Spreads

Spreads

Spreads

Spreads

Spreads

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.

Stocks showed positive momentum on Wednesday during the ongoing corporate earnings season, with the Dow Jones Industrial Average achieving its longest winning streak in nearly four years. The Dow closed 0.31% higher, at 35,061.21 points, marking its eighth consecutive day of gains, a feat not seen since September 2019. The S&P 500 also climbed 0.24% to 4,565.72, while the Nasdaq Composite edged up 0.03% to finish at 14,358.02. The current earnings season has shown promising results, with 78% of S&P 500 companies surpassing expectations, signaling an optimistic outlook for a potential soft-landing scenario as inflation data remains encouraging.

Goldman Sachs reported mixed results on profit and revenue, primarily influenced by losses in real estate and GreenSky. Despite the anticipated lackluster quarter, Goldman’s shares gained nearly 1%. Other major companies, including U.S. Bancorp and J.B. Hunt, experienced notable stock jumps of about 6.5% and 3.7%, respectively. Additionally, as prominent firms such as Netflix, Tesla, IBM, and United Airlines prepare to release their earnings, the market remains hopeful for continued positive outcomes. The positive sentiment was further boosted by Carvana, a used car retailer, which saw its shares surge by 40% after securing a deal to reduce its debt and releasing its quarterly earnings report ahead of schedule.

Data by Bloomberg

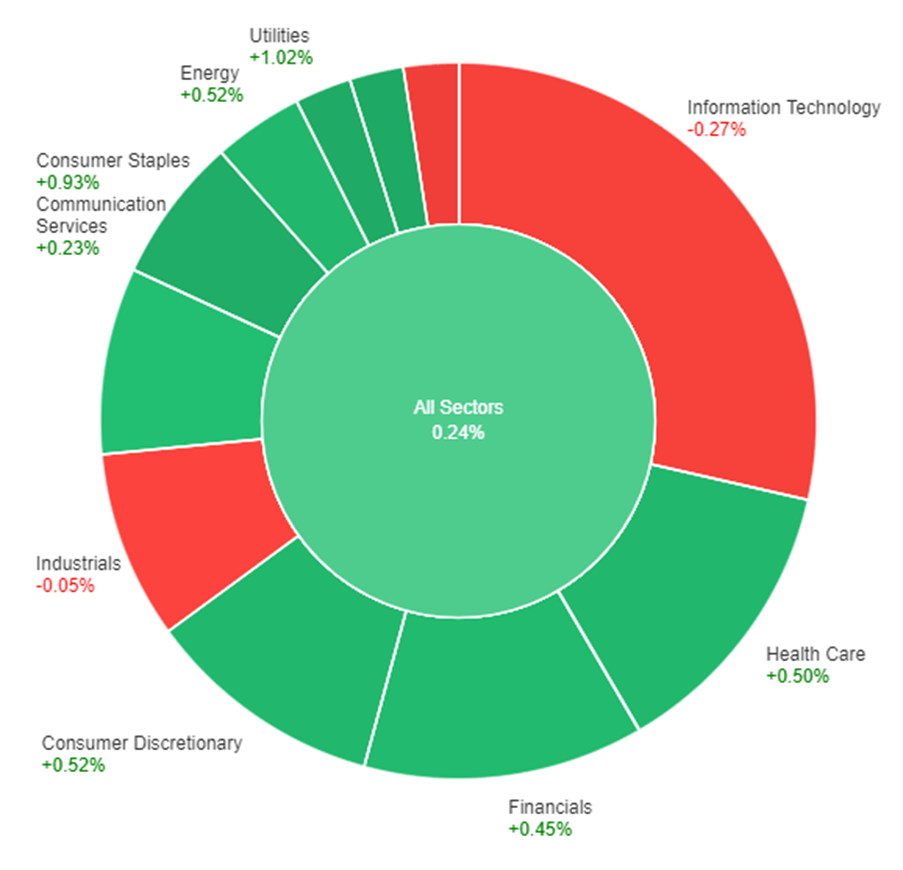

On Wednesday, all sectors in the market showed an overall increase of 0.24%. The real estate sector experienced the highest gain, rising by 1.12%, followed by utilities, which increased by 1.02%. Consumer staples also performed well with a rise of 0.93%, while both the energy and consumer discretionary sectors saw a moderate increase of 0.52%. Health care and financials sectors followed closely with gains of 0.50% and 0.45% respectively. The communication services sector showed a more modest growth of 0.23%.

However, not all sectors had a positive day, as some faced declines. The industrials sector experienced a slight decrease of -0.05%, while the information technology sector saw a more significant decline of -0.27%. The materials sector had the largest decline among all sectors, with a drop of -0.52%. Overall, the market exhibited a mix of positive and negative performances across different sectors on Wednesday.

Major Pair Movement

The dollar index saw a rise of 0.34%, largely driven by a significant 0.85% drop in sterling. This decline in sterling led to a sharp decrease in BoE policy rate pricing and gilts yields. The oversold dollar had been rebounding since its collapse in July and gained traction after finding support at the midpoint of its previous advance. As a result, the two-year gilts yield fell 20bp, and the expectation for a 50bp August BoE hike was repriced to just 25bp, with the likelihood of a following hike now in doubt. On the other hand, two-year Treasury yields remained flat, and the Fed’s next rate hike is priced at 25bp next week, with only a 28% probability of another hike before rate cuts in 2024. EUR/USD also fell 0.25%.

Looking ahead, Thursday’s below-forecast U.S., UK, and Canadian inflation data may bring increased focus on the Fed’s mandate for maximum employment. If initial and continued claims remain above forecast, it could strengthen the dollar’s bearish outlook. However, initial claims remain relatively low compared to historical levels. Meanwhile, the yen rose 0.52%, facing resistance at 140 due to a series of large 140 options expiring in the coming week. The dollar’s rebound and lingering uncertainty influenced the Australian dollar and yuan, both of which saw declines of 0.6% and 0.5% respectively. Upcoming events include Philly Fed, existing home sales, leading indicators on Thursday, and Japan’s CPI report on Friday.

Economic Data

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| AUD | Employment Change | 09:30 | 32.6K (Actual) |

| AUD | Unemployment Rate | 09:30 | 3.5% (Actual) |

| USD | Unemployment Claims | 20:30 | 239K |

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.