Spreads

Spreads

Spreads

Spreads

Spreads

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.

On Tuesday, the S&P 500 reached its highest close since the beginning of 2023, reflecting a recent rally that propelled the index to its strongest level in nine months. The broad-market index added 0.24% to finish at 4,283.85, marking its highest close since August 2022. Similarly, the Nasdaq Composite also achieved a closing high for 2023, rising 0.36% to end at 13,276.42. Meanwhile, the Dow Jones Industrial Average experienced a slight uptick of 0.03%, or 10.42 points, closing at 33,573.28, hindered by notable losses in Merck and UnitedHealth.

In other market news, Coinbase faced a significant setback as it plummeted over 12% following a lawsuit filed by the Securities and Exchange Commission (SEC) against the cryptocurrency company. The SEC accused Coinbase of operating as an unregistered broker and exchange. On a positive note, Bitcoin saw an increase of more than 6% according to CoinMetrics. Additionally, Apple shares declined by 0.2% the day after the highly anticipated unveiling of their virtual reality headset and new software at the annual Worldwide Developer Conference, despite hitting an all-time high in the previous trading session.

Data by Bloomberg

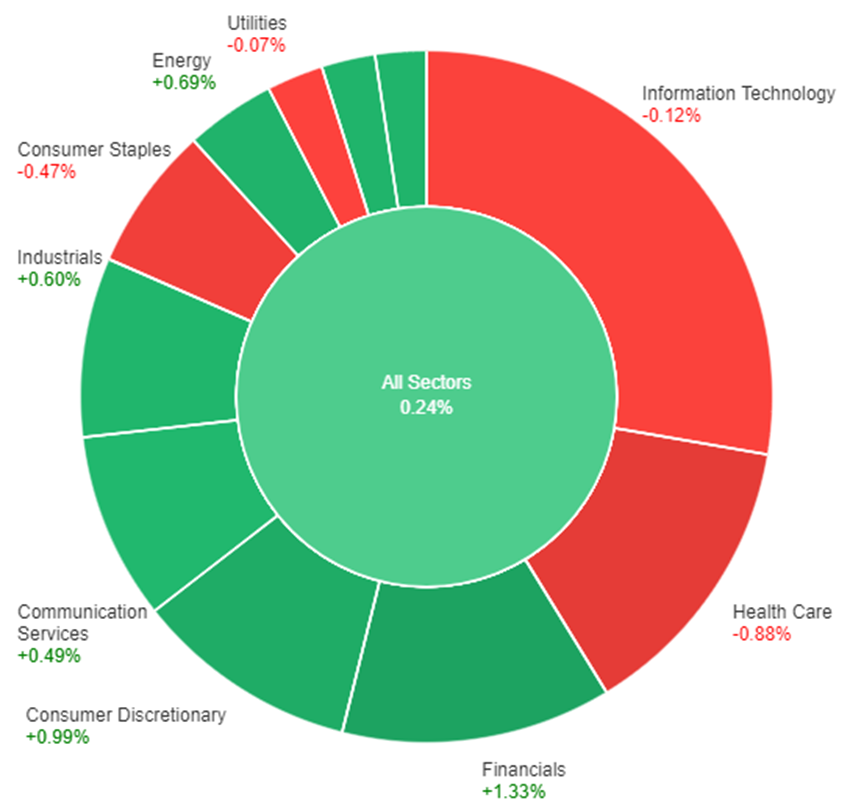

On Tuesday, the overall market experienced a positive price change of 0.24%. Among the sectors, Financials showed the highest increase with 1.33%, followed by Consumer Discretionary at 0.99%. Energy and Real Estate sectors also saw gains, with increases of 0.69% and 0.66% respectively. Materials and Industrials sectors had relatively smaller gains of 0.65% and 0.60% respectively. Communication Services showed a modest increase of 0.49%. On the other hand, Utilities experienced a slight decline of -0.07%. Information Technology and Consumer Staples also showed negative price changes, with decreases of -0.12% and -0.47% respectively. Health Care sector had the largest decrease of -0.88% on Tuesday.

On Tuesday, the US dollar (USD) strengthened due to a lack of significant risk events and a limited news calendar. The US Dollar index had a volatile trading session within a narrow range. The dollar received support from weakness in the euro (EURUSD), while positive growth forecasts for the US by Goldman Sachs and the World Bank further boosted the greenback.

Among the G10 currencies, the euro (EUR) underperformed, causing EURUSD to reach lows of 1.0668 before finding some support at a Fibonacci level. This decline followed a disappointing report on German industrial orders and a consumer survey conducted by the European Central Bank (ECB), which revealed a significant decrease in inflation expectations. Adding to the bearish sentiment were dovish comments from ECB member Knot, known for his hawkish stance, who stated that “the worst of inflation is behind us.” More ECB statements are scheduled for Wednesday, which could reinforce this cautious outlook.

The Australian dollar (AUD) stood out as the top performer among the G10 currencies after the Reserve Bank of Australia (RBA) surprised the market with a 25-basis point rate hike, bringing rates to 4.10%. The RBA’s hawkish statement, indicating the possibility of further rate increases, propelled AUDUSD to a high of 0.6685, just shy of the 200-day moving average at 0.6692. The Australian dollar held most of its gains after the announcement throughout the session.

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| AUD | Gross Domestic Product q/q | 09:30 | 0.3% |

| CAD | BOC Rate Statement | 22:00 | |

| CAD | Overnight Rate | 22:00 | 4.50% |

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.