Spreads

Spreads

Spreads

Spreads

Spreads

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.

Last week’s market recap:

Fed Chair’s speech in Jackson Hole:

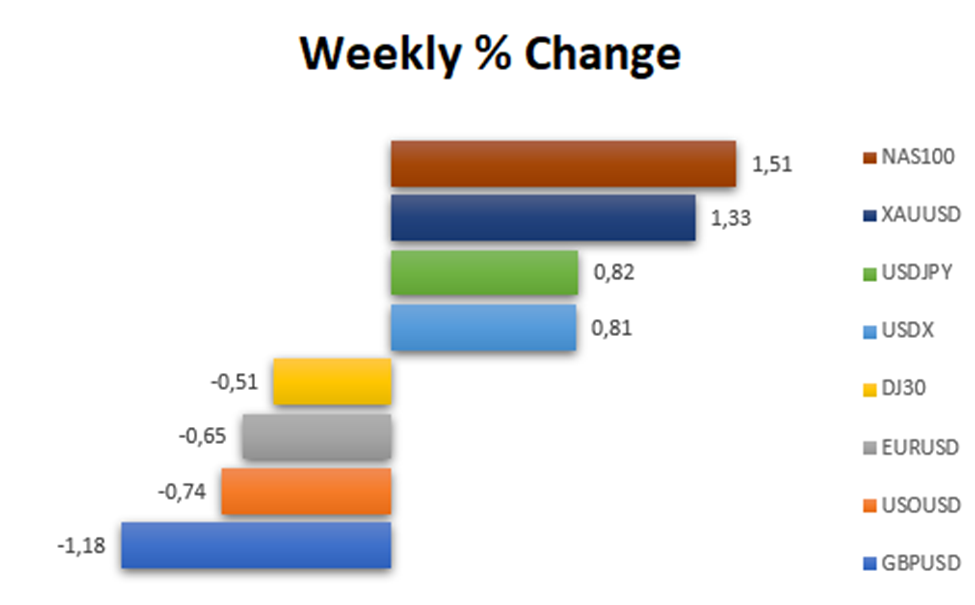

Last Week’s Market Pair Changes (All data is taken from the MT4 VT Markets)

The U.S. dollar remained strong over the week, supported by Federal Reserve Chair Jerome Powell’s cautious remarks on potential interest rate increases to manage inflation, while the U.S. dollar index achieved its sixth consecutive week of gains. Powell’s speech at a Wyoming summit emphasized careful decision-making, even as the Fed considers whether the current benchmark interest rate is sufficient to ensure 2% inflation. The euro and sterling weakened due to weak business data, leading to reduced rate hike expectations in these regions. The euro’s decline was also driven by concerns about slowing growth and the possibility of an interest rate pause. The British pound dropped to a 10-week low amid softened activity data and adjusted rate hike predictions.

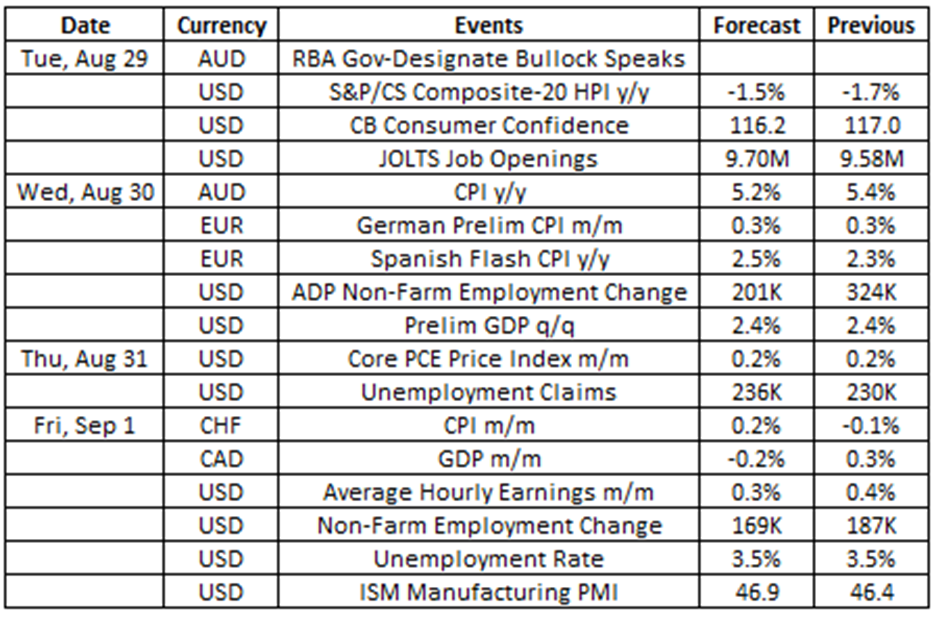

Source: VT Markets Economic Calendar

What to focus on this week?

This week, keep a close watch on Australia’s Consumer Price Index (CPI), the US Core Personal Consumption Expenditure (PCE) Price Index, and the US Jobs Report. These indicators could substantially impact market sentiment, amplifying the need for traders to exercise caution and stay well-informed to optimise their trading efforts throughout the week.

Here are some market highlights for the upcoming week:

US JOLTS Job Openings (29 August 2023)

Figures from the US Job Openings and Labour Turnover Survey (JOLTS) indicate that the number of job openings in the US fell by 34,000 to 9.58 million in June 2023, the lowest level since April 2021.

The figures for July 2023 will be released on 29 August, with analysts expecting a slight drop to 9.57 million.

Takeaway: The week will start with the release of US JOLTS Job Openings data, offering an initial glimpse into the US labour market. Depending on the projected figures, the US Dollar could potentially weaken.

Australia Consumer Price Index (30 August 2023)

Australia’s Consumer Price Index was up by 5.4% in June 2023, easing from the 5.5% rise observed in May 2023.

Analysts predict a slower growth rate of 5.2% in the figures for July 2023, set to be released on 30 August.

Takeaway: Australia’s CPI data is also set to be released, providing insights into price fluctuations. This information could influence the decisions of the RBA in their upcoming meeting. Analyzing the projected figures, it’s possible that the Australian Dollar could experience a decline in strength.

US Core PCE Price Index (31 August 2023)

Core PCE prices in the US, excluding food and energy, experienced a 0.2% increase in June 2023, easing from the 0.3% rise seen in May 2023.

The data for July 2023 is set to be released on 31 August, with analysts expecting a 0.2% growth.

Takeaway: We’re eagerly anticipating the release of the US PCE Price Index figures. This data sheds light on consumer spending trends and could wield significant influence over the US Dollar. The projected forecast indicates a potential slowdown in spending, which has the potential to weaken the US Dollar.

US Jobs Report (1 September 2023)

The US economy created 187,000 jobs in July 2023, while the unemployment rate decreased to 3.5%.

The figures for August 2023 will be released on 1 September, with analysts forecasting the addition of 180,000 more jobs. The unemployment rate is expected to maintain its level at 3.5%.

Takeaway: The US Jobs report is on the horizon, and it holds substantial importance for the US Dollar. This report will provide insights into job numbers, unemployment rates, and wage trends in the US. According to expert analysis, the potential outcome could lead to a strengthening of the US Dollar.

ISM Manufacturing PMI (1 September 2023)

The ISM Manufacturing Purchasing Managers’ Index (PMI) for the US rose to 46.4 in July 2023 from 46 in June 2023.

Analysts predict a reading of 46.6 in the index for August 2023, scheduled for release on 1 September.

Takeaway: Keep an eye out for the US ISM Manufacturing PMI – it’s a key player for the US Dollar. This data will shed light on the performance of the US manufacturing sector. Forecasts suggest ongoing challenges in manufacturing, which might result in a weakening of the US Dollar.

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.