Spreads

Spreads

Spreads

Spreads

Spreads

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.

The S&P 500 extended its winning streak to four days, rising 0.38% and surpassing 4,500 points to close at 4,514.87. The Dow Jones Industrial Average added 0.11%, while the tech-oriented Nasdaq Composite advanced 0.54% to 14,019.31. The S&P’s recent gains helped trim month-to-date losses to approximately 1.6%. The tech sector saw an upswing with chipmaker Nvidia contributing to the rise, and Apple’s shares climbing nearly 2% as anticipation for the iPhone 15 unveiling event on September 12 grew.

Investors have reacted positively to underwhelming economic data for the second consecutive day. Disappointing payrolls data showed that private employers added only 177,000 jobs in August, well below expectations and the previous month’s figure. Additionally, the annual gross domestic product growth forecast was revised downward from 2.4% to 2.1%. This market behavior indicates a hopeful perspective that weaker economic data might lead to adjustments in the Federal Reserve’s policy stance.

Data by Bloomberg

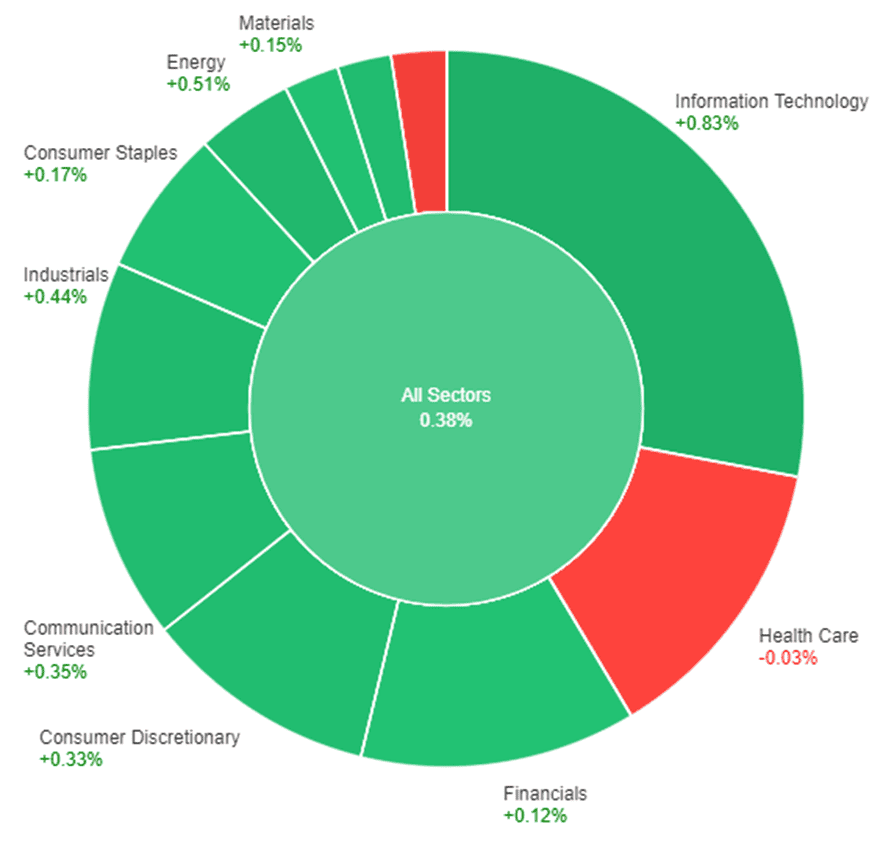

On Wednesday, the S&P 500 showed a 0.38% overall increase. The Information Technology sector led the gains with a significant rise of 0.83%, followed by Energy at 0.51% and Industrials at 0.44%. Communication Services and Real Estate both recorded a 0.35% uptick, while Consumer Discretionary saw a 0.33% increase. Meanwhile, Consumer Staples and Materials experienced more modest growth with gains of 0.17% and 0.15%, respectively. Financials and Health Care registered smaller gains, rising by 0.12% and declining by 0.03%, respectively. Utilities were the only sector to show a notable decrease, falling by 0.42%.

The dollar index decreased by 0.37% due to underwhelming revisions and significant drops in JOLTS and consumer confidence data. The impact of this setback hinges on the forthcoming core PCE on Thursday and the employment report on Friday, which will provide clearer insights into the dollar’s trajectory. While mid-week U.S. data hold less significance for the Fed’s primary inflation and employment assessments, the misses prompted EUR/USD to reach a two-week high, rising 0.4% on Wednesday and 1.63% from August’s lows.

EUR/USD’s advance surpassed multiple technical indicators, such as the downtrend line across July and August highs, the 21- and 100-day moving averages, and last week’s 1.0930 high. The upward momentum paused near the 30-day moving average at 1.0948, favored by trend followers, and the 61.8% retracement level of August’s drop. The British pound increased by 0.6%, encountering resistance near its 30-day moving average at 1.2747. The Bank of England (BoE) is projected to initiate two more 25bp rate hikes to address UK inflation, which stands at 5.3% compared to 3.2% in the U.S.

The Japanese yen gained 0.2%, but its appeal remains limited due to the BoJ’s negative rates and doubts about a near-to-medium-term shift from ultra-easy policies. Treasury-JGB yield spreads declined from recent highs, and market participants are waiting for U.S. inflation, employment, and ISM manufacturing reports to ascertain the direction of the trend. The Australian dollar remained steady, while USD/CNH rose 0.24% following weaker-than-forecast data and attempts to stimulate the sector. Upcoming events include euro zone CPI, U.S. core PCE, jobless claims, and Chicago PMI.

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| USD | Core PCE Price Index m/m | 20:30 | 0.9% |

| USD | Unemployment Claims | 20:30 | 236K |

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.