Spreads

Spreads

Spreads

Spreads

Spreads

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.

Stocks started the final trading week of August on a positive note, with Wall Street striving to recover from a month of losses. The Dow Jones Industrial Average surged by 0.62%, gaining 213.08 points to close at 34,559.98. The S&P 500 climbed 0.63% to reach 4,433.31, and the Nasdaq Composite advanced by 0.84% to finish at 13,705.13. August has witnessed losses across all three indexes, with the S&P 500 declining by 3.4%, and the Nasdaq and Dow slipping by about 4.5% and 2.8% respectively. The tech sector, which suffered a 4.6% drop this month, made efforts to recover as certain tech giants like Meta, Apple, and Nvidia showed slight gains. Meanwhile, other sectors, such as 3M, made notable moves driven by company news.

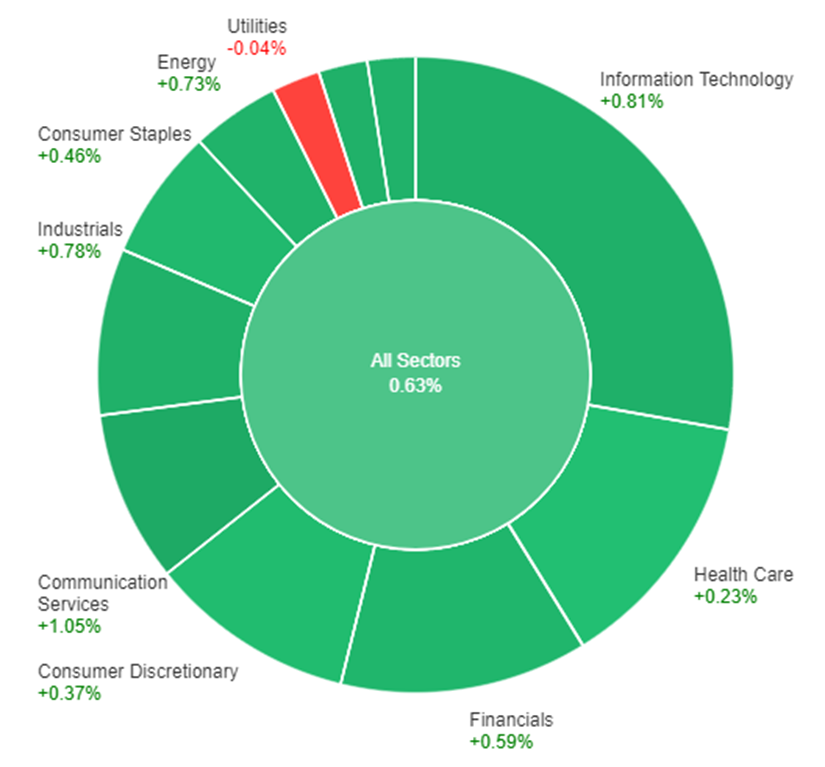

The rally on Monday was characterized by a broader market participation, with 10 of the 11 sectors in the S&P 500 showing positive momentum. Notably, the rally appeared to favor cyclical stocks over tech, as investors responded to stronger-than-expected growth beyond the U.S. borders. The positive sentiment followed Federal Reserve Chair Jerome Powell’s recent remarks, in which he indicated cautiousness in proceeding with further interest rate hikes despite signs of ongoing economic growth and robust consumer spending. Traders were assigning over a 20% probability of another rate hike during the upcoming September meeting. The week ahead holds significance with the release of the Fed’s preferred inflation gauge, the personal consumption expenditures index, and fresh non-farm payroll data.

Data by Bloomberg

On Monday, the overall market saw a positive movement of 0.63%. The Communication Services sector led the gains with a notable increase of 1.05%, followed by Information Technology at 0.81% and Industrials at 0.78%. Real Estate, Materials, and Energy sectors also displayed positive growth, each rising by 0.77%, 0.74%, and 0.73% respectively. Financials experienced a moderate gain of 0.59%, while Consumer Staples and Consumer Discretionary sectors showed more modest increases of 0.46% and 0.37%. Health Care saw a slight uptick of 0.23%, while the Utilities sector had a minor decrease of -0.04%.

The dollar index showed a slight decline on Monday as London observed a bank holiday. Investors grappled with mixed messages from central bankers following the Jackson Hole symposium. While the Bank of Japan (BoJ) Governor leaned dovish, other central banks left their stance ambiguous. The market eagerly awaited upcoming key data releases for clearer guidance.

A rebound in risk appetite, partially triggered by China’s efforts to bolster its slowing growth and curb investment outflows, had a minor impact on safe-haven currencies like the dollar and yen. Meanwhile, risk-sensitive currencies such as the Australian dollar and sterling received support, rising by 0.27% and 0.19% respectively. EUR/USD gained 0.12%, and USD/JPY remained relatively stable.

Following the Jackson Hole event, the Federal Reserve is likely to raise rates by 25 basis points at its November meeting if U.S. data remains robust. The European Central Bank (ECB), facing weaker euro zone data and inflation concerns, may raise rates by 25 basis points as early as September. Fed Chair Jerome Powell emphasized the need for more data before considering rate hikes, while ECB President Christine Lagarde highlighted potential inflation risks. With the focus on upcoming euro zone and U.S. data, market attention is on economic indicators, including CPI, core PCE, employment data, and ISM manufacturing reports for August. The dollar’s trajectory against the yen depends on U.S. data and Treasury yields, while sterling remained relatively unaffected by hawkish comments from the Bank of England Deputy Governor, already priced in due to inflation concerns.

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| AUD | RBA Gov-Designate Bullock Speaks | 15:40 | |

| USD | CB Consumer Confidence | 22:00 | 116.0 |

| USD | JOLTS Job Openings | 22:00 | 9.49M |

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.