Spreads

Spreads

Spreads

Spreads

Spreads

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.

In a dramatic turn of events, the stock market experienced a sharp decline following a brief surge triggered by Nvidia’s impressive quarterly results. As the tech rally faded, investors also braced themselves for a significant address from Federal Reserve Chairman Jerome Powell. The Dow Jones Industrial Average closed with a hefty loss of 373.56 points, marking a 1.08% drop to settle at 34,099.42. Similarly, the S&P 500 witnessed a substantial decline of 1.35%, concluding the day at 4,376.31, while the Nasdaq Composite, renowned for its tech-heavy constituents, plunged by 1.87% to reach 13,463.97.

This Thursday brought forth the Dow’s most challenging day since March, while the S&P 500 and Nasdaq encountered their most significant single-day losses since August 2nd. Nvidia, a prominent tech player, reported better-than-expected earnings and revenue, propelling its shares to an all-time high. Although the company’s leadership projected a remarkable third-quarter revenue increase of 170% year-over-year, the stock only managed a meager 0.1% gain by the closing bell. Meanwhile, the tech sector faced a notable setback, causing the S&P 500’s largest loss of 2.15%. Renowned tech giants like Amazon, Apple, and Netflix saw their shares decrease during the session, with losses ranging from 2.6% to 4.8%. As the market awaits Powell’s speech, U.S. Treasury yields climbed, touching 4.241% for the benchmark 10-year Treasury note.

Data by Bloomberg

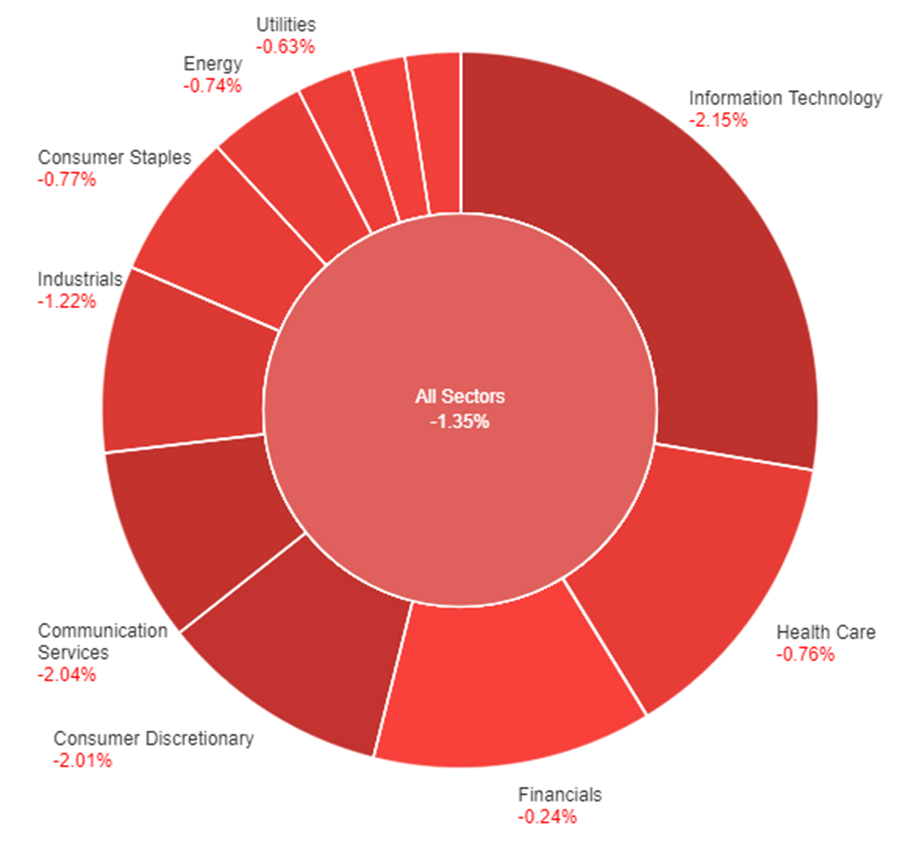

On Thursday, all sectors of the stock market experienced a decline of 1.35%. Among the various sectors, technology and communication services were hit the hardest, both dropping by 2.15% and 2.04% respectively. Consumer discretionary also faced a substantial decrease of 2.01%. Industrials followed with a decline of 1.22%. Health care, energy, and utilities sectors recorded losses of 0.76%, 0.74%, and 0.63% respectively. Financials, real estate, and materials sectors had more modest declines, each decreasing by 0.24%, 0.41%, and 0.43%. The consumer staples sector also saw a decrease of 0.77% in its value.

Major Pair Movement

The US Dollar Index rebounded and surged above 104.00, marking its highest point since early June after a brief correction. This resurgence was fueled by fundamental factors, risk aversion, and higher US Treasury yields, all of which contributed to the strengthening of the Greenback. All eyes are on the Jackson Hole event, with European Central Bank President Christine Lagarde and Federal Reserve Chair Jerome Powell scheduled to speak. Their speeches are anticipated to induce volatility and potentially lead to significant movements in financial markets. Despite mixed data from the US on Thursday, including a 5.2% decline in July’s Durable Goods Orders (versus an expected -4%) and a lower than expected initial Jobless Claims of 230K (versus 240K expected), the US Dollar remained resilient. The University of Michigan’s Consumer Sentiment report is expected to be released on Friday. Additionally, Federal Reserve officials’ comments varied, with some suggesting that policy actions may have been sufficient, while others warned of the possibility of further rate hikes.

The 10-year US Treasury yield rebounded to 4.2%, though it remained below recent peaks, while the 2-year yield climbed back above 5%. These rising yields exerted pressure on the Japanese Yen, causing USD/JPY to rise from 144.65 to 145.85, poised for Jerome Powell’s speech. Meanwhile, EUR/USD retreated to 1.0800, trading with a bearish bias just above the 200-day Simple Moving Average (SMA). ECB President Christine Lagarde’s speech at Jackson Hole and upcoming data on German Q2 GDP and the IFO Survey are awaited. USD/CHF consolidated above 0.8800, achieving its highest daily close in a month around 0.8850, as Switzerland prepared to release Q2 employment data. Conversely, GBP/USD resumed its downtrend, slipping below 1.2600 after failing to hold above the 20-day SMA at 1.2740. In the Antipodean region, AUD/USD reversed its gains from Wednesday and neared the 0.6400 mark, while NZD/USD struggled to regain 0.6000 and dropped to 0.5920, both currencies facing pressure amidst cautious market sentiment.

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| EUR | German ifo Business Climate | 16:00 | 86.8 |

| USD | Revised UoM Consumer Sentiment | 22:00 | 71.2 |

| USD | Fed Chair Powell Speaks (Jackson Hole Symposium) | 22:05 | |

| EUR | ECB President Lagarde Speaks (Jackson Hole Symposium) | 03:00 (26th) |

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.