Spreads

Spreads

Spreads

Spreads

Spreads

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.

The S&P 500 soared to its highest level in over a year as traders anticipated that the Federal Reserve would refrain from raising interest rates during their policy meeting. The index closed at 4,338.93, surpassing its previous high from August and marking the best intraday and closing levels since April 2022. The Nasdaq Composite also experienced significant gains, reaching its highest point since April 2022, while the Dow Jones Industrial Average climbed to 34,066.33.

Market expectations indicate a high probability that the Fed will skip a rate hike this month, with investors pricing in a 72% chance of no increase. While the June hike seems unlikely, the central bank may continue raising rates in the future. Inflation data, expected to show a drop in May’s consumer price index, could support the notion that inflation is receding, reinforcing the case for holding rates steady. Many anticipate that the Fed will emphasize its commitment to controlling inflation and potentially implement a final rate increase at the July meeting before pausing for the rest of the year.

The recent surge in the S&P 500, which gained over 20% from its October low, has sparked optimism among investors, signalling the end of the bear market. The index has experienced a four-week winning streak, while the Nasdaq Composite has seen an even more substantial increase, rising 33% from its 52-week low. On Monday, technology stocks, including Amazon and Tesla, led the market’s upward trajectory, with each stock gaining over 2%.

Data by Bloomberg

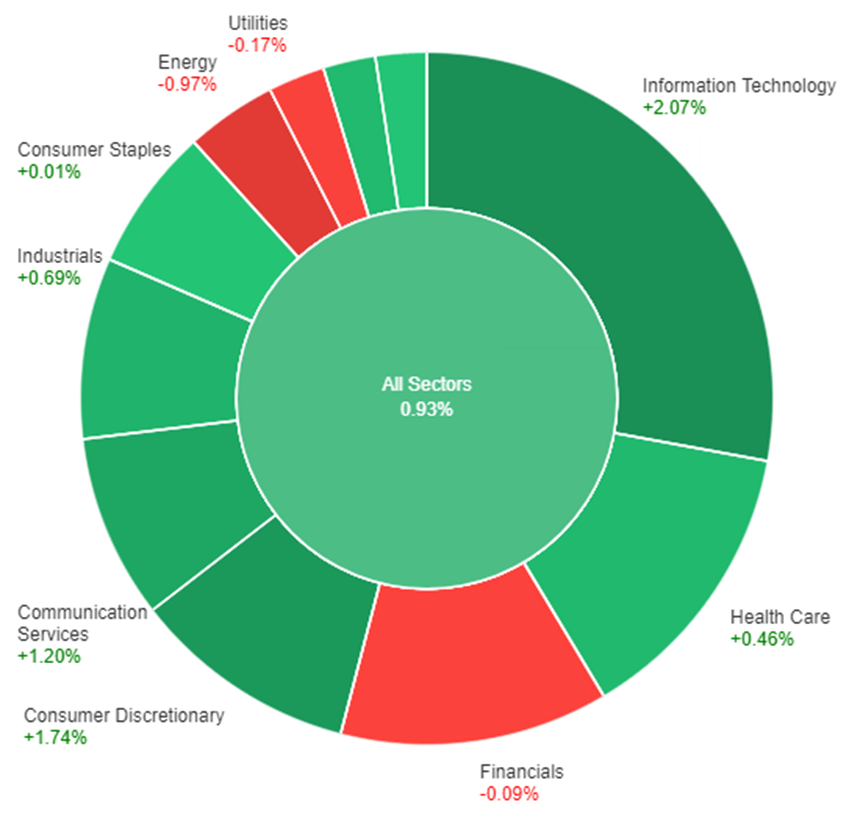

On Monday, the overall market saw a positive trend, with all sectors collectively increasing by 0.93%. The Information Technology sector performed exceptionally well, with a significant rise of 2.07%. The Consumer Discretionary and Communication Services sectors also experienced substantial gains, growing by 1.74% and 1.20% respectively. The Industrials and Health Care sectors followed suit, showing modest growth of 0.69% and 0.46% respectively. The Materials sector and Real Estate sector saw smaller increases of 0.44% and 0.03% respectively. The Consumer Staples sector and Financials sector experienced minimal gains, with a rise of only 0.01% and a slight decline of 0.09% respectively. On the other hand, the Utilities and Energy sectors faced declines, with drops of 0.17% and 0.97% respectively.

The dollar index initially declined but later recovered as Treasury yields rebounded in cautious trading ahead of the U.S. CPI release, as well as the Federal Reserve and European Central Bank meetings. The dollar and yields received a boost from a sizable $72 billion Treasury issuance, while billionaire investor Ray Dalio expressed concerns about a forthcoming financial crisis and suggested equities would outperform risky U.S. Treasuries. Following the auctions, EUR/USD remained largely unchanged, and the yield curve steepened, with 2s remaining flat and a 2.5 basis point increase in 10s.

Market expectations continue to support the Fed’s guidance of skipping a rate hike this week, with another 25-basis point increase likely in July and potential cuts starting in December, though significantly lower than initial projections in early May. The ECB is priced for a 25-basis point rate hike on Thursday, followed by another in July, and a rate cut is expected by April. Sterling experienced the most notable movement among major currencies, falling by 0.63% due to surging gilts yields and increasing UK political risk. The Bank of England is still seen as needing to raise rates by at least another 100 basis points to address inflation concerns, with average hourly earnings forecasted to rise in Tuesday’s April employment report.

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| GBP | Claimant Count Change | 14:00 | 21.4K |

| USD | Consumer Price Index m/m | 20:30 | 0.2% |

| USD | Consumer Price Index y/y | 20:30 | 4.1% |

| USD | Core Consumer Price Index m/m | 20:30 | 0.4% |

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.