Spreads

Spreads

Spreads

Spreads

Spreads

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.

The Dow Jones Industrial Average experienced gains as major banks passed the Federal Reserve’s stress test, while an upward revision of the GDP provided relief against recession concerns. The 30-stock index surged by 0.8%, gaining 269.76 points to close at 34,122.42.

JPMorgan Chase, Goldman Sachs, Wells Fargo, and other financial stocks saw significant increases, with each rising by more than 3% and 4.5% respectively. Positive economic data, including an upward revision in first-quarter GDP and a drop in weekly jobless claims, contributed to the overall sentiment of economic resilience. Despite the strong first half of the year, some caution is advised as Wall Street prepares for a potentially volatile second half.

The S&P 500, up by 14.5% this year, is on track for its best monthly performance since January. The Nasdaq Composite, driven by optimism surrounding artificial intelligence, has climbed nearly 30% and is poised for its best first half since 1983.

In contrast, the Dow has underperformed, with only a 2.9% increase. While the markets have shown strength, experts anticipate the possibility of consolidation and urge investors to utilize market volatility to position themselves for a broader recovery.

Overall, the passing of the stress test and positive economic indicators have contributed to a positive sentiment in the market, but caution remains as Wall Street prepares for potential market fluctuations in the second half of the year.

Data by Bloomberg

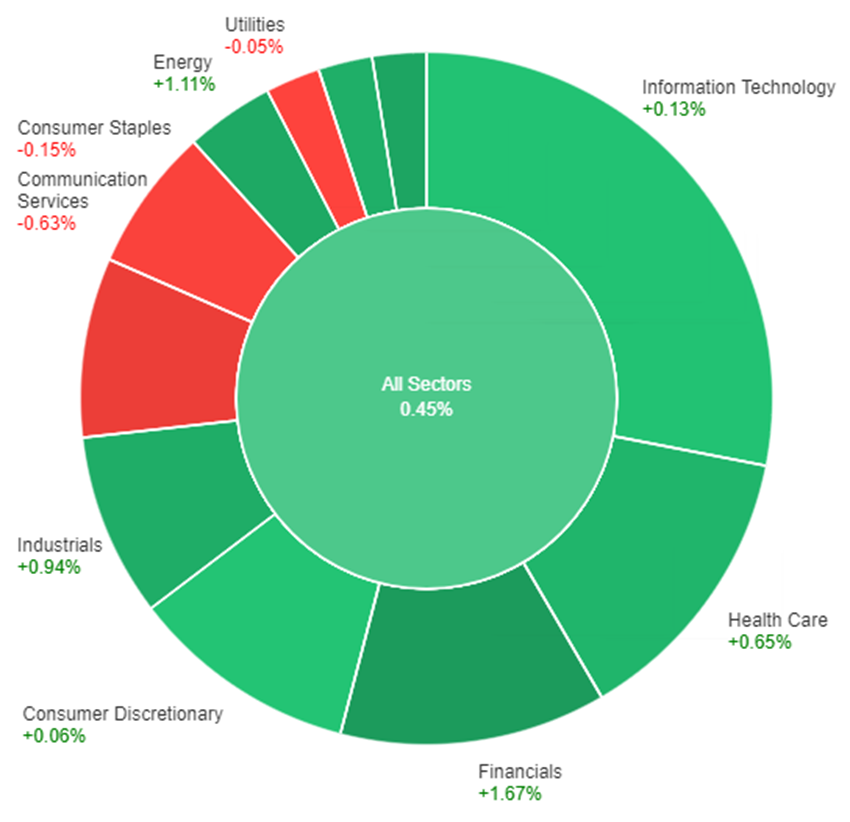

On Thursday, the stock market showed a generally positive performance across various sectors. The overall market, represented by the All-Sectors index, rose by 0.45%. The Financials sector led the gains with a strong increase of 1.67%, followed by Materials with a rise of 1.27% and Energy with a gain of 1.11%.

Industrials also performed well, showing a growth of 0.94%. Real Estate and Health Care sectors exhibited moderate gains of 0.87% and 0.65% respectively. Information Technology experienced a slight increase of 0.13%, while Consumer Discretionary showed a minimal rise of 0.06%.

However, some sectors faced a decline in value. Utilities experienced a slight decrease of 0.05%, while Consumer Staples saw a more notable decline of 0.15%. The Communication Services sector showed the largest decrease among the sectors, with a decline of 0.63%.

Overall, the stock market on Thursday displayed a positive performance, with notable gains in the Financials, Materials, and Energy sectors. The declines in the Utilities, Consumer Staples, and Communication Services sectors represented a small portion of the overall market movement.

The dollar index experienced a 0.34% increase as a result of the upward revision of Q1 GDP and the anticipation of two more rate hikes, causing 2-year Treasury yields to surge by 15 basis points. This surge brought the yields closer to the peak observed in March before the banking crisis.

Two-year bund yields also rose by 7 basis points and are approaching their March highs at 3.395%, while 2-year Treasury yields reached a peak of 5.084% in March. Eurozone core inflation for June is forecasted to be 6.7% year-on-year, slightly lower than the previous figure of 6.9%, and U.S. May core PCE is expected to remain at 4.7%.

However, the core PCE is currently at its highest level since December, while eurozone core inflation, if it meets the forecast, would be at its lowest since December.

The disparity between the European Central Bank’s rates at 3.5% and the inflation rate remains significant, whereas the Federal Reserve’s target range of 5.0-5.25% is higher than the core PCE. Considering the overall economic data, the dollar has benefited from the divergent performance of the eurozone and the United States, which may result in less negative bund-Treasury yield spreads and a potentially higher EUR/USD exchange rate.

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| CAD | Gross Domestic Products | 20:30 | 0.2% |

| USD | Core PCE Price Index | 20:30 | 0.3% |

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.