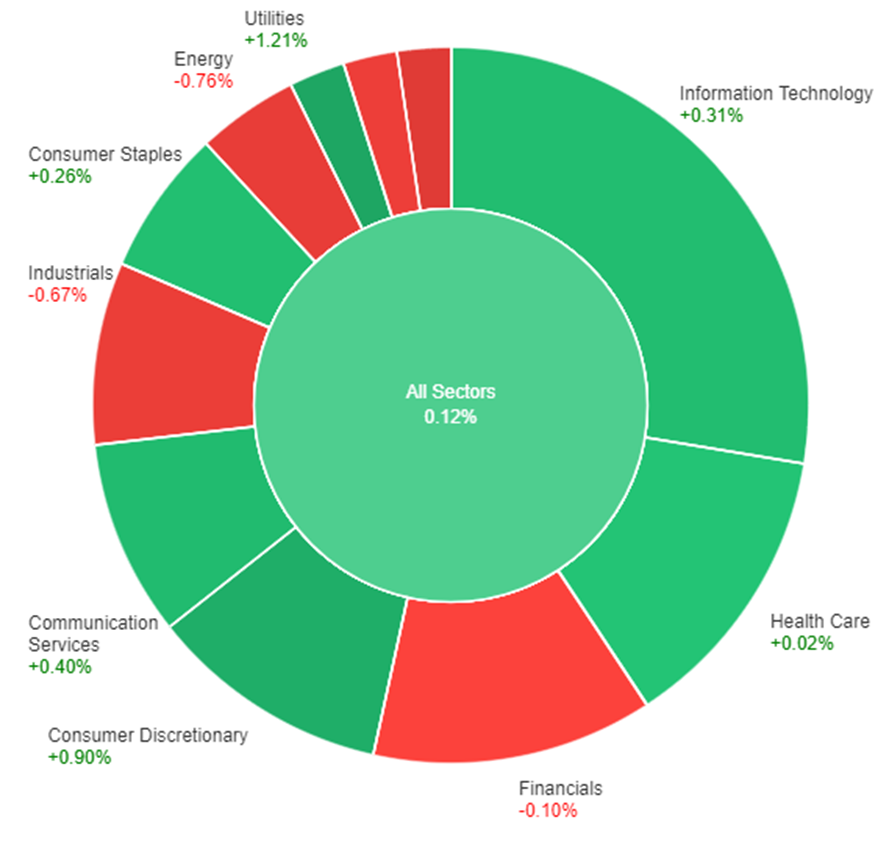

Data by Bloomberg

On Wednesday, the overall market saw a modest gain of 0.12%. Among the sectors, Utilities performed the best with a significant increase of 1.21%, followed by Consumer Discretionary, which rose by 0.90%. Communication Services and Information Technology also showed positive momentum, with gains of 0.40% and 0.31%, respectively. Consumer Staples and Health Care had smaller increases of 0.26% and 0.02%. However, Financials experienced a slight decline of -0.10%. The Materials sector saw a more notable decrease of -0.59%, while Industrials and Energy had more substantial losses of -0.67% and -0.76%, respectively. Real Estate was the weakest performing sector, declining by -1.03% on Wednesday.

The currency market reacted to the U.S. CPI data with a cautious stance, as traders had entered the session with an excessively short position in Treasuries and a strong long position in the U.S. dollar. The dollar index initially saw gains following a higher-than-expected increase in core CPI and an above-forecast overall rise compared to the previous year. However, the core CPI figure fell to 4.3% from the August reading, aligning with forecasts, which led to a perception of disinflationary pressure, eliminating the possibility of a Fed interest rate hike in the near term. Two- and 10-year Treasury yields, which had approached their highest levels of the year, attracted significant buying interest but failed to surpass those peaks.

Meanwhile, in the currency pairs, EUR/USD experienced a 0.14% decline but remained above its Wednesday low. This was partly supported by higher bund-Treasury yield spreads. The market is closely watching the ECB meeting, with a 64% probability of an ECB rate hike priced in after being below 50% just a day earlier. Sterling remained relatively stable, recovering from an initial dip due to disappointing data and a subsequent drop following the U.S. CPI release. USD/JPY saw a 0.18% rise, showing resilience to the drop in Treasury yields, as concerns about a potential BoJ rate hike or FX intervention by the Ministry of Finance (MoF) receded. However, the path to higher prices in this pair depends on a resumption of the uptrend in Treasury yields. The Australian dollar remained flat, while the offshore yuan gained 0.4% on hopes of China’s FX actions and housing stimulus efforts stabilizing the financial and economic landscape amid growth concerns.

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| AUD | Employment Change | 09:30 | 64.9K (Actual) |

| AUD | Unemployment Rate | 09:30 | 3.7% (Actual) |

| EUR | Main Refinancing Rate | 20:15 | 4.25% |

| EUR | Monetary Policy Statement | 20:15 | |

| USD | Core PPI m/m | 20:30 | 0.2% |

| USD | Core Retail Sales m/m | 20:30 | 0.4% |

| USD | PPI m/m | 20:30 | 0.4% |

| USD | Retail Sales m/m | 20:30 | 0.1% |

| USD | Unemployment Claims | 20:30 | 226K |

| EUR | ECB Press Conference | 20:45 |

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.