Spreads

Spreads

Spreads

Spreads

Spreads

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.

Stocks surged on Thursday as the latest inflation data came below expectations, leading to renewed optimism in the market. The S&P 500 and the Nasdaq Composite reached their highest levels in over a year, with the S&P 500 climbing 0.85% to 4,510.04 and the Nasdaq Composite advancing 1.58% to 14,138.57.

The Dow Jones Industrial Average also saw a modest gain of 0.14%, adding 47.71 points to close at 34,395.14. Notably, cybersecurity stock Palo Alto Networks saw a notable increase of 2.7%, while MGM Resorts and Alphabet rose 4.1% and 4.7%, respectively.

The positive market performance was attributed to the release of June’s producer price index (PPI) report, which indicated a smaller increase than anticipated. The PPI, measuring wholesale prices, rose by 0.1% in June, falling short of economists’ expectations of a 0.2% increase.

Furthermore, the core PPI, excluding volatile food and energy prices, also rose by 0.1%, below the anticipated level. The favourable inflation data further complemented the optimism generated by Wednesday’s consumer price index report, fueling investors’ confidence in the market.

Data by Bloomberg

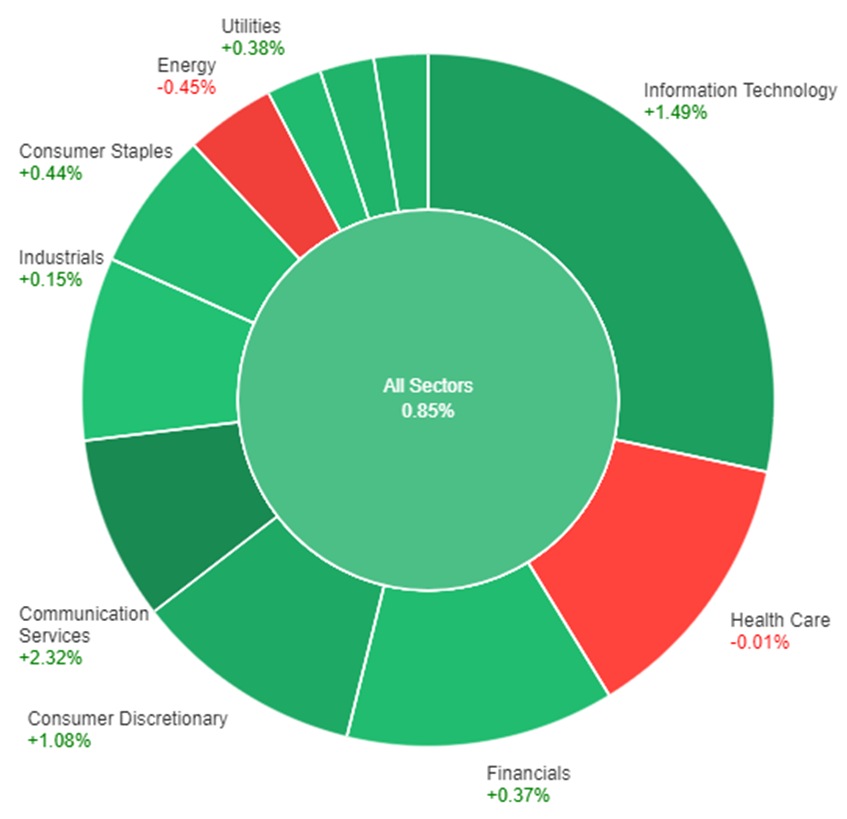

On Thursday, the overall market experienced a positive trend, with all sectors showing gains except for the Health Care and Energy sectors. The Communication Services sector had the highest increase, rising by 2.32%.

The Information Technology and Consumer Discretionary sectors also performed well, with gains of 1.49% and 1.08% respectively. The Materials and Real Estate sectors saw moderate increases of 0.79% and 0.67% respectively. The Consumer Staples, Utilities, Financials, and Industrials Sectors also showed positive but smaller gains, ranging from 0.38% to 0.37%.

However, the Health Care sector experienced a marginal decline of -0.01%, while the energy sector showed a decrease of -0.45%.

Major Pair Movement

The dollar index experienced a significant decline of 0.7%, marking a weekly plunge of 2.4% and dropping below 100 for the first time since April 2022. This decline in the dollar was accompanied by a decrease in 2-year Treasury yields by 12 basis points.

Market expectations now suggest that the Federal Reserve’s rate hike in July will likely be the last one before a series of rate cuts totalling nearly 200 basis points next year. In contrast, the European Central Bank (ECB) is anticipated to raise rates by 50 basis points before implementing rate cuts of around 65 basis points in the second half of 2024.

The positive sentiment toward the euro resulted in a 0.8% increase in the EUR/USD exchange rate, surpassing the key 200-week moving average and reaching its highest level since April 2022.

The anticipation of additional rate hikes and China’s stimulus measures contributed to a surge of 1.5% in the AUD/USD exchange rate. Despite concerns surrounding the situation, USD/CNH fell by 0.25%. The Swiss franc (CHF) experienced a 1% decline against the US dollar (USD), reaching its lowest level since the Swiss National Bank removed its 1.20 EUR/CHF floor in January 2015.

The USD/JPY pair, which had fallen by 4.3% in June, saw a modest increase of 0.34% on Thursday as it encountered support near the 138 expiry level. If the pair closes below the 38.2% Fibonacci retracement level of its advance in 2023, at 138.25 and 138, further downward pressure may be expected.

Additionally, gold prices rose by 1.1% following the departure of a member of the Bank of England (BoE), reinforcing expectations of aggressive rate hikes totalling 117 basis points to address the current economic challenges.

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| USD | Prelim UoM Consumer Sentiment | 22:00 | 65.5 |

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.