Spreads

Spreads

Spreads

Spreads

Spreads

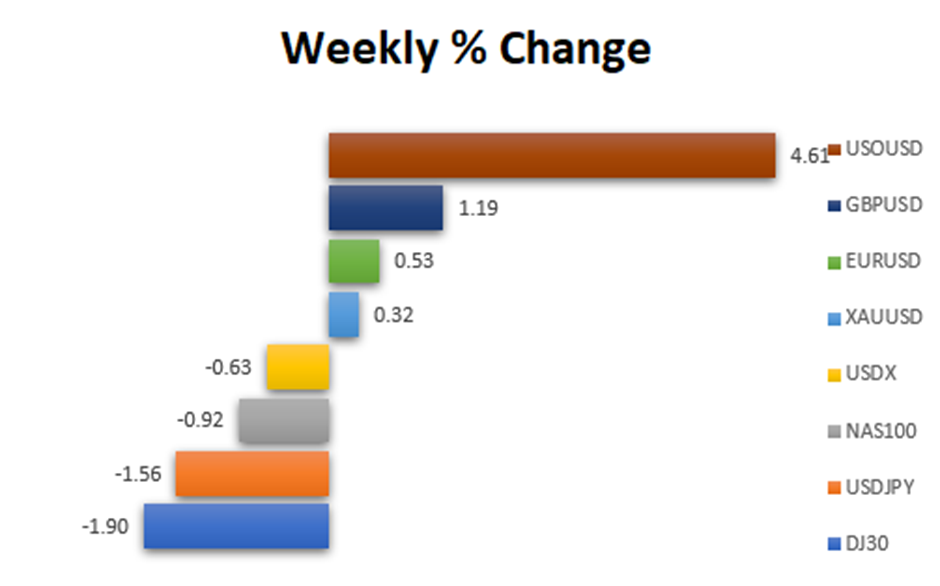

Last Week Market Pair Changes (All data is taken from the MT4 VT Markets)

Last week saw a slight decline in the strength of the US dollar against a majority of significant currencies, with a 0.63% drop in the US Dollar Index (USDX).

This downward shift was primarily prompted by the publication of varied economic data from the United States, sparking concerns about the robustness of the US economy.

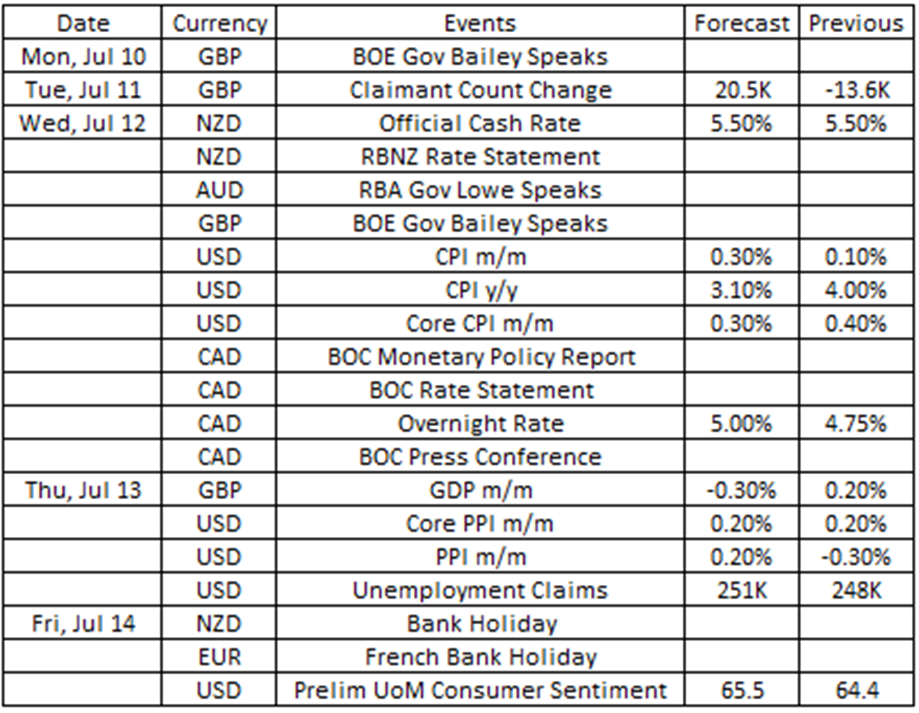

Source: VT Markets Economic Calendar

The financial world is poised for some key events this week with the potential to shake up markets. Top of the agenda is the upcoming decisions from various central banks on their interest rates. Alongside this, the focus will be on the US as it releases its latest Consumer Price Index (CPI) and Producer Price Index (PPI).

These important data points could provide crucial insights into the current economic climate.

Stay tuned as we delve into what the coming week holds in store.

The Reserve Bank of New Zealand raised its official cash rate by 25bps to 5.5% during its May meeting, marking the highest level since December 2008. This was the 12th consecutive rate hike.

Analysts predict that at the upcoming meeting on July 12, the RBNZ will keep its interest rates steady at 5.5%.

Takeaway: The RBNZ’s decision to raise interest rates for the 12th consecutive time in May demonstrates its commitment to managing inflation and ensuring price stability. By increasing the official cash rate, the central bank aims to control inflationary pressures and promote sustainable economic growth.

The decision to keep interest rates steady in the upcoming meeting suggests a potential pause in the tightening cycle, indicating that the RBNZ may be monitoring the impact of previous rate hikes on the economy. This might have a neutral effect on the New Zealand Dollar.

Consumer prices in the US saw a slight rise of 0.1% in May 2023, a slowdown from the 0.4% increase witnessed in the previous month.

Analysts anticipate a 0.2% rise for June data, scheduled for release on 12 July.

Takeaway: The slight rise indicates a deceleration in inflationary pressures. This slowdown could be attributed to various factors, such as stabilising commodity prices or reduced demand for certain goods and services.

However, the projected increase for June suggests a potential rebound in inflationary trends. This might have a positive effect on the US Dollar.

The Bank of Canada unexpectedly raised the target for its overnight rate by 25bps to 4.75% in June 2023, after pausing the tightening campaign in the previous two meetings.

The next rate statement will be released on 12 July 2023, with analysts anticipating another increase of 25bps to 5%.

Takeaway: The unexpected rate hike by the Bank of Canada in June indicates a shift in monetary policy towards a tightening stance. This decision suggests that the central bank is taking measures to curb potential inflationary pressures or address economic conditions that warrant higher interest rates.

The anticipation of another rate increase in July further reinforces the central bank’s commitment to managing inflation and maintaining a balanced economic environment. This data might have a positive effect on the Canadian Dollar.

The British economy expanded 0.2% month-over-month in April 2023, rebounding from a 0.3% drop in the previous month.

For May data, set to be released on 13 July, the country’s GDP is expected to be steady at 0.0%.

Takeaway: The April rebound in the British economy indicates a recovery from the previous month’s contraction, suggesting a return to positive growth. This improvement may be attributed to factors such as increased economic activity or improved market conditions.

However, the expected steady GDP for May suggests a potential stabilisation or plateauing of growth momentum. This might have a positive effect on the British Pound.

Producer prices for final demand in the US decreased 0.3% month-over-month in May 2023, following a 0.2% rise in April.

For June 2023 data, set to be released on 13 July, analysts expect a 0.2% increase.

Takeaway: The decrease in producer prices for final demand in May suggests a potential slowdown in inflationary pressures. However, the expected increase in June indicates a possible rebound in producer prices, indicating a renewed upward trajectory.

It is important to monitor these trends as changes in producer prices can have implications for consumer prices and overall inflation levels. This might have a slight negative effect on the US Dollar.

The University of Michigan’s consumer sentiment for the US was adjusted upwards to 64.4 in June 2023, its highest level in four months, up from an initial reading of 63.9.

For July preliminary data, analysts expect a reading of 64.5.

Takeaway: The rise in consumer sentiment indicates growing optimism among consumers about the economy. This positive outlook can lead to increased consumer spending and overall economic growth.

The anticipated increase in July suggests a continued positive trend. This might have a positive effect on the US Dollar.