Spreads

Spreads

Spreads

Spreads

Spreads

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.

Investors rallied around tech stocks, propelling the Nasdaq Composite up by more than 1% on Tuesday, seeking respite in the closing stages of a challenging August for the market. The tech-centric index surged 1.74% to reach a closing figure of 13,943.76. Similarly, the S&P 500 marked its most robust performance since June 2, surging 1.45% to conclude at 4,497.63, while the Dow Jones Industrial Average managed a 0.85% rise, accumulating 292.69 points to cap off the session at 34,852.67.

Leading the ascent among tech stocks was chipmaker Nvidia, boasting a gain of over 4%, with Meta Platforms, Tesla, Apple, and Microsoft also closing the day in positive territory. The sector found support in declining bond yields prompted by the release of fresh U.S. economic data. Moreover, AT&T’s shares climbed 3.9% on the back of a Citi upgrade, while Best Buy saw a 3.8% increase after reporting better-than-anticipated earnings. As the month of August concludes, the Dow is projected to record a 1.9% dip, with the S&P 500 and Nasdaq anticipated to incur losses of 1.9% and 2.8%, respectively.

Data by Bloomberg

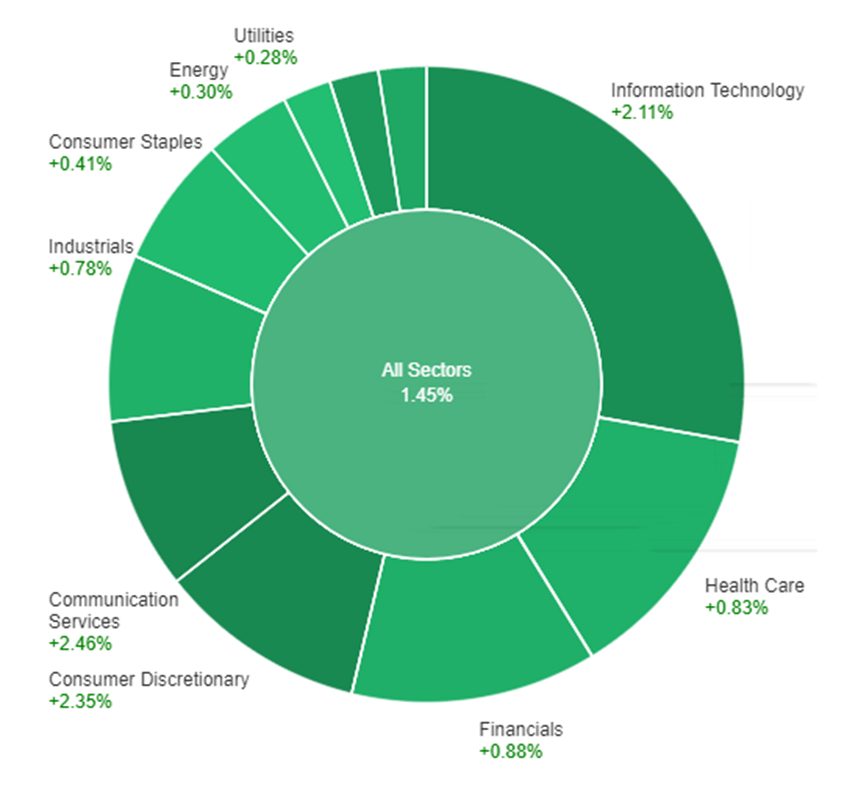

On Tuesday, all sectors of the market showed positive movement, with an average increase of 1.45%. Communication Services experienced the highest gain, rising by 2.46%, followed closely by Consumer Discretionary at 2.35% and Information Technology at 2.11%. Other notable sector increases included Materials at 1.68%, Real Estate at 1.15%, Financials at 0.88%, Health Care at 0.83%, Industrials at 0.78%, Consumer Staples at 0.41%, Energy at 0.30%, and Utilities at 0.28%.

The dollar index started with gains but ended with a 0.55% loss due to disappointing JOLTS and consumer confidence data, causing Treasury yields to drop significantly. This shift, along with recent remarks from central bank leaders, suggests the Fed might prioritize rate cuts over hikes in 2024. Further U.S. data this week will likely influence this view. Despite initially strong levels, the dollar index’s momentum waned after speeches by Fed Chair Jerome Powell, ECB President Christine Lagarde, and BoJ Governor Kazuo Kuroda. EUR/USD stayed above key supports while USD/JPY reached new 2023 highs. However, Tuesday’s U.S. data led to a 0.64% gain for EUR/USD, raising it from crucial supports.

The ECB is leaning toward a rate hike by October, while the likelihood of a September hike is uncertain. Sterling rose 0.44%, hindered slightly by EUR/GBP clearing resistance, yet still reclaiming its 100-day moving average. The Australian dollar surged by 0.86% as falling Treasury yields boosted higher-risk assets. It also benefited from increased commodity prices and positive economic prospects after Chinese state banks lowered mortgage rates. Australian CPI data and the RBA’s stance on potential rate hikes will be closely watched. USD/CNH declined 0.15%, remaining within its recent range due to skepticism surrounding the resolution of structural issues impacting the Chinese economy. The upcoming release of German CPI, ADP data, and U.S. pending home sales on Wednesday, followed by more crucial U.S. data on Thursday and Friday, will further shape market trends.

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| AUD | CPI y/y | 09:30 | 4.9% (Actual) |

| EUR | German Prelim CPI m/m | ALL DAY | 0.3% |

| EUR | Spanish Flash CPI y/y | 15:00 | 2.5% |

| USD | ADP Non-Farm Employment Change | 20:15 | 194K |

| USD | Prelim GDP q/q | 20:30 | 2.4% |

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.