Spreads

Spreads

Spreads

Spreads

Spreads

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.

In a much-needed boost for the market, the Dow Jones Industrial Average rebounded after a seven-day slump, as investors embraced tech stocks ahead of the end of the first half.

The index gained 0.63%, or 212.03 points, closing at 33,926.74. The S&P 500 and Nasdaq Composite also experienced substantial gains of 1.15% and 1.65% respectively, signalling renewed investor confidence.

Tech giants such as Nvidia, Meta Platforms, and Microsoft spearheaded the market rally, reversing the previous day’s downturn and propelling the tech-heavy Nasdaq to surge.

Additionally, consumer discretionary and travel stocks saw significant gains, driven by Delta Air Lines’ improved financial guidance, resulting in a remarkable 6.8% increase in the airline’s stock.

However, Walgreens faced a downturn of 9.3% due to a cut in its full-year profit guidance and weaker-than-expected earnings.

Despite concerns of an impending recession, the market found solace in promising economic data. May durable goods unexpectedly increased, consumer confidence exceeded expectations in June, and new home sales surpassed forecasts.

These indicators suggested that the economy remained on solid ground, dampening recession fears. As the second quarter and first half of 2023 concluded, the Nasdaq emerges as the top performer, with a 29.5% gain for the year and a remarkable 10.9% surge since April.

The S&P 500 and Dow are also set to close the quarter with gains of around 6.6% and 2%, respectively, while the month of June itself is on track to deliver a nearly 5% increase for the S&P 500 and Nasdaq, and a 3.1% advance for the Dow.

Data by Bloomberg

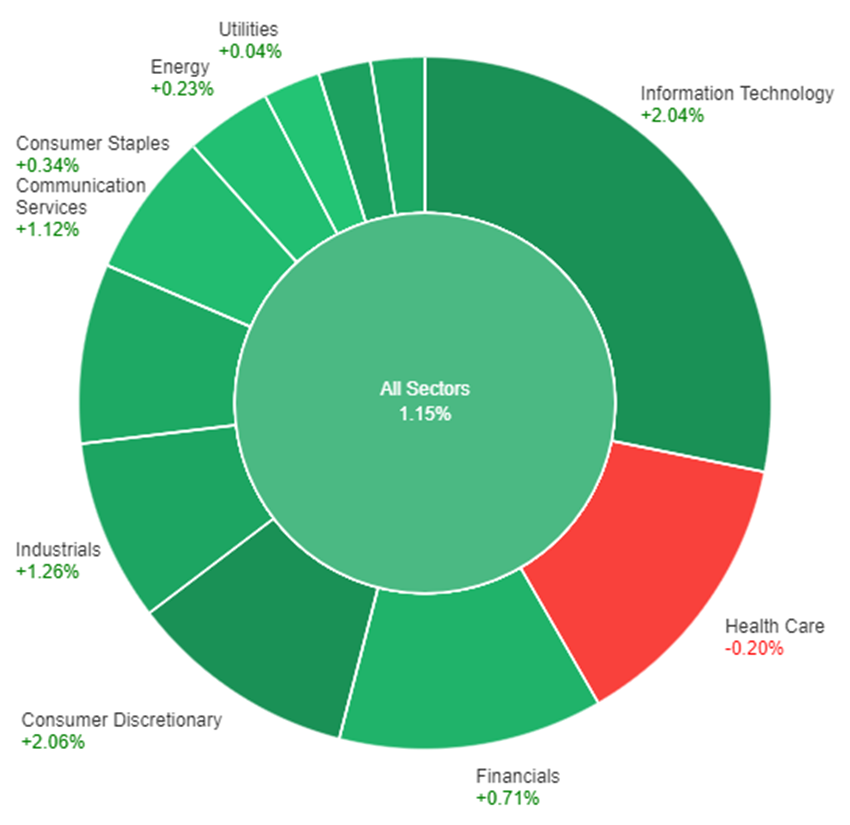

On Tuesday, the overall market showed a positive trend with a gain of 1.15%. The Consumer Discretionary sector performed well, with a significant increase of 2.06%. Similarly, the Information Technology sector also had a strong day, rising by 2.04%.

The Materials sector experienced a gain of 1.40%, while the Industrials and Communication Services sectors saw increases of 1.26% and 1.12%, respectively. Real Estate showed a modest gain of 1.11%, followed by Financials at 0.71%. The Consumer Staples sector had a smaller increase of 0.34%, and Energy and Utilities sectors had minor gains of 0.23% and 0.04%, respectively.

However, the Health Care sector experienced a slight decline of 0.20%. Overall, it was a positive day for the market, driven by strong performances in the Consumer Discretionary and Information Technology sectors.

The dollar index experienced a 0.24% decline, mainly due to gains in EUR/USD by 0.5%. This gain was attributed to the argument for raising rates at upcoming meetings, with reduced chances of rate cuts next year due to ongoing inflationary pressures.

However, various economic indicators such as durable goods, home prices, consumer confidence, and new home sales prevented the euro from reaching its previous high. As a result, two-year Treasury yields initially experienced losses but eventually rose by 9 basis points.

The dollar’s challenge lies in the fact that the Federal Reserve is still expected to lower rates more rapidly compared to the European Central Bank. Federal Reserve Chair Jerome Powell’s appearance at the ECB’s central banker’s conclave further underscored this expectation.

The decision to pause the June rate hike has made it difficult to anticipate more than one additional rate hike unless significant US data, such as the Personal Consumption Expenditures (PCE) and June ISM (Institute for Supply Management) reports, support it.

Sterling saw a 0.3% increase, aided by improved risk sentiment and a rise in two-year gilts yields by 0.13%. The Bank of England is attempting to catch up with persistent inflation. USD/JPY experienced a 0.35% gain due to rising Treasury yields and sustained demand for carry trades, as the Bank of Japan has maintained its ultra-easy policies this month.

The yuan remained stable, close to the level at which the Ministry of Finance intervened last year, with USD/CNH experiencing a 0.25% loss due to further adjustments by the People’s Bank of China.

AUD/USD rose by 0.2%, although it has retraced its recent highs and is mostly consolidating following last week’s decline. USD/CAD gained 0.17% with minor assistance from slightly lower-than-expected data.

Economic Data

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| AUD | Consumer Price Index | 09:30 | 5.6% (Actual) |

| GBP | BOE Gov Bailey Speaks | 21:30 | |

| JPY | BOJ Gov Ueda Speaks | 21:30 | |

| USD | FED Chair Powell Speaks | 21:30 |

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.