Spreads

Spreads

Spreads

Spreads

Spreads

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.

In a remarkable show of strength, the Dow Jones Industrial Average experienced its best winning streak since 1987, advancing for 13 consecutive days. The 30-stock index added 82.05 points, or 0.23%, reaching 35,520.12, and is now on the cusp of matching the longest streak ever recorded dating back to June 1897. The market’s optimism was fueled by a Federal Reserve rate hike, pushing rates to their highest level in over 22 years. However, Fed Chief Jerome Powell’s comments about the possibility of a pause in future rate increases left traders uncertain, impacting Treasury yields. While some companies, like Google-parent Alphabet and Boeing, reported strong earnings leading to stock gains, others, like Microsoft, experienced declines due to slower cloud revenue growth.

Overall, the market’s mixed sentiment reflects the delicate balance between economic indicators and the Federal Reserve’s data-dependent approach in determining future monetary policies. Traders eagerly await the Fed’s decision on rates in September, hoping for signs that the economy can avoid a recession if the central bank chooses to remain on hold. The ongoing corporate earnings season is also influencing market movements, with companies like Alphabet and Boeing showing strength, while Microsoft’s performance was met with some disappointment. As the market continues to digest these factors, investors are keeping a close eye on the Dow Jones as it seeks to extend its historic winning streak.

Data by Bloomberg

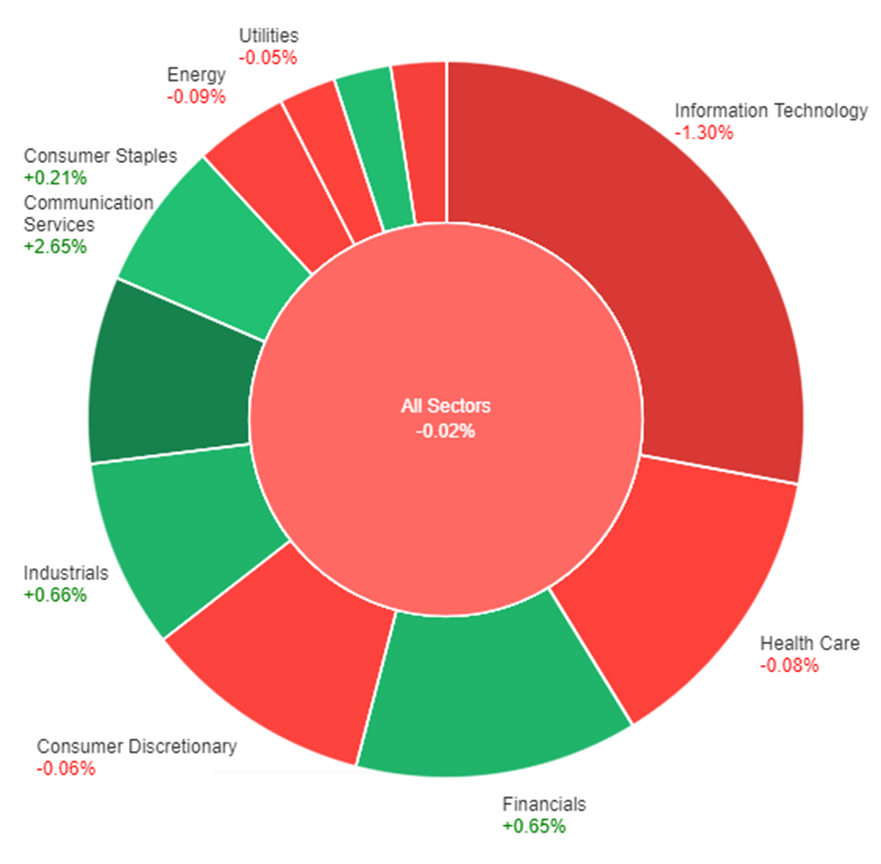

On Wednesday, the overall market experienced a slight decline of 0.02%. Among the sectors, Communication Services stood out with a significant increase of 2.65%, while Industrials and Financials also showed positive gains of 0.66% and 0.65% respectively. Real Estate and Consumer Staples sectors also saw modest growth, rising by 0.34% and 0.21% respectively. However, Utilities, Consumer Discretionary, and Health Care sectors faced marginal declines, with drops of 0.05%, 0.06%, and 0.08% respectively. Energy and Materials sectors experienced somewhat larger losses, declining by 0.09% and 0.28%. Information Technology, on the other hand, took the steepest hit with a significant drop of 1.30%.

Major Pair Movement

On Wednesday, the dollar index weakened as investors focused on Federal Reserve Chair Jerome Powell’s dovish comments, overshadowing slightly improved economic growth language in the FOMC statement. While Treasury yields and the dollar initially rose after the statement mentioned the economy growing at a “moderate” pace, Powell’s news conference suggested that the end of rate hikes might be approaching. Market attention now turns to the upcoming policy announcements from the European Central Bank (ECB) and the Bank of Japan (BoJ) on Thursday and Friday, as well as crucial U.S. data. Thursday’s GDP and claims data, along with Friday’s personal income, spending, core PCE, employment cost index, and Michigan sentiment figures will be closely monitored ahead of the August Jackson Hole symposium and the September Fed meeting. Investors are also closely watching the ECB’s potential rate hike and the outlook for the EUR/USD pair, which rose after Powell’s comments, despite concerns about deteriorating euro zone economic data and the ECB’s dovish stance.

Meanwhile, USD/JPY fell as the market awaits the BoJ’s decision on whether it will tighten its policy on Friday. Governor Kazuo Ueda’s indications that policy will not be tightened are being scrutinized, but speculation about a possible rise in the JGB yield cap persists based on economic projections from the meeting. In the UK, the sterling rose after coming off earlier highs, with the possibility of a 50bp Bank of England (BoE) rate hike in August remaining slightly less favored compared to a 25bp increase. However, nearly 1% of further increases are still priced in due to the UK’s high inflation rate and the risks associated with managing it. On the other hand, the Australian dollar and the yuan faced declines after Q2 Australian inflation came in below forecasts, and doubts arose about the impact of Chinese stimulus plan promotions.

Overall, the global currency markets remain highly sensitive to central bank decisions, economic data, and policymakers’ statements, with investors assessing each currency’s strength based on a complex interplay of economic conditions and monetary policies.

Economic Data

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| EUR | Main Refinancing Rate | 20:15 | 4.25% |

| EUR | Monetary Policy Statement | 20:15 | |

| USD | Advance GDP q/q | 20:30 | 1.8% |

| USD | Unemployment Claims | 20:30 | 234K |

| EUR | ECB Press Conference | 20:45 |

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.