Spreads

Spreads

Spreads

Spreads

Spreads

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.

Stock markets experienced declines on Wednesday as investors absorbed insights from the Federal Reserve’s July meeting, which hinted at the possibility of raising interest rates. The Dow Jones Industrial Average dropped by 0.52%, concluding at 34,765.74, while the S&P 500 decreased by 0.76% to settle at 4,404.33. The Nasdaq Composite also saw a decline of 1.15%, ending the day at 13,474.63. This marked the second consecutive session of losses for the major indices.

During the July meeting, the Federal Reserve officials discussed the potential need for further tightening of monetary policy to counter ongoing inflation. The meeting summary highlighted that most participants recognized significant upside risks to inflation due to it remaining above the Committee’s longer-term goal. The current federal funds rate lies within a range of 5.25% to 5.5%, reaching its highest point in over two decades. The markets’ reaction to the meeting minutes reflected concerns about the economic backdrop and the potential need to curtail demand in order to achieve price stability. Consequently, market sentiment was impacted, leading to declines across various sectors, with Intel and other industries experiencing notable drops.

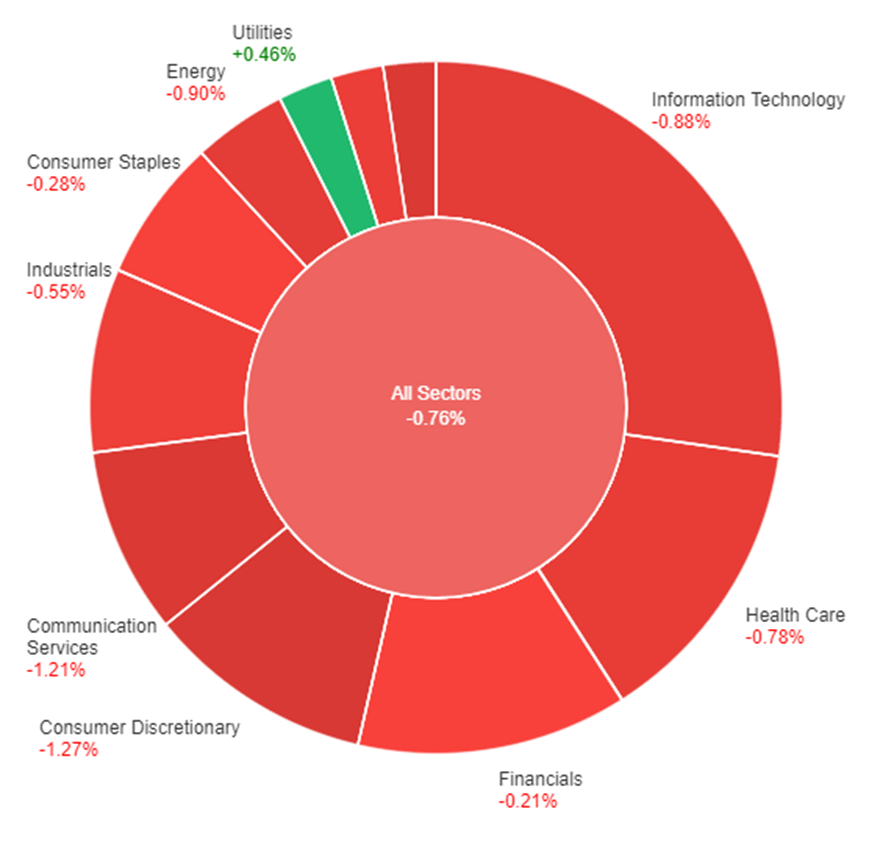

Data by Bloomberg

On Wednesday, a broad decline was observed across all sectors of the market, with the overall market dropping by 0.76%. Some sectors managed to buck the trend, with Utilities gaining 0.46%. However, most sectors faced losses: Financials were down by 0.21%, Consumer Staples by 0.28%, Industrials by 0.55%, Materials by 0.66%, Health Care by 0.78%, Information Technology by 0.88%, Energy by 0.90%, Real Estate by 1.20%, Communication Services by 1.21%, and Consumer Discretionary by 1.27%.

Major Pair Movement

On Wednesday, the dollar index experienced a slight increase, recovering from earlier losses. This recovery was attributed to better-than-expected U.S. housing and industrial production data, as well as rebounding Treasury yields compared to euro zone yields. The release of Federal Reserve meeting minutes further supported the dollar’s performance later in the session. However, the dollar’s gains were somewhat limited by strong UK inflation data, which maintained expectations for a rate hike by the Bank of England (BoE) and boosted the pound.

Amid robust U.S. retail sales figures and ongoing uncertainties surrounding China’s economic stability, the dollar continued to attract interest from investors. The Fed meeting minutes aligned with previous indications, hinting at a potential additional rate hike, contributing to the extension of Treasury yields and the dollar’s turnaround from earlier losses.

The EUR/USD pair declined by 0.24% due in part to negative spreads between 2-year bund and Treasury yields. Sterling, while retreating from its Wednesday high, still gained 0.17% on the back of increased gilts-Treasury yields spreads, driven by strong UK core price growth, rising services inflation, and record-breaking basic earnings.

The USD/JPY pair saw a 0.47% increase, benefiting from rising Treasury-JGB yield spreads and breaching resistance levels. Risk-off sentiment stemming from China’s situation and recent rate cuts led to declines for the Chinese yuan (CNY) and the Australian dollar (AUD), with the latter hitting a 9-month low and the former nearing its 2022 record high.

Economic Data

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| AUD | Employment Change | 09:30 | 14.6K |

| AUD | Unemployment Rate | 09:30 | 3.6% |

| USD | Unemployment Claims | 20:30 | 240K |

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.