Spreads

Spreads

Spreads

Spreads

Spreads

What happened in the market last week?

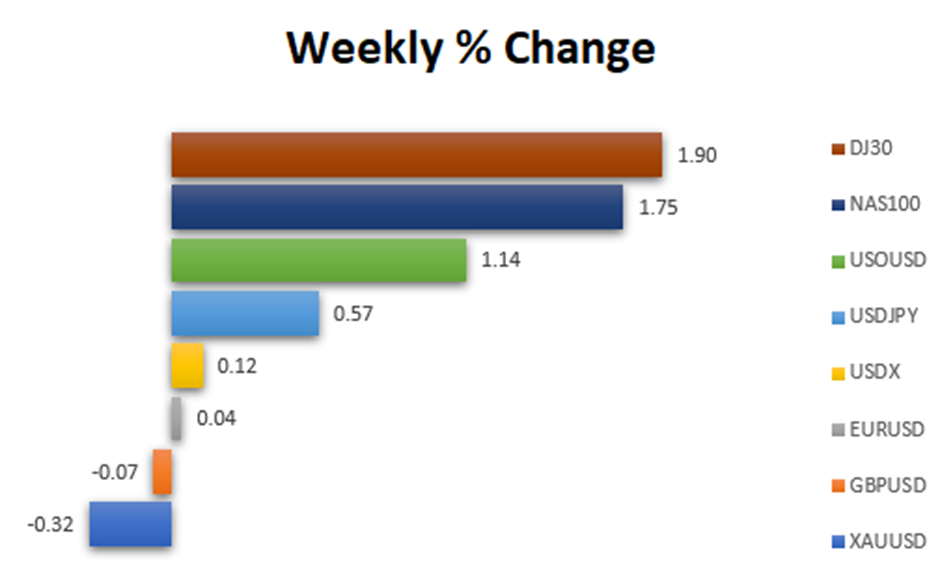

Last Week Market Pair Changes (All data is taken from the MT4 VT Markets)

The US dollar experienced a robust week as it was bolstered by economic data that surpassed projections. Unemployment claims, GDP growth, consumer confidence, and housing sales all demonstrated positive performance. With the market anticipating two additional interest rate hikes from the Federal Reserve, yields are expected to increase.

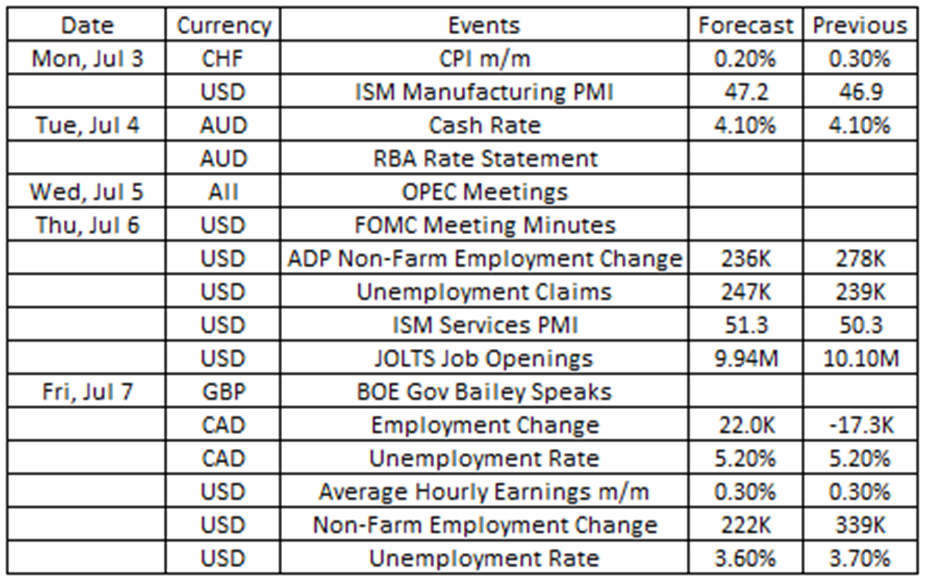

Source: VT Markets Economic Calendar

As we kick off a new week, market watchers will focus on two key events: the release of the Federal Open Market Committee (FOMC) meeting minutes and the US jobs reports. Both have the potential to influence market trends significantly and offer vital insights into the health of the US economy.

Switzerland’s CPI increased by 0.30% in May 2023 from the previous month.

For June 2023 data, which is set to be released on 3 July, analysts expect a 0.2% increase.

Takeaway: The upcoming release of Switzerland’s Consumer Price Index (CPI) is set to be a significant influence on the Swiss Franc. This CPI data will shed light on the state of inflation within the country. Predicted figures suggest a potential slowdown in inflation, which could potentially lead to a depreciation of the Swiss Franc.

The US ISM Manufacturing PMI fell to 46.9 in May of 2023 from 47.1 in April.

Analysts predict that for June 2023 data, scheduled for release on July 3rd, the index will be at 48.

Takeaway: US ISM Manufacturing PMI, a key influencer for the US Dollar, will reveal the state of the US manufacturing sector. Predictions suggest a continued contraction in this sector, which could potentially devalue the US Dollar.

The RBA unexpectedly raised its cash rate to 4.1% in June, following a similar hike in May. The door remains open for further increases due to persistently high inflation and rising wage growth.

The next cash rate will be released on 4 July 2023, with analysts expecting the central bank to hold its interest rate at 4.1%.

Takeaway: The Reserve Bank of Australia’s (RBA) forthcoming interest rate decision is expected to cause significant Australian Dollar volatility. This decision will reveal Australia’s economic status. Market predictions suggest the RBA will hold the current interest rate, which could potentially devalue the Australian Dollar.

Fed Chair Powell stated that multiple rate hikes are anticipated this year to combat inflation. The Fed has already raised the policy rate by 5 points since last year, impacting areas like housing and investment.

While the funds rate target remained the same in June, there could be a rise to 5.6% by year-end if economic and inflation rates don’t decelerate.

Takeaway: The minutes from the previous Federal Open Market Committee (FOMC) meeting are due for release, offering deeper insights into the Fed’s decisions and future plans. It’s expected that these minutes could potentially impact the US Dollar, particularly if any changes or updates were discussed at the meeting.

The US ISM Services PMI fell to 50.3 in May 2023 from 51.9 in April, pointing to the fifth consecutive month of expansion in the services sector, but the slowest in the current sequence.

Data for June 2023 is scheduled for release on 6 July 2023, with analysts anticipating a higher figure of 50.

Takeaway: The upcoming PMI data will shed light on the state of the US services industry. Forecasts suggest the sector continues to expand, which could potentially strengthen the US Dollar.

The Canadian economy shed 17.3K jobs in May 2023, the first decline in nine months. The unemployment rate rose to 5.2% after remaining at 5% for the five previous months, the first monthly increase in the unemployment rate since August 2022.

Analysts predict the June 2023 data, due on 7 July 2023, will show a further job loss of 10,000 and a rise in the unemployment rate to 5.4%.

Takeaway: Predicted figures suggest potential job losses and a rise in unemployment, which could potentially devalue the Canadian Dollar.

The US economy unexpectedly added 339K jobs in May 2023, the most in four months. Concurrently, the unemployment rate increased to 3.7% in May 2023, the highest since October 2022. A

Analysts predict that for June 2023, set to be released on 7 July, Non-Farm Employment will add approximately 250k jobs, with the unemployment rate remaining steady at 3.7%.

Takeaway: The upcoming US Jobs report, a key determinant for the US Dollar, will reveal data on non-farm employment changes, unemployment rates, and average hourly earnings in the US. Predictions suggest a potential strengthening of the US Dollar based on these figures.