Spreads

Spreads

Spreads

Spreads

Spreads

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.

Stocks climbed as new inflation data revealed a slowdown in price pressures in May, fueling optimism among investors that the Federal Reserve might opt to forgo a rate hike during its upcoming policy decision this week. The Dow Jones Industrial Average, S&P 500, and Nasdaq Composite all experienced gains, with the latter two indices reaching their highest closing levels since April 2022.

The consumer price index for May showed a 4% year-over-year increase, the slowest annual rate since March 2021, prompting traders to increase their bets on the Fed maintaining the current target rate of 5% to 5.25%. This sentiment was further supported by market expectations and speculation of a “skip” rather than an extended pause in rate hikes.

Tech shares, in particular, led the market surge, benefiting from the positive outlook driven by easing inflation and interest rates. Oracle shares saw a 0.2% increase following better-than-expected results for the fiscal fourth quarter, while streaming giant Netflix experienced a 2.8% climb.

Overall, the market responded favorably to the inflation data, reinforcing expectations that the Fed may adopt a cautious approach and provide further clarity on its rate hike plans to maintain stability and assess the impact of prior rate increases.

Data by Bloomberg

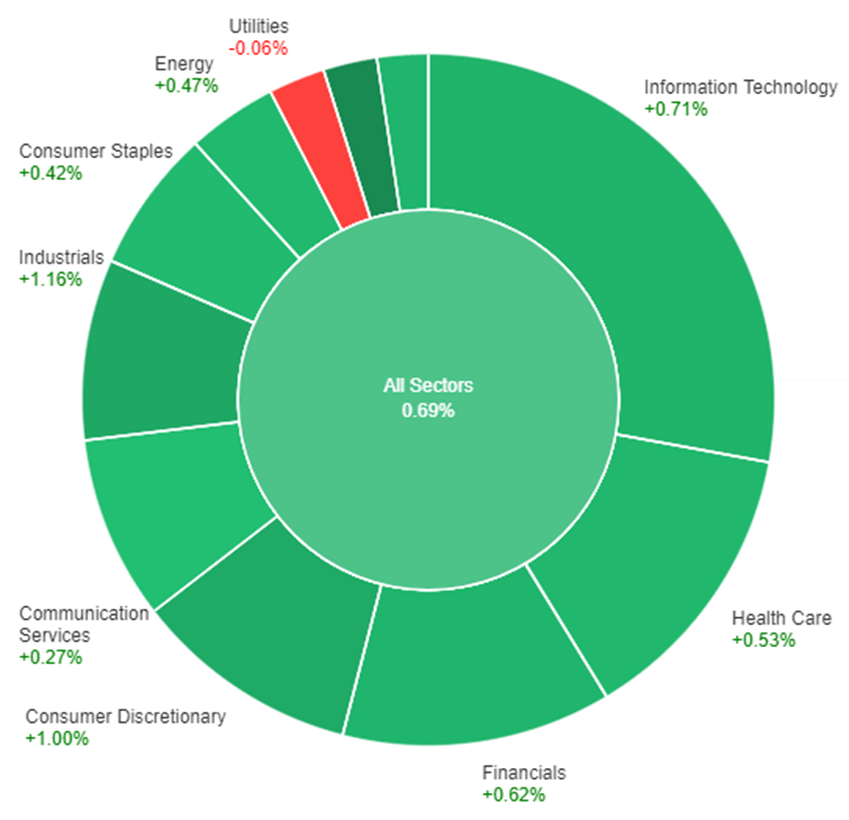

On Tuesday, the overall market showed a positive trend with a 0.69% increase across all sectors. The Materials sector had the highest gain, rising by 2.33%, followed by Industrials at 1.16% and Consumer Discretionary at 1.00%. Information Technology also saw a modest increase of 0.71%. Real Estate and Financials sectors both showed a 0.62% gain, while Health Care and Energy had smaller gains of 0.53% and 0.47%, respectively.

Consumer Staples and Communication Services sectors experienced more modest gains with increases of 0.42% and 0.27%, respectively. However, the Utilities sector showed a slight decline with a decrease of 0.06%.

Major Pair Movement

On Tuesday, the US dollar experienced a decline against the euro and sterling, as US CPI data indicated that the Federal Reserve would likely not raise interest rates during their upcoming meeting. This news also increased expectations of tighter monetary policy from the Bank of England. The dollar had already been weakening due to risk-on sentiment and pre-Fed selling.

While Treasury yields initially dropped, they later rebounded, but the dollar only managed to gain against the yuan and the yen, which had been affected by the Bank of Japan’s efforts to support economic growth. The biggest winner among the major currencies was sterling, which saw a surge after positive UK economic data, including rising average hourly earnings, increased employment, and a lower jobless rate.

EUR/USD experienced a slight gain after Treasury yields recovered, although it encountered resistance from various technical indicators. The European Central Bank is expected to raise rates at upcoming meetings but then enter a period of keeping rates steady. USD/JPY recovered with a 0.46% gain, supported by a rise in 2-year Treasury yields. To surpass previous highs, it may require a more hawkish stance from the Federal Reserve.

Overall, the US dollar faced downward pressure against major currencies on Tuesday, while sterling emerged as a strong performer due to positive economic indicators, and the outlook for central bank actions played a significant role in influencing market sentiment.

Economic Data

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| GBP | GDP m/m | 14:00 | 0.2% |

| USD | Core PPI m/m | 20:30 | 0.2% |

| USD | PPI m/m | 20:30 | -0.1% |

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.