Spreads

Spreads

Spreads

Spreads

Spreads

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.

In a positive turn for investors, the Dow Jones Industrial Average soared on Tuesday as traders reacted to impressive corporate earnings reports. The Dow closed the day with a gain of 366.58 points, marking a 1.06% increase and reaching a new high of 34,951.93. Similarly, the Nasdaq Composite rose by 0.76% to end at 14,353.64, while the S&P 500 recorded a 0.71% gain, closing at 4,554.98. This remarkable performance resulted in the Dow’s seventh consecutive day of gains and the longest winning streak since March 2021, with all three major indexes achieving their highest closes since April 2022.

The positive earnings reports were led by Bank of America, which exceeded expectations for the second quarter due to higher interest rates, resulting in a more than 4% increase in the bank’s shares. Bank of New York Mellon also reported better-than-expected earnings, contributing to the upward momentum in the market. Other notable companies, such as Morgan Stanley and PNC Financial, saw their stocks rise following strong revenue and earnings performances. As the earnings season progresses, it is worth noting that a significant 84% of the S&P 500 companies that have reported have surpassed profit estimates, according to FactSet.

Despite softer data from the Commerce Department, including a modest increase of 0.2% in advance retail sales for June, investors remain optimistic. The positive sentiment stems from the belief that recent inflation data supports the likelihood of a soft-landing scenario, easing concerns of an imminent interest rate hike by the Federal Reserve. As a result, the stock market continues its rally, providing a positive outlook for investors in the near term.

Data by Bloomberg

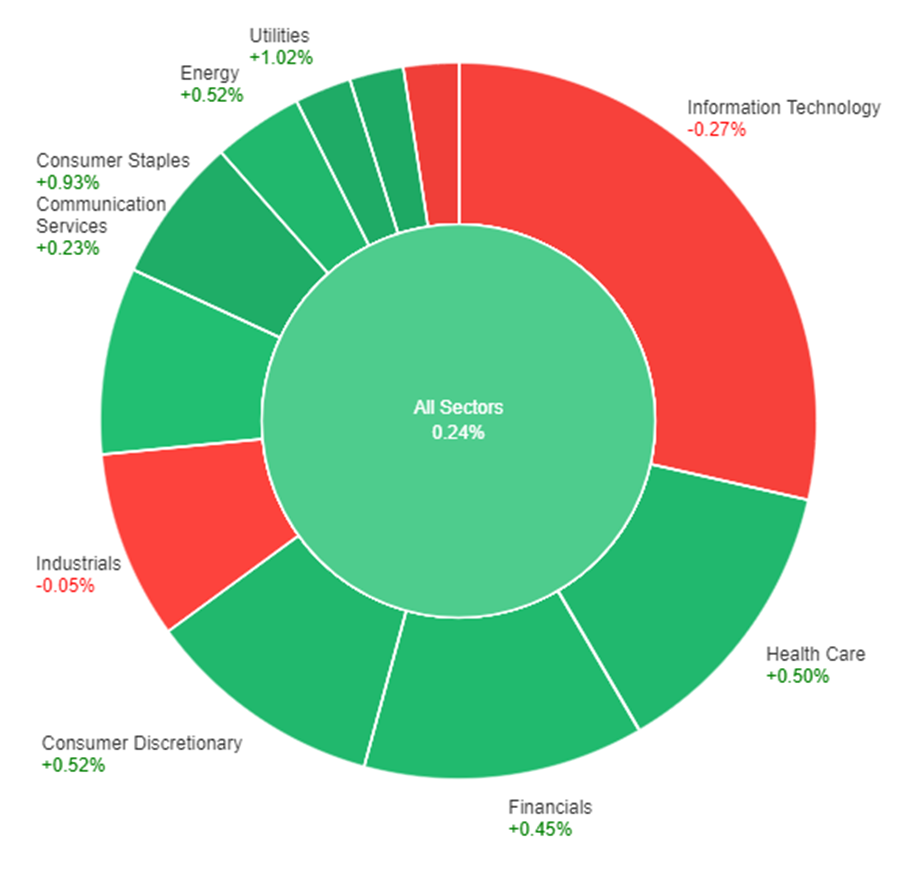

On Tuesday, the overall market saw a positive performance with a gain of 0.71%. The Information Technology sector led the way with a significant increase of 1.26%, followed closely by Financials, which rose by 1.12%. The energy and Materials sectors also performed well, gaining 0.98% and 0.78% respectively. Health Care and Industrials sectors experienced moderate growth with gains of 0.70% and 0.57% respectively. Communication Services and Consumer Discretionary sectors had smaller gains of 0.38% and 0.28% respectively. On the other hand, the Consumer Staples sector showed a slight decline of 0.13%. Utilities and Real Estate sectors experienced losses of 0.78% and 0.82% respectively.

Overall, it was a positive day for most sectors, particularly Information Technology and Financials, while the Utilities and Real Estate sectors faced some decline.

Major Pair Movement

The dollar index managed to recover from its recent 13-month lows, halting the decline in Treasury yields that followed the release of the Consumer Price Index (CPI) data. Initially, the dollar dipped briefly after U.S. retail sales rose by 0.2%, falling short of the 0.5% forecast. However, the May figures were revised upward, and the control group, which feeds into the GDP calculation, saw a 0.6% increase, double the forecast and with a revised higher figure for May. This positive data reassured investors that the economy was performing well and eased concerns about the Federal Reserve tightening its monetary policy excessively. Consequently, the dollar and Treasury yields rebounded, with two-year Treasury yields rising by 2 basis points after a previous 9 basis point fall, while two-year bund yields fell by 9.4 basis points.

The divergence between two-year bund and Treasury yields had already begun to affect EUR/USD prices since Thursday, contributing to the retreat from 13-month highs observed on Tuesday. The upcoming Federal Reserve and European Central Bank meetings will provide further guidance to the markets, which are currently pricing in a peak in Fed rates this month and a faster decline in ECB rates next year. Despite hitting a high of 1.1276 on EBS, EUR/USD slid and failed to close above the 61.8% Fibonacci retracement level of the 2021-2022 decline at 1.1271. Meanwhile, the yen rebounded sharply against other currencies after Bank of Japan (BoJ) Governor Haruhiko Kuroda dashed hopes of a JGB yield cap increase. The recovery of the yen crosses has been struggling to regain the uptrend line from March, which was broken below last week and currently stands at 139.51. The importance of Japan’s Consumer Price Index data, scheduled for release on Thursday, has been reduced due to Ueda’s stance.

In the currency markets, the pound depreciated by 0.25%, influenced by a drop of approximately 10 basis points in gilts yields and a correction in the pound’s overbought readings, which were at their highest level in nearly three years. These developments occurred ahead of the upcoming UK employment data, which could impact the decision between a 25 basis point or 50 basis point rate hike at the Bank of England’s August meeting.

Economic Data

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| NZD | CPI q/q | 06:45 | 1.1% (Actual) |

| GBP | CPI y/y | 14:00 | 8.2% |

| USD | Housing Starts | 20:30 | 1.48M |

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.