Spreads

Spreads

Spreads

Spreads

Spreads

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.

In a shortened session marking the start of a new trading month, quarter, and half, stock markets experienced slight gains on Monday. The Dow Jones Industrial Average rose by 0.03%, adding 10.87 points to close at 34,418.47.

Similarly, the S&P 500 climbed 0.12% to end at 4,455.59, while the Nasdaq Composite advanced 0.21% to 13,816.77. Tesla shares surged by 6.9% after the company exceeded analysts’ expectations with impressive delivery and production numbers, leading to a boost in other electric vehicles stocks like Rivian, Fisker, and Lucid.

The first half of the year proved to be exceptional for Wall Street, with the Nasdaq Composite registering its highest first-half gain since 1983, surging by 31.7%. The S&P 500 also performed well, jumping 15.9%, marking its best first-half performance since 2019.

Meanwhile, the Dow Jones Industrial Average had a more modest gain of 3.8% during the period. Factors such as increasing enthusiasm around artificial intelligence and resilient U.S. economic data, which defied concerns over rising interest rates, contributed to positive investor sentiment.

Investors are now shifting their mindset from fear of missing out (FOMO) to a more positive outlook for the second half of the year. Sam Stovall, chief investment strategist at CFRA Research, suggests that after a strong first half, investors are considering the potential for continued positive momentum.

While the ISM’s manufacturing purchasing managers’ index for June fell slightly below expectations, signalling a decline in economic activity, investors will be closely watching job market data later in the week for further insights.

Data by Bloomberg

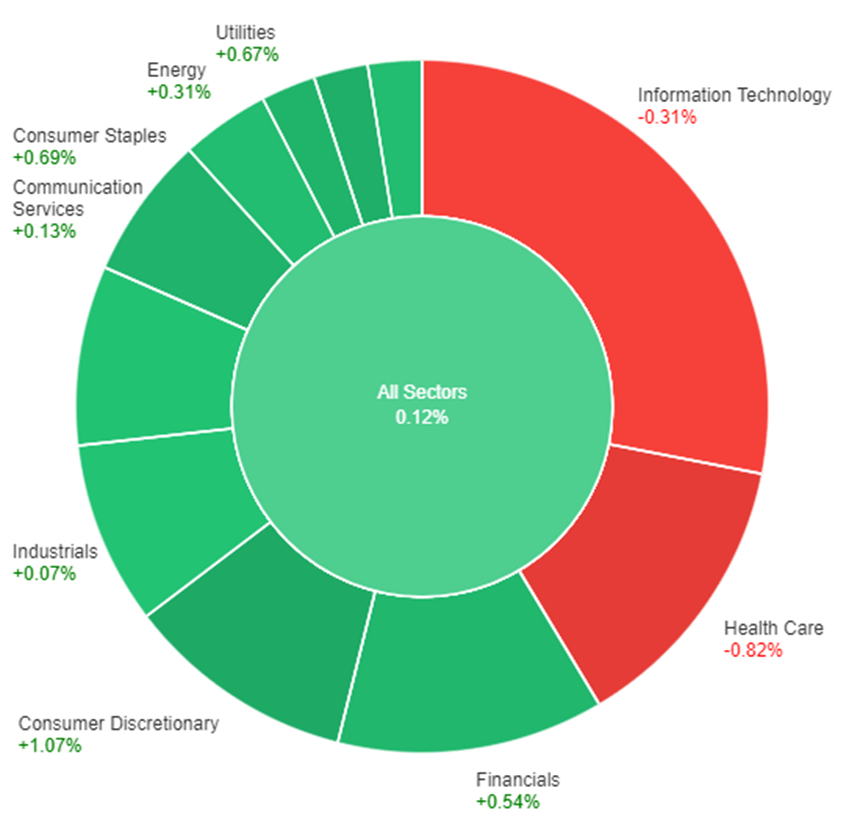

On Monday, the overall market showed a slight increase of 0.12%. Among the different sectors, Consumer Discretionary experienced the highest growth with a positive change of 1.07%, followed by Real Estate at 0.85% and Consumer Staples at 0.69%.

Utilities and Financials also saw positive gains with increases of 0.67% and 0.54% respectively. Energy and Materials both had modest growth of 0.31%. Communication Services had a minimal increase of 0.13%, while Industrials only saw a slight rise of 0.07%. On the other hand, Information Technology suffered a decline of -0.31%, and Health Care experienced the largest decrease with a negative change of -0.82%.

The dollar index initially gained in early European trading but later levelled off as Treasury yields decreased and proved to be less inflationary than anticipated. However, with significant data scheduled to be released later in the week and a U.S. holiday on Tuesday, market reactions remained limited.

The EUR/USD currency pair initially rose from 1.0870 to 1.0934 before stabilizing near unchanged levels. The final eurozone PMI manufacturing index, although slightly higher than the flash estimate, indicated caution for investors and suggested waiting for more data, especially the U.S. claims, ISM services, JOLTS, and employment report to be released later in the week.

The minutes from the Federal Reserve meeting are also set to be released on Wednesday.

USD/JPY broke through a support level that had been holding since June 16. However, despite weaker ISM data, buyers emerged around the 144 level, preventing a significant correction. For a larger correction to occur, there would need to be a retreat in the spread between Treasury and Japanese Government Bond yields.

This retreat seems plausible only if U.S. labour data turns out to be weaker than expected, reversing the trend of mostly positive outcomes.

Additionally, the British pound received a boost following the release of the ISM data, after a previous decline. Market expectations for future rate hikes by the Bank of England continue to overshadow those anticipated by the Federal Reserve.

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| AUD | Cash Rate | 12:30 | 4.10% |

| AUD | RBA Rate Statement | 12:30 | |

| USD | Bank Holiday |

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.