Spreads

0.05%

Spreads

0.04%

Spreads

0.00%

Spreads

0.11%

Spreads

0.74%

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.

Stocks closed higher on Wednesday as investors awaited Nvidia’s latest quarterly earnings report, with the company being a top performer in the S&P 500 due to its association with the artificial intelligence trend. The Dow Jones Industrial Average rose by 0.5%, the S&P 500 had its best daily performance since June 30 with a 1.1% gain, and the Nasdaq Composite climbed 1.6% for a third consecutive day of gains. Nvidia’s report was anticipated to show substantial year-over-year increases in profit and revenue. Investors are keen on the results to gauge the continued momentum of the AI trend, which has propelled Nvidia’s significant stock gains. The benchmark 10-year Treasury yield’s decline by over 11 basis points to 4.21% was also well-received by traders, while concerns over inflation and slowing demand negatively affected athletic apparel stocks like Nike and Foot Locker.

Investors are keeping an eye on Nvidia’s earnings report as the company’s stock has surged over 200% in 2023, largely due to its AI-related prospects. The positive sentiment on Wall Street was further boosted by a decline in the 10-year Treasury yield, which fell by more than 11 basis points to 4.21%. However, athletic apparel stocks faced challenges amidst worries about inflation and decreasing demand, with Nike experiencing its longest losing streak on record and Foot Locker reporting shrinking sales and reducing its forecast. The anticipation of the Federal Reserve symposium in Jackson Hole, Wyoming, and Fed Chair Jerome Powell’s upcoming remarks also drew attention from investors. The market’s short-term direction is seen to hinge significantly on Nvidia’s earnings and how it reflects the AI trend’s momentum, with cautionary notes about stretched valuations and potential market implications in the face of changing economic conditions.

Data by Bloomberg

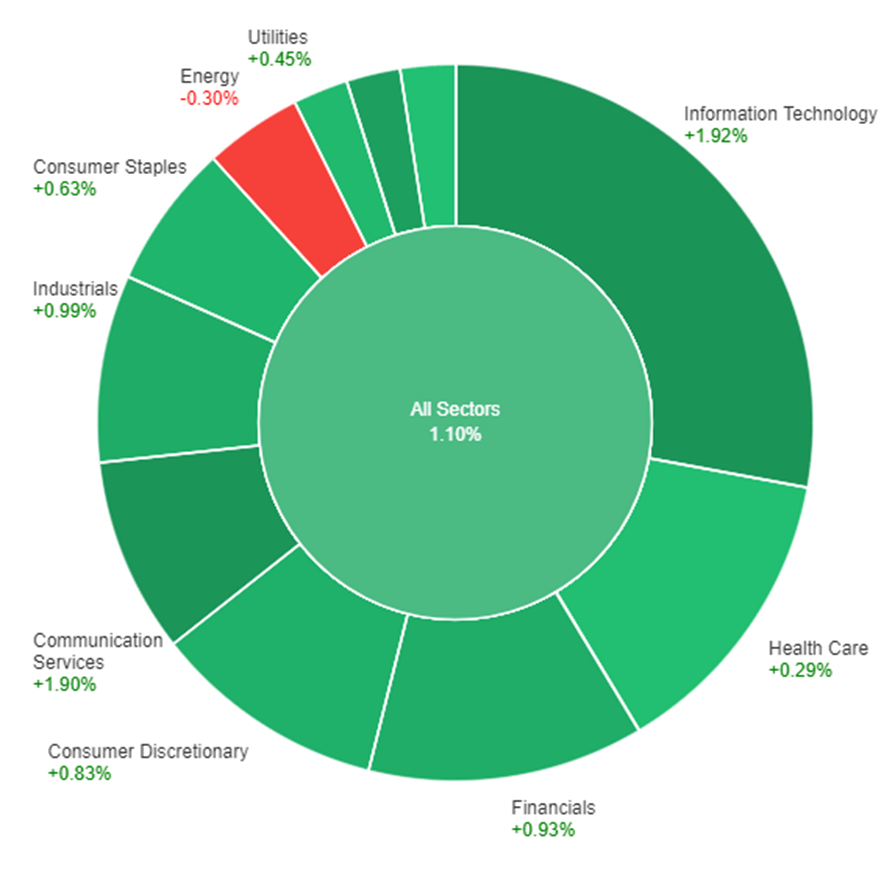

On Wednesday, across all sectors, the market witnessed a positive movement with a gain of 1.10%. The Information Technology sector showed strong growth, leading with a substantial increase of 1.92%, closely followed by the Communication Services sector, which also surged by 1.90%. The Real Estate sector experienced a notable rise of 1.46%, while the Industrials sector saw a more moderate gain of 0.99%. Financial and Consumer Discretionary sectors exhibited growth of 0.93% and 0.83% respectively. The consumer Staples and Utilities sectors showed smaller yet positive increases of 0.63% and 0.45% respectively. The Health Care and Materials sectors saw minor gains of 0.29% and 0.18% respectively. However, the Energy sector faced a decline of -0.30% on the same day.

The US Dollar saw a significant decline, marking its weakest performance since early August, with the Dollar Index (DXY) falling below 103.50 from its recent high around 104.00. This correction was driven by weaker-than-expected US PMI figures and a pullback in US Treasury yields, notably the 10-year yield dropping below 4.20%. The risk-on sentiment was boosted, leading to gains in major indices like the Dow Jones and Nasdaq. The anticipation of Fed Chair Powell’s speech at the Jackson Hole Symposium is notable, as it could shape upcoming policy directions. The Eurozone experienced a drop in the Composite PMI, indicating a contraction, likely impacting ECB projections and hinting at potential policy adjustments. Similarly, the UK’s Composite index fell below 50, weakening GBP/USD and boosting EUR/GBP. The Japanese yen gained ground against the US dollar due to lowered expectations of tightening by central banks, and the Australian dollar rebounded despite disappointing PMI data. Precious metals like gold and silver surged, while cryptocurrencies, including Bitcoin and Ethereum, enjoyed gains due to improved risk sentiment.

Despite its recent highs, the US Dollar weakened notably due to disappointing US PMI data and a decrease in US Treasury yields. The risk-on sentiment was evident in the positive performance of stock indices, and market participants are looking forward to Fed Chair Powell’s speech. The Eurozone and the UK both showed signs of economic contraction, influencing currency dynamics. The Japanese yen benefited from reduced tightening expectations, while the Australian dollar rebounded despite weak data. Precious metals and cryptocurrencies also experienced positive shifts in line with the risk sentiment.

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| USD | Unemployment Claims | 20:30 | 239K |

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.