Spreads

0.00%

Spreads

0.00%

Spreads

0.01%

Spreads

0.03%

Spreads

0.24%

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.

What happened in the market last week?

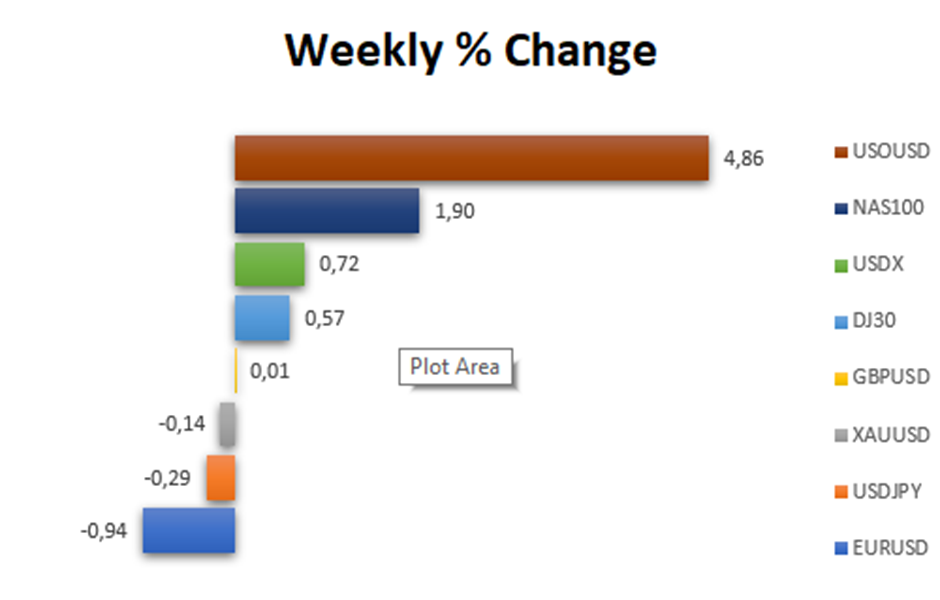

Last Week Market Pair Changes (All data is taken from the MT4 VT Markets)

The US dollar strengthened last week as investors bet on the Federal Reserve’s aggressive interest rate hikes to combat inflation. The US Dollar Index (DXY) rose by 0.72%. The dollar’s strength was supported by robust US economic data and hawkish comments from Fed officials. Fed Chairman Jerome Powell emphasised the central bank’s commitment to bringing inflation down to its 2% target and readiness to take more aggressive actions if necessary. Investors expect further rate hikes, but the dollar’s strength could fade if inflation starts to decrease.

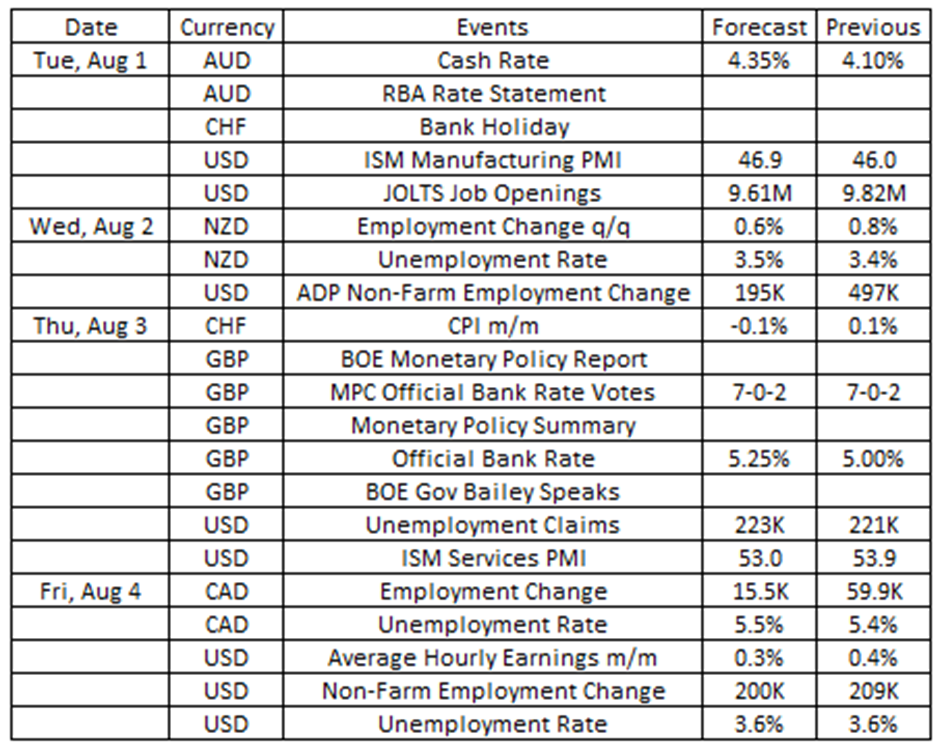

Source: VT Markets Economic Calendar

What to focus on this week?

This week’s economic calendar features key events that will have a considerable impact on the markets. Major events include the US jobs reports, the Reserve Bank of Australia (RBA) rate statement, and the Bank of England (BOE) rate statement. Traders are advised to carefully prepare for potential market volatility triggered by these announcements and adapt their strategies accordingly.

Here are some notable highlights coming up over the next week:

Reserve Bank of Australia Rate Statement (1 August 2023)

After raising its interest rate by 25 bps in June, the Reserve Bank of Australia announced during its July meeting that it has maintained its interest rate at 4.1%. This represents a total increase of 400 bps since May 2022.

The central bank will announce the next interest rate adjustment on 1 August, with analysts expecting an increase of 25 bps to 4.35%.

Takeaway: The interest rate statement decision from the RBA this week will create high volatility for the Australian Dollar. Market experts expect the central bank to raise the interest rate, which could potentially strengthen the Australian Dollar.

ISM Manufacturing PMI (1 August 2023)

The ISM manufacturing PMI in the US fell to 46 in June 2023 from 46.9 in May 2023.

The figures for July are scheduled for release on 1 August, with analysts expecting the index to increase to 48.

Takeaway: The release of the US ISM Manufacturing PMI figures this week will significantly influence the US Dollar market. Based on the projected figures, it appears that the manufacturing sector is still experiencing contraction, which could potentially lead to a weakening of the US Dollar.

Switzerland’s Consumer Price Index (3 August 2023)

Switzerland’s CPI increased by 0.1% in June 2023 from the previous month.

Analysts anticipate a 0.1% decrease in the figures for July, which will be released on 3 August.

Takeaway: Based on the forecasted numbers, we can see that the inflation rate in Switzerland is expected to be slower, which could potentially weaken the Swiss Franc.

Bank of England Rate Statement (3 August 2023)

The Bank of England raised its policy interest rate by 50 bps to 5% during its June meeting, marking a 13th consecutive hike.

Analysts expect the next rate hike to be another 25-bps increase to 5.25%.

Takeaway: The release of BOE’s Rate Statement is expected to create high volatility for the Great Britain Pound. Based on analysts’ predictions, we could see the GBP increase in value.

US ISM Services PMI (3 August 2023)

The ISM services PMI rose to 53.9 in June 2023. This mark, which is well above the 50 seen in May, points to the strongest growth in the services sector in four months.

The ISM’s data for July 2023 is scheduled for release on 3 August, with analysts anticipating a decrease in PMI to 52.

Takeaway: The US ISM Services PMI will be the market mover for the US Dollar this week. This PMI data will provide information about the health of the US services sector. Based on the forecasted numbers, we can see that the services sector is still in expansion mode, which could potentially boost the US Dollar.

Canada Employment Change (4 August 2023)

The Canadian economy saw 59,900 jobs created in June. This increase was driven by the rise in full-time jobs and marks the highest number of jobs created in five months. However, the unemployment rate also rose to 5.4% in June from 5.2% in May, the highest since February 2022.

The figures for July are set to be released on 4 August, with analysts predicting the creation of 20,000 additional jobs. However, the unemployment rate is also expected to remain at 5.4%.

Takeaway: According to the projected figures, there is a possibility that Canada may add jobs while keeping the unemployment rate unchanged, potentially strengthening the Canadian Dollar.

US Jobs Report (4 August 2023)

The US economy added 209,000 jobs in June 2023, lower than the 306,000 seen in May. The unemployment rate in the country decreased slightly to 3.6%, which is also lower than May’s seven-month high of 3.7%.

The data for July 2023 will be released on 4 August, with analysts predicting the creation of 190,000 additional jobs. However, the unemployment rate is also expected to remain at 3.6%.

Takeaway: Based on the forecasted numbers, there is a possibility that the US Dollar might strengthen.

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.