Spreads

Spreads

Spreads

Spreads

Spreads

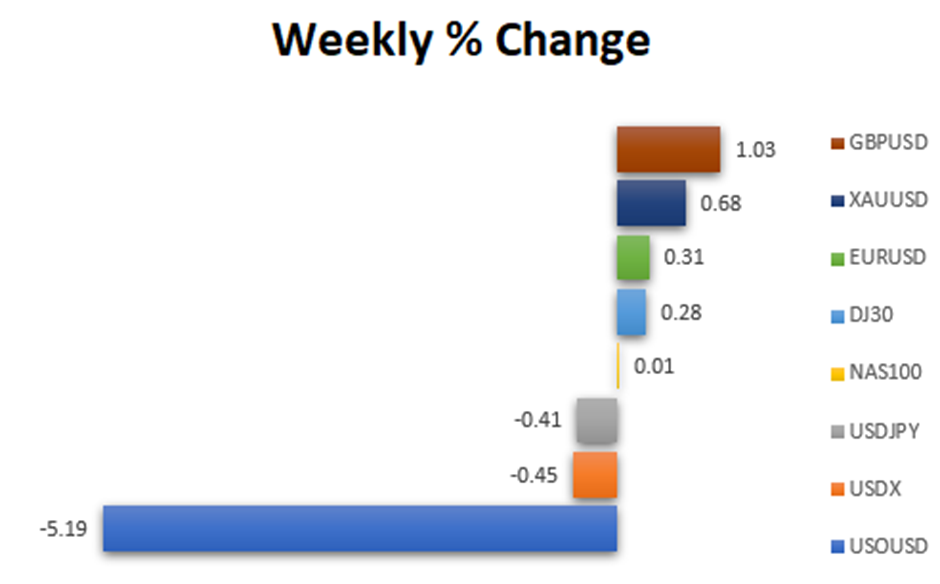

Last Week Market Pair Changes (All data is taken from the MT4 VT Markets)

The US Dollar (DXY) experienced a minor decrease during a week of low volatility, as the market anticipates the upcoming Federal Reserve rate decision.

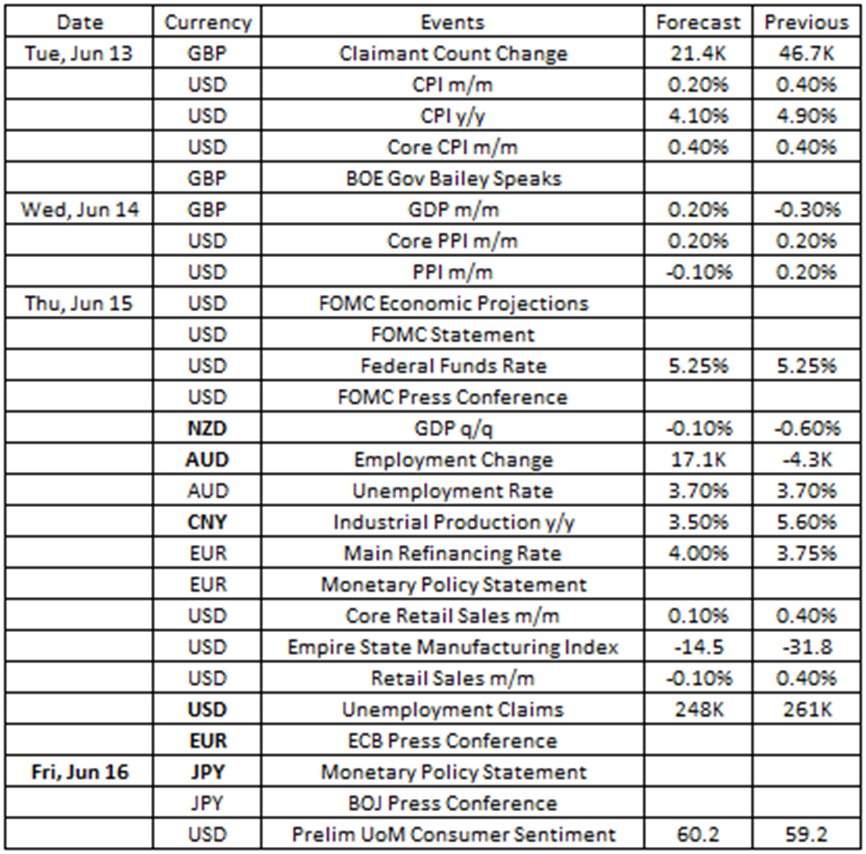

Source: VT Markets Economic Calendar

In the week ahead, market participants will be closely monitoring several vital economic events, including interest rate decisions by major central banks and the release of US Producer Price Index (PPI) and Consumer Price Index (CPI) data.

Market watchers and financial experts are expected to pay close attention to these releases, eager to understand their potential impact on financial markets and the global economy as a whole.

US CPI rose 0.4% month-over-month in April 2023, higher than the 0.1% increase seen in March.

Analysts anticipate a 0.3% rise for May data, scheduled for release on 13 June 2023.

Takeaway: This week, the US Dollar’s performance will be influenced by several economic indicators, including the Consumer Price Index (CPI), which serves as a key inflation indicator closely monitored by the market. If the data aligns with forecasts, we can expect a modest strengthening of the USD.

Producer prices for final demand in the US increased 0.2% month-over-month in April 2023, following a downwardly revised 0.4% drop in March.

For May 2023 data, set to be released on 14 June 2023, analysts expect a 0.1% increase.

Takeaway: PPI is set to be a key inflation indicator closely observed by the market this week. Should the data be released in line with forecasts, it’s likely that the USD will experience a slight strengthening.

During its May meeting, the Fed increased the Fed funds rate by 25bps, reaching a range of 5%-5.25%. This marks the 10th hike, setting borrowing costs at their highest since September 2007.

For the upcoming meeting on June 14 2023, analysts forecast that the Fed will hold the rate steady at 5.25%.

Takeaway: The FOMC Meeting and Rate Statement are the most significant events that will be closely monitored by the market this week. If the Fed maintains its current interest rates, the market’s attention will shift to its economic projections and statements, resulting in high volatility movements for the US Dollar.

In April 2023, Australia’s employment saw an unanticipated drop of 4,300, bringing the total to 13.88 million. The unemployment rate increased unexpectedly to 3.7%.

Data for May 2023 is scheduled for release on 15 June 2023, and analysts predict a 20,000 rise in employment with the unemployment rate staying at 3.7%.

Takeaway: This week, the AUD will be influenced by the release of Australia’s Employment Change data, which will be announced alongside the unemployment rate data. If the data is in line with forecasts, we can anticipate a strengthening of the AUD pairs.

During its May meeting, the ECB raised its key interest rates by 25 bps to 3.75%, signalling a slower pace of policy tightening. In a press conference, President Lagarde mentioned that the ECB still had progress to make and did not intend to halt the cycle of rate increases soon.

Analysts anticipate that for June, the central will increase its interest rates by 25 bps to 4.0%.

Takeaway: This week, the EUR pairs are expected to experience high volatility due to the ECB’s interest rate release and Lagarde’s update on the economic conditions in the EU. If the ECB continues to raise its interest rates, we can anticipate a strengthening of the EUR pairs.

Retail sales in the US increased 0.4% month-on-month in April 2023, rebounding from two consecutive months of declines.

For May 2023 data, which will be released on 15 June, analysts expect a 0.5% increase.

Takeaway: This week, the US Dollar’s performance will be influenced by several economic indicators, including Retail Sales data. If the data aligns with forecasts, we can expect a modest strengthening of the USD.

In April, the Bank of Japan unanimously voted to maintain its key short-term interest rate at -0.1% and 10-year bond yields at around 0%. They also altered guidance on their policy rate by removing references to guarding against risks from the COVID pandemic and maintaining interest rates at “current or lower levels.”

Analysts predict that for June, the rate will remain unchanged.

Takeaway: Considering the recent mixed guidance from Governor Ueda regarding the future path of inflationary growth in Japan, the consensus anticipates no change in its ultra-loose policy. If the data is released in line with forecasts, we can expect a weakening of the JPY pairs.