Spreads

Spreads

Spreads

Spreads

Spreads

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.

U.S. stocks experienced a rebound on Tuesday, following a three-session decline, as investors eagerly awaited the release of crucial inflation data later in the week. The Dow Jones Industrial Average closed with a 0.93% gain, rising by 317.02 points to reach 34,261.42.

Similarly, the S&P 500 ended the day with a 0.67% increase at 4,439.26, while the Nasdaq Composite, focused on technology, gained 0.55% and closed at 13,760.70.

In related news, Salesforce’s stock soared by almost 4% after the company announced its plans to implement a price increase across all its offerings in August.

Furthermore, Activision Blizzard witnessed a 10% surge in its shares following a federal judge’s decision to deny the Federal Trade Commission’s request to halt Microsoft’s acquisition of the video game company. This ruling brought the two companies closer to finalizing their deal.

The upcoming release of the June consumer price index report on Wednesday and the June producer price index on Thursday is expected to provide insights into the trajectory of inflation and guide the future direction of interest rates.

Economists surveyed by Dow Jones project a 3.1% rise in the index on a year-over-year basis for last month. While investors anticipate another quarter-point increase at the Federal Reserve’s July meeting, uncertainty looms regarding the central bank’s actions in September, particularly after robust jobs data raised concerns about a potential resumption of rate hikes.

Looking ahead, the second-quarter earnings season is set to commence, with key reports expected from “systemically important financial institutions” such as JPMorgan Chase, Wells Fargo, and Citigroup, as well as BlackRock, PepsiCo, Delta Air, and UnitedHealth, a component of the Dow index, which will release its earnings on Friday.

Data by Bloomberg

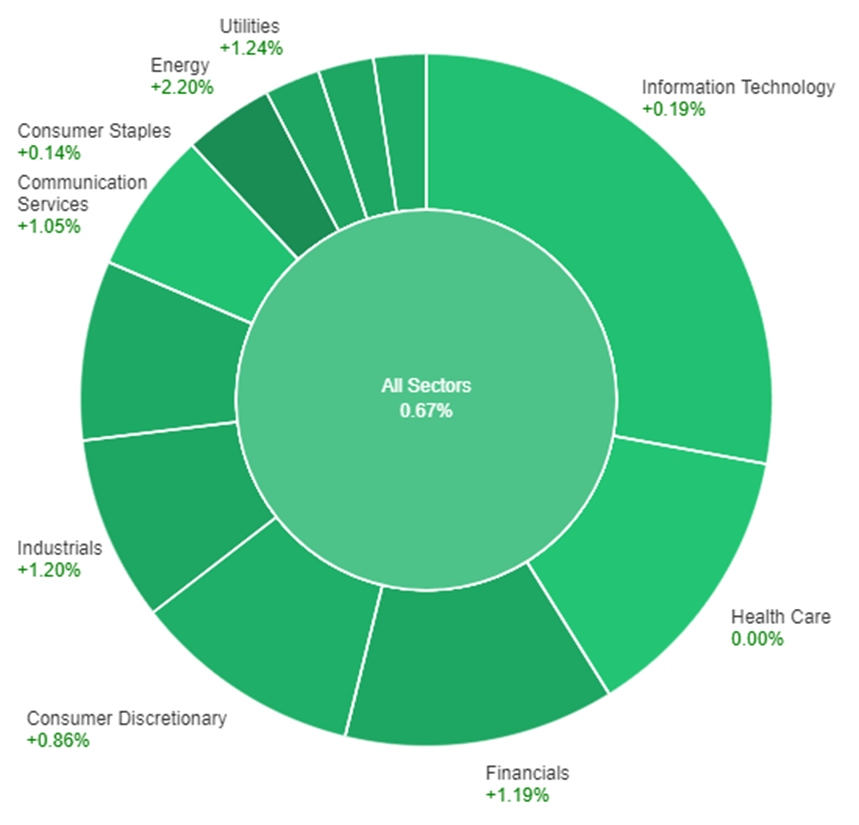

On Tuesday, across all sectors, the stock market showed a positive trend with a 0.67% increase. The Energy sector performed exceptionally well, rising by 2.20%. Utilities and Industrials also experienced notable gains, with increases of 1.24% and 1.20% respectively.

Financials, Real Estate, and Communication Services sectors saw healthy gains of 1.19%, 1.17%, and 1.05% respectively. Materials and Consumer Discretionary sectors also contributed to the positive sentiment, with increases of 0.97% and 0.86% respectively.

However, the Information Technology and Consumer Staples sectors had more modest gains of 0.19% and 0.14% respectively. The Health Care sector remained relatively stable, showing no change at 0.00%.

Major Pair Movement

The dollar continued its decline on Tuesday, falling further after the release of employment data and reaching a new low for the month of June.

This downward trend comes ahead of the U.S. Consumer Price Index (CPI) report on Wednesday, with market sentiment remaining skeptical about the Federal Reserve’s ability to raise interest rates beyond one more hike, especially as other central banks are moving forward with their tightening cycles.

The upcoming inflation report will be closely watched to shape expectations regarding the Fed’s actions, which will have a significant impact on the value of the dollar.

Forecasts indicate that the CPI is expected to decrease from 4.0% to 3.1%, mainly due to a favourable base effect that will turn unfavourable after July. Additionally, on a monthly basis, a 0.3% increase is anticipated for both the CPI and core inflation, compared to 0.1% and 0.4% respectively in May.

The year-on-year rate is projected to slide from 5.3% to 5.0%. It’s worth noting that core inflation reached its peak last year in October, which will reduce the impact of the Fed-friendly base effect as we approach the end of the year.

Regarding currency pairs, the EUR/USD remained stable after breaking above June’s peak and preparing for a pullback before the CPI release. If the CPI results maintain the bund-Treasury yield spreads on the rebound, the next significant obstacle for the EUR/USD would be April’s 2023 peak at 1.1096.

Market expectations currently include at least two additional 25bp European Central Bank (ECB) rate hikes before reaching a plateau, while the Federal Reserve rates are predicted to decrease by 1% between November and September of next year.

External factors like China’s actions and Brent crude oil prices reaching 10-week highs may influence growth, inflation, and currency movements.

Furthermore, sterling experienced a substantial increase of 0.45%, reaching its highest level since April 2022 and approaching 76.4% of the dive observed in 2022-23 at 1.2941. The market has priced in an additional 150bp of Bank of England (BoE) rate hikes by March.

USD/JPY also saw a 0.6% increase following its recent decline, with expectations of a potential recovery in the coming months.

Economic Data

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| NZD | Official Cash Rate | 10:00 | 5.50% (Actual) |

| USD | Consumer Price Index y/y | 20:30 | 3.1% |

| USD | Consumer Price Index m/m | 20:30 | 0.3% |

| USD | Core CPI | 20:30 | 0.3% |

| CAD | Overnight Rate | 23:00 | 5.00% |

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.