Spreads

Spreads

Spreads

Spreads

Spreads

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.

In a mixed day for the financial markets, the Nasdaq Composite faced a 1.04% decline on Tuesday, spurred by Oracle’s sharp 13.5% drop following disappointing results. This decline, though not a massive stock, reflects broader business spending trends and impacted both the Nasdaq and the S&P 500. Meanwhile, tech giants like Apple and Adobe also saw their share prices decline. On the energy front, U.S. crude oil prices hit their highest level since last November, boosting energy stocks. In the currency market, the US Dollar Index showed a modest increase as investors awaited the release of the August US Consumer Price Index (CPI), which is expected to influence Federal Reserve monetary policy expectations. The week also holds key inflation data with the Producer Price Index (PPI) scheduled for Thursday. In the UK, mixed labor market data pointed to economic challenges, while in currency trading, the Pound weakened amid uncertainties. The EUR/USD pair faces upcoming Eurozone Industrial Production data and the European Central Bank’s meeting.

On Tuesday, the Nasdaq Composite experienced a 1.04% decline, marking its first day of losses in three days. This drop was primarily driven by the sharp decline in Oracle shares, which tumbled 13.5% following disappointing quarterly results and a lackluster revenue forecast. This setback in Oracle, while not a massive stock, is indicative of larger business spending trends, impacting both the Nasdaq and the S&P 500. Additionally, other tech giants like Amazon, Alphabet (Google’s parent company), and Microsoft also saw their stock prices slide.

Meanwhile, Apple’s shares fell by 1.7% after the announcement of a new iPhone model, and Adobe’s shares dropped approximately 4% ahead of its upcoming earnings report. On a different note, U.S. crude oil prices reached their highest level since November of the previous year, driven by OPEC’s optimistic demand growth forecast. This surge in oil prices provided a boost to energy stocks, with Chevron and Exxon Mobil both seeing gains of about 1.9% and 2.9%, respectively. Investors are now closely watching key inflation data set to be released later this week, along with the European Central Bank’s interest rate decision on Thursday.

Investors eagerly await the release of key inflation data later this week, especially following a series of stronger-than-expected economic indicators from the previous week, which raised concerns about the possibility of the Federal Reserve increasing rates more than previously anticipated.

Data by Bloomberg

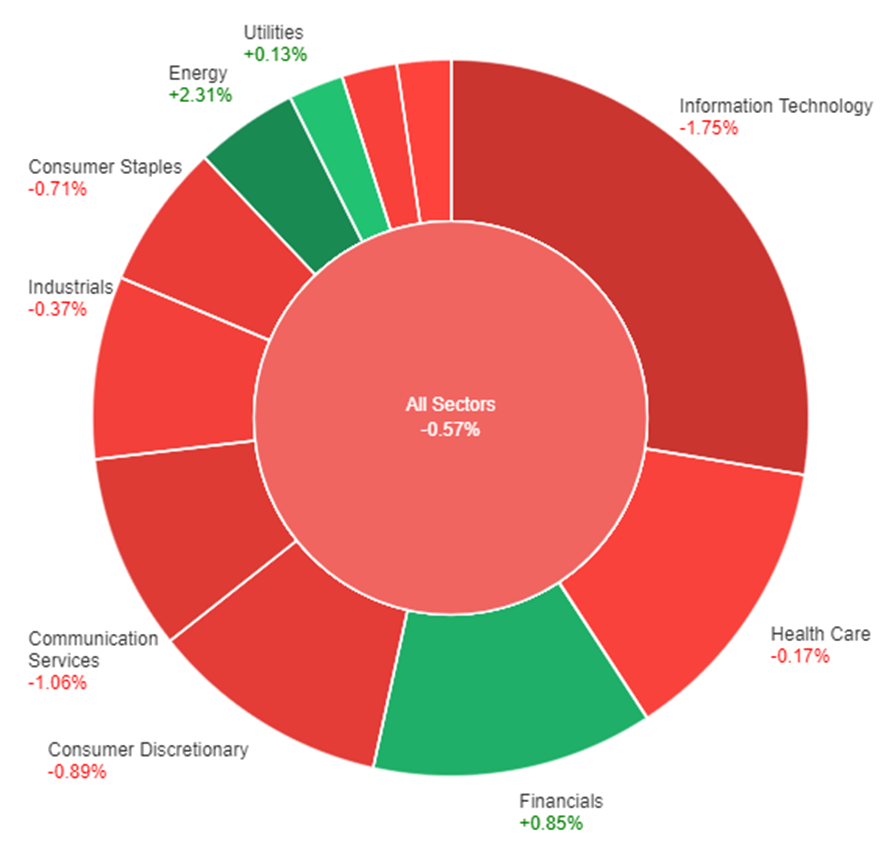

On Tuesday, the overall market slipped by 0.57%, with notable sector performance variations. Energy surged by 2.31%, and financials gained 0.85%, while utilities and real estate had slight gains of 0.13% and -0.03%, respectively. In contrast, information technology saw a substantial 1.75% drop, and communication services declined by 1.06%. Consumer discretionary, industrials, materials, and health care sectors faced moderate declines ranging from -0.17% to -0.89%, while consumer staples decreased by 0.71%. These sector-specific movements contributed to the market’s overall decline.

The US Dollar Index saw a modest uptick on Tuesday, nearing 105.00 before retracing, with markets relatively calm as they awaited crucial US data. The highlight of the week, the August US Consumer Price Index (CPI), is scheduled for release on Wednesday. It’s expected to show an annual rate rebound from 3.2% to 3.6%, while the Core rate may slow down from 4.7% to 4.3%. These figures are poised to influence expectations about the Federal Reserve’s monetary policy, likely leading to increased volatility. Thursday will bring more inflation data with the Producer Price Index (PPI).

In the UK, mixed labor market data signaled a deteriorating economic situation, as the unemployment rate rose to 4.3% – the highest since September 2021 – accompanied by a decline in employment by 207K. Despite average hourly weekly earnings exceeding expectations at 8.5%, the Pound weakened. The GBP/USD pair approached its monthly low before rebounding toward 1.2500. Meanwhile, the EUR/USD pair reached a weekly high at 1.0769 and has Eurozone Industrial Production data scheduled for Wednesday, along with the European Central Bank’s Governing Council meeting on Thursday.

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| GBP | GDP m/m | 14:00 | -0.2% |

| USD | Core CPI m/m | 20:30 | 0.2% |

| USD | CPI m/m | 20:30 | 0.6% |

| USD | CPI y/y | 20:30 | 3.6% |

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.