Spreads

Spreads

Spreads

Spreads

Spreads

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.

The Nasdaq Composite and the S&P 500 ended their three-day losing streaks on Thursday, propelled by renewed investor interest in tech stocks. The Nasdaq, a tech-heavy index, surged by 0.95% to 13,630.61, while the S&P 500 rose 0.37% to 4,381.89, with both indices closing near session highs.

In contrast, the Dow Jones Industrial Average dipped slightly by 0.01% to 33,946.71. The market appeared to be in a state of pause, noted the balance between the bull and bear market sentiments, implying increased volatility and uncertainty ahead.

Investors seized the opportunity to buy major tech stocks that experienced declines earlier in the week. Tesla’s shares, despite being downgraded by a second Wall Street bank, rebounded and closed higher. Amazon’s shares surged by over 4%, Microsoft climbed 1.8%, and Apple reached a new all-time high.

However, concerns loomed in other sectors, as Boeing supplier Spirit AeroSystems saw a significant drop of over 9% due to a halt in production caused by an upcoming worker strike. Additionally, Boeing’s shares fell by over 3%, impacting the Dow’s performance.

Wednesday’s decline in the S&P 500, which marked its worst daily performance in June, was attributed to Federal Reserve Chair Jerome Powell’s statement indicating the likelihood of further interest rate hikes to combat inflation.

Powell’s remarks disappointed investors who had hoped the central bank was nearing the end of its tightening cycle. The Bank of England also raised interest rates by 50 basis points, continuing its streak of consecutive increases. The persistence of central banks worldwide in their inflation-fighting stance, even at the expense of economic growth, contributed to the overall market weakness.

Data by Bloomberg

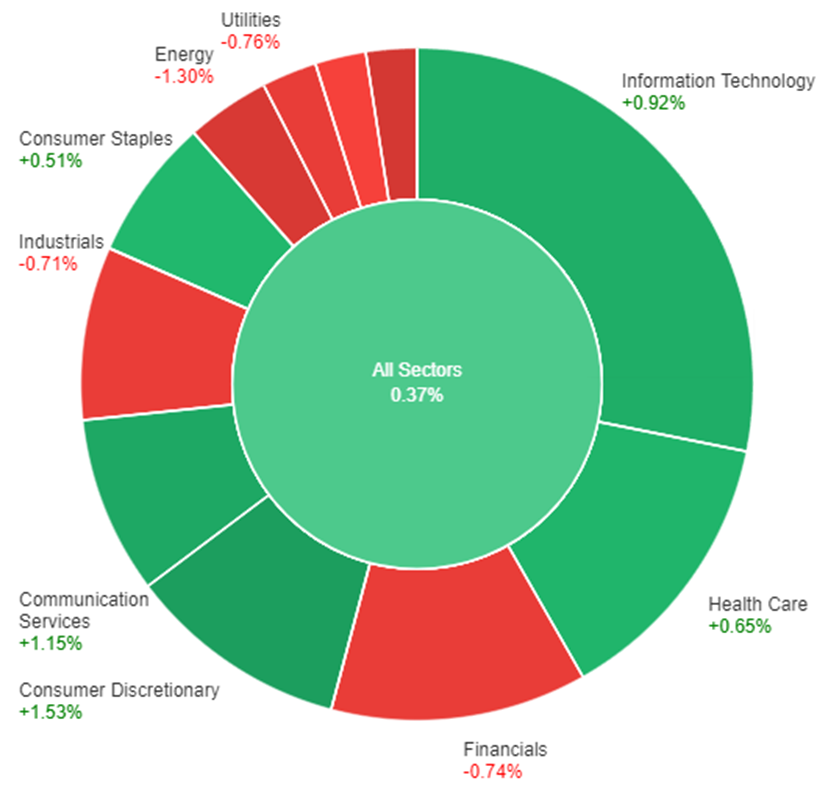

On Thursday, across all sectors, the market experienced a slight increase of 0.37%. Among the specific sectors, Consumer Discretionary showed the highest gain with a growth of 1.53%, followed by Communication Services with a rise of 1.15%, and Information Technology with an increase of 0.92%. Health Care and Consumer Staples also saw modest gains of 0.65% and 0.51%, respectively.

However, Materials and Industrials sectors both suffered declines, with Materials showing a decrease of 0.29% and Industrials experiencing a larger decline of 0.71%. Financials, Utilities, and Energy sectors all had negative performance as well, with declines of 0.74%, 0.76%, and 1.30% respectively. Real Estate had the largest decline among the sectors, with a decrease of 1.44%.

On Thursday, the oversold dollar index initially declined but later rebounded as Treasury yields rose and the Federal Reserve expressed a more hawkish stance, leading to risk-off flows. Despite the Bank of England’s aggressive 50bp rate hike and signs of high UK inflation, the pound struggled to surpass June’s highs, causing traders to take profits.

A similar setback occurred in the EUR/USD pair, which failed to make significant progress above 1.10. Concerns arose that the BoE and ECB were lagging behind in addressing inflation, potentially causing more widespread damage to the UK and eurozone economies compared to the United States.

The dollar experienced a brief decline following higher-than-expected initial jobless claims, but this reversed as continued claims came in below forecast and the Fed Chair emphasized gradual rate hikes to manage inflation without severe economic consequences. EUR/USD ended with a 0.28% loss, and GBP/USD was down 0.25% despite expectations of a 25bp rate hike. The market is monitoring the 10-day moving average as a potential support level for GBP/USD.

If the spread between 2-year gilts and Treasury yields remains positive, there may be a pullback in the pound, enticing new buyers. USD/JPY and other yen crosses reached new highs as the yen weakened due to the contrast between the Bank of Japan’s negative rates and the rising rates of other major central banks.

Technical analysis suggests a bullish close above a certain level is imminent. On Friday, market participants will pay attention to Japanese core CPI, UK retail sales, and flash PMI readings as key event risks.

In summary, the dollar index initially declined but later recovered, driven by rising Treasury yields and a hawkish Federal Reserve. The pound and EUR/USD faced setbacks despite aggressive rate hikes, raising concerns about the central banks’ ability to address inflation effectively.

The dollar experienced a temporary dip after initial jobless claims exceeded expectations but rebounded as continued claims were lower than forecasted. The yen weakened against the dollar and other currencies due to the divergence in interest rate policies among major central banks.

Technical indicators point to potential support and bullish momentum in certain currency pairs. Notable event risks on Friday include Japanese core CPI, UK retail sales, and flash PMI readings.

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| EUR | French Flash Manufacturing PMI | 15:15 | 45.4 |

| EUR | French Flash Services PMI | 15:15 | 52.2 |

| EUR | German Flash Manufacturing PMI | 15:30 | 43.6 |

| EUR | German Flash Services PMI | 15:30 | 56.3 |

| GBP | Flash Manufacturing PMI | 16:00 | 46.9 |

| GBP | Flash Services PMI | 16:00 | 54.8 |

| USD | Flash Manufacturing PMI | 21:45 | 48.6 |

| USD | Flash Services PMI | 21:45 | 53.9 |

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.