Spreads

Spreads

Spreads

Spreads

Spreads

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.

The Dow Jones Industrial Average rebounded on Monday, recovering from a previous week of losses. Investors were optimistic ahead of upcoming inflation data and the start of the second-quarter earnings season.

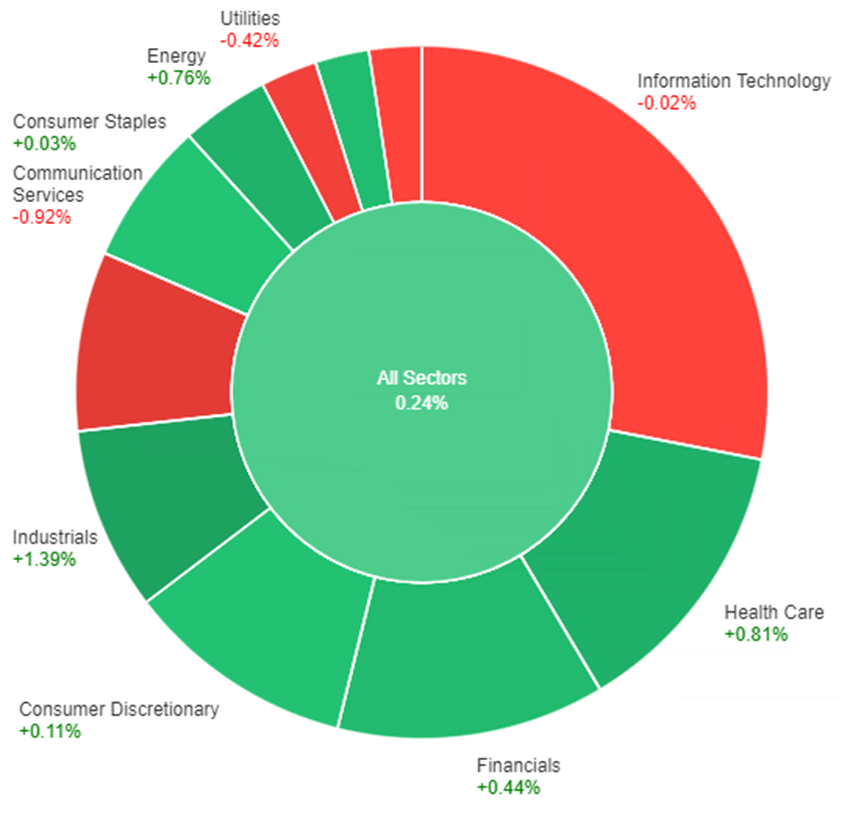

The Dow rose by 0.62%, adding 209.52 points, while the S&P 500 increased by 0.24%, and the Nasdaq Composite saw a gain of 0.18%. This positive momentum ended a three-day losing streak for the major averages.

The consumer price index report is scheduled for Wednesday, followed by the producer price index on Thursday, which will provide further insights into inflation and wholesale price pressures.

Last week, the S&P 500, Nasdaq Composite, and Dow experienced declines of 1.16%, 0.92%, and 1.96%, respectively. Despite weaker-than-expected nonfarm payrolls in June, concerns over potential Federal Reserve rate hikes were raised due to slightly stronger-than-anticipated wage growth.

However, investors will be closely watching the quarterly reports of finance giants BlackRock, JPMorgan Chase, Wells Fargo, and Citigroup, which will mark the beginning of the second-quarter earnings season.

Data by Bloomberg

On Monday, all sectors in the market saw a modest overall increase of 0.24%. The Industrials sector performed the best, gaining 1.39%, followed by Health Care with a rise of 0.81% and Energy with a gain of 0.76%. Financials also had a positive day, increasing by 0.44%, while Real Estate and Consumer Discretionary sectors experienced smaller gains of 0.35% and 0.11% respectively.

Consumer Staples had a minimal increase of 0.03%. On the other hand, the Materials and Information Technology sectors had slight declines of -0.01% and -0.02% respectively. Utilities and Communication Services sectors performed the worst, with declines of -0.42% and -0.92% respectively.

The dollar index experienced a decline of 0.29% as last week’s disappointing payrolls report continued to put pressure on Treasury yields, potentially leading to a further decrease in the U.S. currency. While Japanese Government Bond (JGB) and bund yields rose, Treasury yields fell, contributing to the downward trend.

Market sentiment was influenced by Fed speakers’ comments and a New York Fed survey indicating a decrease in household inflation expectations.

The upcoming U.S. CPI report on Wednesday is highly anticipated, with the possibility that even a minor shortfall could result in a core inflation rate below 5%, which could support dovish views.

EUR/USD saw a gain of 0.26%, reaching its highest level since June, supported by a surge in the 2-year bund-Treasury yield spreads. Despite concerns about the eurozone investor mood and deflationary data from China, which could have negative implications for German businesses, the euro remained strong.

USD/JPY declined by 0.63% due to falling Treasury yields, with 10-year JGB yields approaching the Bank of Japan’s 50 basis points cap. The pair broke below key support levels, leaving speculators who were net long in a precarious position.

Sterling initially faced losses but eventually surpassed previous peaks, reaching its highest level since April 2022. Bank of England Governor Andrew Bailey emphasized the importance of combating UK inflation, which currently stands as the highest among the G7 countries.

AUD/USD and USD/CNH experienced minor declines of 0.2% and 0.02% respectively.

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| GBP | Claimant Count Change | 14:00 | 20.5K |

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.