Spreads

Spreads

Spreads

Spreads

Spreads

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.

The Dow Jones Industrial Average continued its impressive winning streak for the ninth consecutive day, fueled by the better-than-expected earnings results of pharmaceutical giant Johnson & Johnson. With a 6% rise in Johnson & Johnson’s shares, the Dow recorded its best daily performance since 2017. Additionally, insurer Travelers surpassed revenue expectations for the quarter, contributing to the Dow’s overall gains.

However, the broader market faced challenges as post-earnings declines hit popular tech stocks like Netflix and Tesla. Netflix’s revenue fell short of analysts’ estimates, causing a more than 8% drop in its stock value, despite a positive year leading up to the report. Meanwhile, Tesla’s shares tumbled by 9.7% after CEO Elon Musk announced a slowdown in vehicle production during the third quarter for factory improvements.

Overall, corporate earnings have shown strength, with 74% of S&P 500 companies surpassing expectations. This has generated optimism for a favorable economic outlook, despite concerns from some about a potential bear market rally. The Dow’s outperformance compared to the tech-heavy Nasdaq 100 index marked a significant trend, emphasizing the market’s current dynamics.

Data by Bloomberg

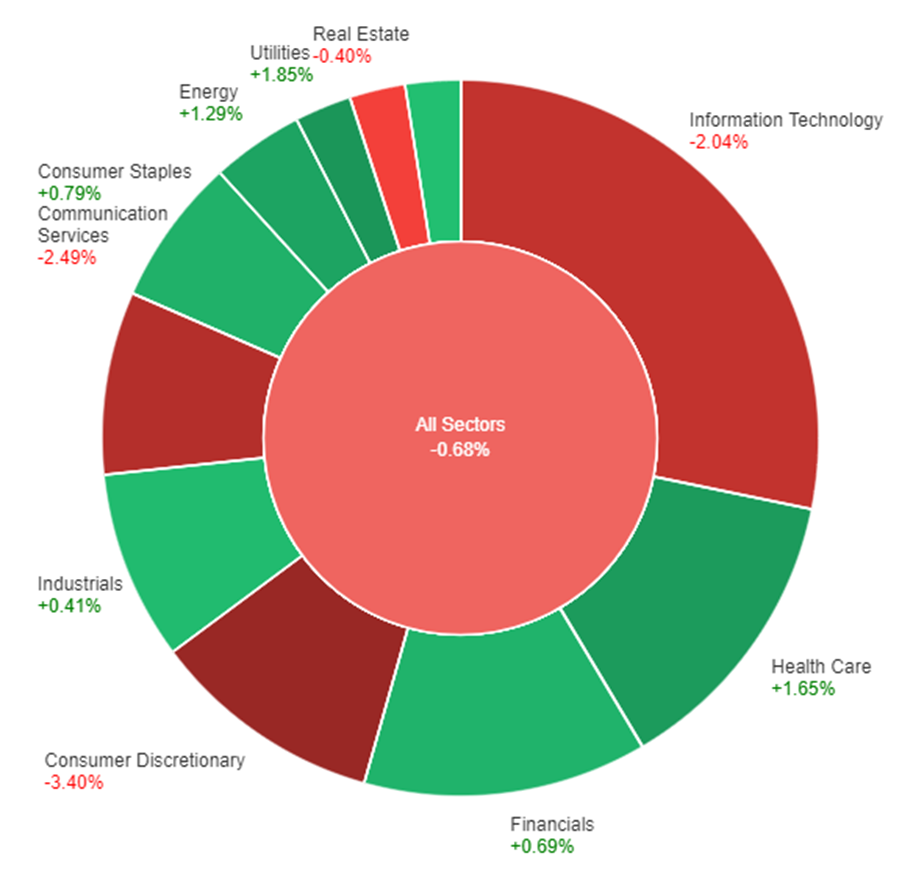

On Thursday, the market declined by 0.68%. Utilities, Health Care, and Energy sectors showed gains of 1.85%, 1.65%, and 1.29%, respectively. Information Technology and Communication Services sectors experienced the most significant declines, dropping by 2.04% and 2.49%, while Consumer Discretionary sector faced the largest setback, declining by 3.40%.

Major Pair Movement

On Thursday, the dollar index rose by 0.6% as positive jobless claims and Philly Fed data boosted Treasury yields, leading to a risk-off sentiment in the market. The Nasdaq declined by about 2% as investors turned cautious. The dollar’s recovery was driven by its earlier decline in July, caused by hopes of U.S. disinflation, despite steady core PCE figures.

The dollar’s gains were fueled by the Bank of Japan’s Governor dismissing tightening speculation, doubts raised by an ECB hawk about multiple rate hikes, and below-forecast UK CPI affecting BoE rate hike expectations. The EUR/USD fell by 0.67% due to Germany’s real estate crisis and uncertainty surrounding China’s efforts to boost the yuan and economic growth. Sterling sank by 0.6%, testing BoE rate hike expectations. USD/JPY gained 0.33%, but caution remains ahead of Japan’s CPI report. The AUD/USD’s earlier gains were trimmed amid dollar strength and derisking despite solid jobs data and PBoC’s action to weaken USD/CNY.

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.