Spreads

Spreads

Spreads

Spreads

Spreads

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.

The S&P 500 saw minimal movement on Wednesday as investors closely analyzed Federal Reserve Chair Jerome Powell’s remarks regarding future monetary policy. Powell emphasized the likelihood of more restrictive measures to combat inflation, including potential consecutive interest rate hikes.

His comments, made at the ECB Forum on Central Banking, alongside other global central bankers, had a mixed impact on the markets.

While the Dow Jones Industrial Average declined by 0.22%, and the S&P 500 dipped slightly by 0.04%, the Nasdaq Composite bucked the trend and closed higher for a second consecutive day. This was driven by the positive performance of tech giants such as Alphabet and Tesla, which saw gains of over 1% and 2% respectively, while Netflix shares surged by more than 3%.

These results contributed to the Nasdaq Composite’s impressive year-to-date increase of nearly 30%, leading to its strongest first half in four decades.

The divergent outcomes on Wall Street reflected a tug-of-war between market optimism and concerns over prolonged low-interest rates. Despite the potential headwinds caused by discussions of future monetary policy, investors remained optimistic, particularly in the tech sector, riding the wave of excitement surrounding artificial intelligence, and propelling the market to significant gains in the first half of the year.

Data by Bloomberg

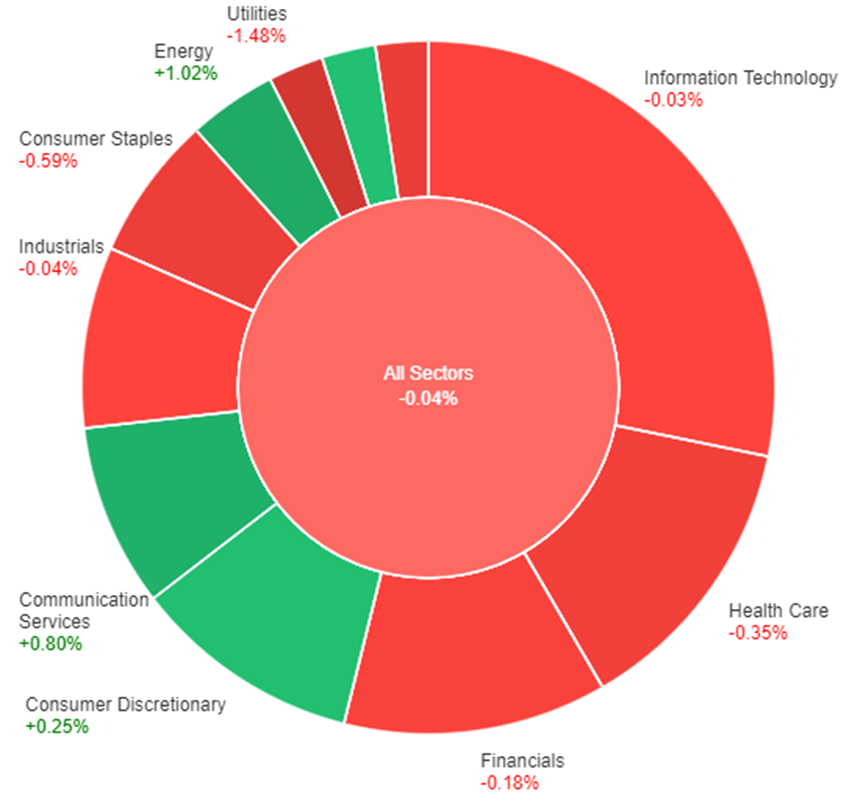

On Wednesday, the overall market saw a slight decline of 0.04%. The energy sector performed well, experiencing a gain of 1.02%, followed by communication services with a rise of 0.80%. Consumer discretionary stocks also showed a modest increase of 0.25%, while real estate saw a smaller gain of 0.21%.

However, there were some sectors that experienced declines. The utilities sector had the largest decrease, dropping by 1.48%. Materials and consumer staples also saw significant declines of 0.68% and 0.59% respectively. The healthcare sector experienced a decline of 0.35%, while information technology and industrials both had small decreases of 0.03% and 0.04% respectively. Financials also declined, albeit to a lesser extent, with a decrease of 0.18%.

On Wednesday, the dollar index strengthened by 0.4% as weaker economic indicators in the eurozone and other regions contrasted with generally positive U.S. data. The eurozone displayed signs of economic weakness, and concerns were raised about the effectiveness of government stimulus measures in boosting the economy and commodity currencies.

In contrast, U.S. data released on Tuesday showed positive results. The market briefly responded to hawkish remarks made at the European Central Bank’s conference, but overall, the focus remained on data dependence. The upcoming days will feature inflation data from both the eurozone and the U.S., as well as jobless claims.

Sterling experienced a decline of 0.8% amid the Bank of England’s dilemma in managing inflation. The USD/JPY pair, despite some fluctuations, maintained its rally since the June meetings of the Federal Reserve and the Bank of Japan, with uncertainty injected by the Japanese side.

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| EUR | German Prelim CPI m/m | Tentative | 0.2% |

| USD | FED Chair Powell Speaks | 14:30 | |

| USD | Final GDP q/q | 20:30 | 1.4% |

| USD | Unemployment Claims | 20:30 | 264K |

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.