Spreads

Spreads

Spreads

Spreads

Spreads

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.

U.S. stock futures showed little change on Tuesday night as Wall Street prepared to resume trading after the Fourth of July holiday. Dow Jones Industrial Average futures declined by 0.1%, while S&P 500 and Nasdaq 100 futures dipped by less than 0.1%.

The market had closed early on Monday, with slight gains in the Dow Jones, S&P 500, and Nasdaq Composite. The positive session followed a strong first half of the year, particularly for the Nasdaq Composite and S&P 500, which experienced their best starts since 1983 and 2019, respectively.

Market participants remain optimistic about a potential rally in the second half of the year, despite the possibility of a pullback later on.

Investors are keeping an eye on upcoming economic indicators, such as May factory orders data, which is expected to show a rise of 0.6% compared to the previous month. Additionally, the release of June’s Federal Reserve meeting minutes at 2 p.m.

ET will provide insight into the future of interest rate hikes. New York Fed President John Williams is scheduled to speak later in the day at the 2023 Annual Meeting of the Central Bank Research Association (CEBRA) in New York City.

Overall, with the holiday period ending, traders are cautiously anticipating the market’s direction, while remaining hopeful for a potential rally in the second half of the year.

Data by Bloomberg

The stock market is closed on Tuesday due to Independence Day in the US.

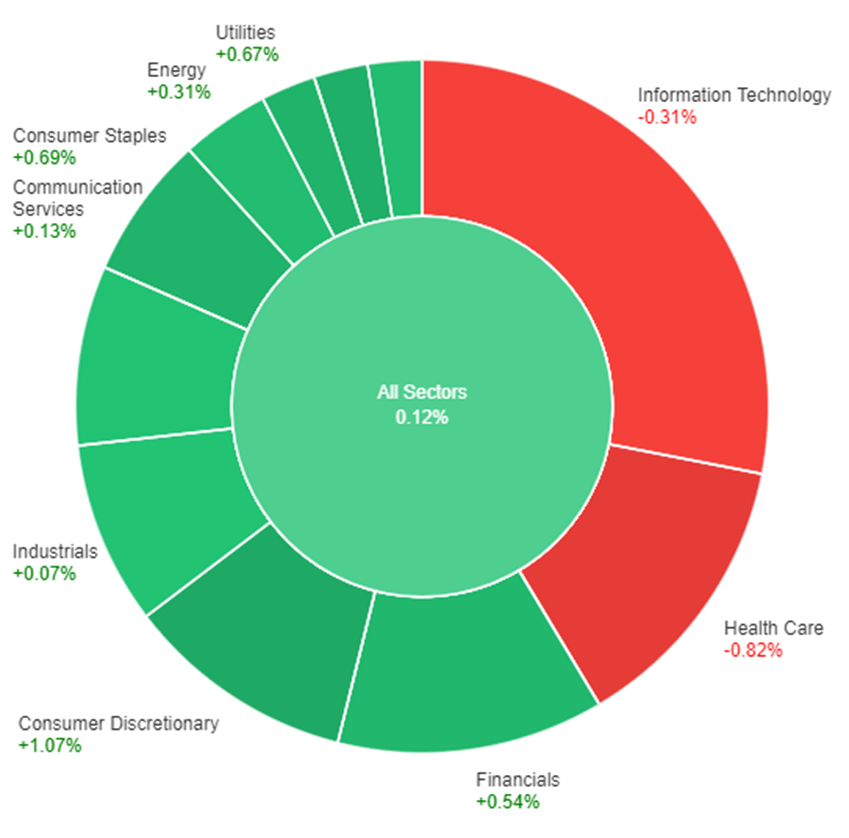

On Monday, the overall market showed a slight increase of 0.12%. Among the different sectors, Consumer Discretionary experienced the highest growth with a positive change of 1.07%, followed by Real Estate at 0.85% and Consumer Staples at 0.69%.

Utilities and Financials also saw positive gains with increases of 0.67% and 0.54% respectively. Energy and Materials both had modest growth of 0.31%. Communication Services had a minimal increase of 0.13%, while Industrials only saw a slight rise of 0.07%. On the other hand, Information Technology suffered a decline of -0.31%, and Health Care experienced the largest decrease with a negative change of -0.82%.

The GBP/USD pair displayed resilience by closing up 0.2% despite the strengthening of the US dollar, while the EUR/GBP pair experienced a decline of 0.5%. This strength in the British pound can be attributed to varying expectations regarding interest rate hikes, which are providing a solid foundation of support.

Despite the challenges posed by the stronger US dollar, the pound managed to hold its ground and maintain a positive trajectory.

The AUD/USD pair commenced trading with a 0.31% increase, following a relatively calm session influenced by holiday factors. The Australian dollar (AUD) managed to gain against all major currencies except for the New Zealand dollar (NZD).

Market participants brushed off the Reserve Bank of Australia’s decision to pause, as an underlying hawkish bias remained intact. The positive sentiment surrounding the AUD/USD pair reflected the market’s indifference towards the central bank’s cautious approach.

The EUR/USD pair began trading with a decline of 0.35% after a quiet session influenced by holiday-related factors. The selling pressure on the euro (EUR) against the Japanese yen (JPY) contributed to this lower opening.

The EUR/USD pair faced challenges due to the light selling of EUR/JPY, which weighed on its performance. The impact of the holiday season was felt in the market, resulting in subdued trading activity and influencing the euro’s initial weakness against the US dollar (USD).

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.