Spreads

Spreads

Spreads

Spreads

Spreads

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.

On Tuesday, the stock market faced turbulence with notable declines in major indices like the Dow Jones Industrial Average, which dropped 0.56%, and the S&P 500, which fell by 0.42%. This market downturn was primarily triggered by a significant surge in crude oil prices, driven by Saudi Arabia and Russia’s decision to extend supply cuts. Energy stocks benefited from this surge, but airline and cruise stocks took a hit. Additionally, rising oil prices pushed up Treasury yields, adding pressure to risk assets. The dollar gained strength, driven by disappointing economic data, particularly in China and the Eurozone, contributing to a dimmer global growth outlook. This led to a decline in the EUR/USD pair, while USD/JPY reached a new high for 2023. GBP/USD also declined, despite positive UK PMI data. AUD/USD was hit hardest, reflecting concerns about weak Chinese growth. Gold and Bitcoin were sensitive to rising global yields, experiencing price declines. In the upcoming Asian session, attention will turn to Australia’s Q2 Real GDP data for insights into the Reserve Bank of Australia’s policy direction.

On Tuesday, stocks faced a turbulent start to the trading week, primarily due to a significant surge in crude oil prices. The Dow Jones Industrial Average closed with a loss of 195.74 points, representing a 0.56% decline, settling at 34,641.97. Similarly, the S&P 500 experienced a 0.42% drop, concluding the day at 4,496.83, while the Nasdaq Composite edged down 0.08%, settling at 14,020.95. This downward trend in the stock market was triggered by an increase in oil prices, following Saudi Arabia and Russia’s decision to extend voluntary supply cuts. West Texas Intermediate futures saw a substantial gain of over 1%, briefly surpassing $87 per barrel, marking their highest levels since November. This news had a positive impact on energy stocks, with the S&P 500 energy sector gaining 0.5%. Notably, shares of companies like Halliburton, Occidental Petroleum, and EOG Resources saw notable increases. However, the surge in oil prices had adverse effects on airline and cruise stocks, causing significant declines for companies such as American Airlines, United Airlines, Delta Air Lines, and Carnival.

Furthermore, this spike in oil prices also led to a rise in Treasury yields, putting pressure on risk assets. The yield on the 10-year Treasury increased by approximately 9 basis points, reaching around 4.27%. Keith Lerner, co-chief investment officer at Truist Advisory Services, highlighted the potential inflationary impact of rising oil prices, which could complicate the Federal Reserve’s efforts to maintain a delicate balance between achieving a soft economic landing and preventing a slowdown. Consequently, the day witnessed substantial losses in small and midcap stocks, with the S&P Small Cap 600 experiencing its worst day since February with a nearly 3% decline. Additionally, the S&P Midcap 400 slumped approximately 2.3%, and the Russell 2000 fell by 2.1%.

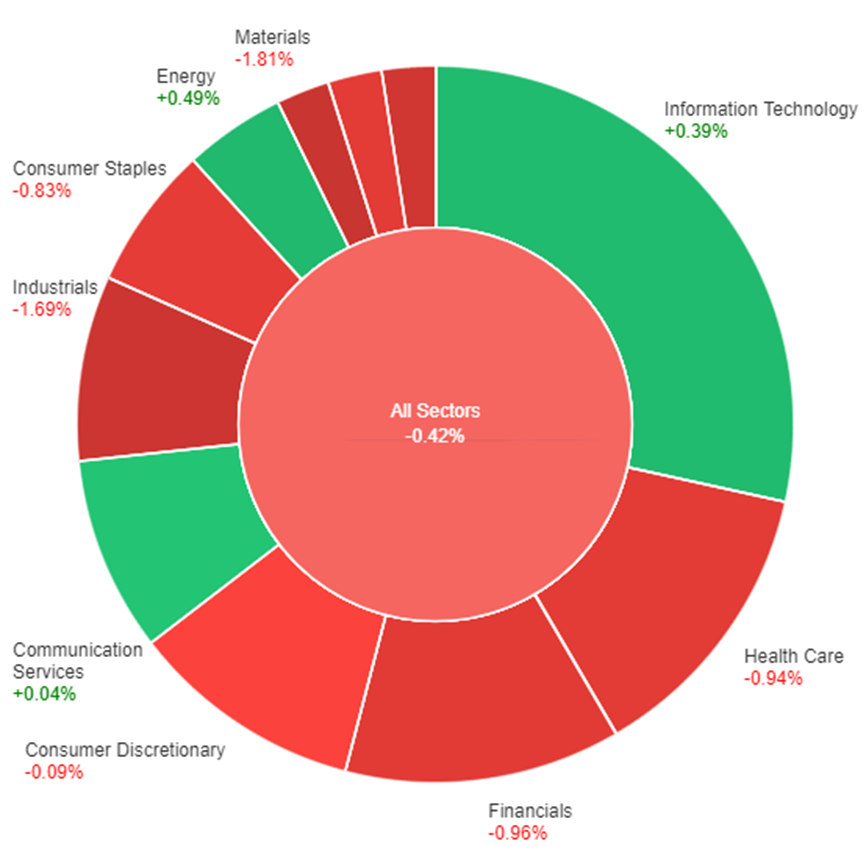

Data by Bloomberg

On Tuesday, the overall stock market (All Sectors) experienced a slight decline of 0.42%. However, there were variations in performance among different sectors. The Energy sector stood out with a notable gain of 0.49%, followed by Information Technology, which saw a 0.39% increase. Communication Services showed a modest uptick of 0.04%. In contrast, several sectors faced declines, including Consumer Discretionary (-0.09%), Consumer Staples (-0.83%), Health Care (-0.94%), Real Estate (-0.95%), Financials (-0.96%), Utilities (-1.54%), Industrials (-1.69%), and Materials (-1.81%).

The dollar index saw a notable 0.6% increase as trading resumed after the Labor Day holiday weekend. Traders displayed a preference for safe-haven assets, leading to increased demand for the dollar. This shift was driven by disappointing China Caixin services PMI data and added pressure from euro zone PMI figures, which collectively contributed to a dimmer global growth outlook. Consequently, the EUR/USD pair declined by 0.63%, reflecting concerns about reduced European growth prospects and doubts about the European Central Bank’s potential rate hike at its upcoming Governing Council meeting on September 14. The pair reached a three-month low at 1.0705 before slightly rebounding to 1.0730 in North American afternoon trading. Euro bears now have their sights set on the June 2 weekly low at 1.0635, with late-February lows below 1.0550 as potential targets.

In contrast, USD/JPY reached a new high for 2023 at 147.76 and remained near that level in late trading. The yen continued to face considerable downward pressure due to widening U.S.-Japan yield differentials. The Bank of Japan’s commitment to an ultra-accommodative rate stance contrasted with expectations of the Federal Reserve maintaining higher rates for an extended period, further contributing to the yen’s decline. Traders also appeared to have shifted their expectations for Japanese government intervention to the 150 level, slightly below the 2022 high at 151.94. Additionally, GBP/USD experienced a 0.47% decline, with sterling’s weakness lagging slightly behind. Despite UK PMI data surpassing forecasts, concerns about the impact of rising UK rates on the economy persisted. However, with the Bank of England expected to continue raising rates and maintain a relatively hawkish stance compared to other developed market central banks, GBP/USD may be approaching a bottom. Finally, AUD/USD faced the sharpest decline among major currency pairs, falling to a session low at 0.6358 and closing down 1.32% at 0.6380. This decline was attributed to falling China PMI data, which suggested that weak growth in China could temper Australian economic prospects. Rising U.S. Treasury yields impacted gold, leading to a 0.6% decrease in its price to $1,926. Bitcoin, sensitive to global yield trends, experienced a 0.3% decline to $25.7k after trading in the range of $25.9k-$25.5k. In the upcoming Asia session, the focus will be on Australia’s Q2 Real GDP data, which may provide insights into the Reserve Bank of Australia’s policy direction.

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| AUD | GDP q/q | 09:30 | 0.4% |

| CAD | BOC Rate Statement | 22:00 | |

| CAD | Overnight Rate | 22:00 | 5.00% |

| USD | ISM Services PMI | 22:00 | 52.5 |

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.