Spreads

Spreads

Spreads

Spreads

Spreads

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.

Stocks experienced gains as the U.S. House of Representatives successfully passed a debt ceiling bill, reducing the risk of a default. Despite a 4.7% decline in Salesforce shares following their earnings report, the Dow Jones Industrial Average rose by 0.47%, closing at 33,061.57. The S&P 500 and Nasdaq Composite also reached their highest levels since August 2022, with gains of 0.99% and 1.28% respectively. With the debt ceiling issue resolved, investors now turn their attention to the upcoming Federal Reserve policy meeting and the potential impact of rising interest rates.

The bipartisan passage of the Fiscal Responsibility Act, by a vote of 314-117, brought relief to the market by removing a major negative catalyst. The Senate is expected to follow suit, ensuring the bill reaches President Biden’s desk. Analysts suggest that the equity market had already discounted the debt ceiling concerns, shifting focus to the possibility of future interest rate hikes. Meanwhile, positive economic data, including stronger-than-expected private payroll growth and lower-than-forecasted jobless claims, reinforced the market’s optimism about the economy’s recovery. Investors will closely monitor the Federal Reserve’s policy meeting for insights into the central bank’s stance on interest rates.

Data by Bloomberg

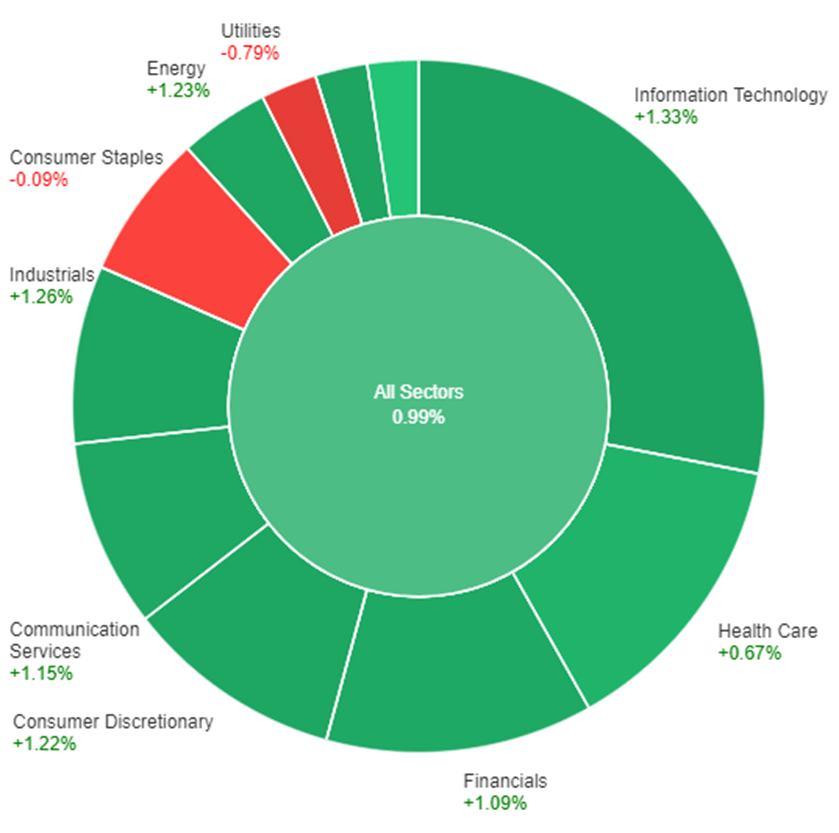

On Thursday, the stock market saw overall gains, with all sectors experiencing positive movement except for Consumer Staples and Utilities. The Information Technology sector led the way with a strong increase of 1.33%, followed closely by Industrials, Materials, and Energy, all of which saw gains above 1%. Consumer Discretionary and Communication Services also performed well, with increases of 1.22% and 1.15% respectively. Financials and Health Care sectors showed solid growth as well, with gains of 1.09% and 0.67% respectively. Real Estate had minimal movement, with a slight increase of 0.03%. However, the Consumer Staples sector experienced a slight decline of -0.09%, while Utilities saw a notable decrease of -0.78%.

On Thursday, the U.S. dollar weakened as concerns over the Federal Reserve’s rate hike cycle grew, while optimism surrounding the debt ceiling eased and U.S. economic data indicated a cooling economy. The dollar’s decline was also influenced by positive news from Europe, including better-than-expected economic indicators and the European Central Bank’s potential interest rate hikes. Additionally, the ADP report exceeded expectations, but revisions to previous job data and other economic indicators revealed a slowdown in the U.S. economy.

Investors are closely watching Friday’s payrolls data to gauge the Federal Reserve’s future actions and the impact on the dollar. If the payrolls report continues to outperform expectations, it could lead to a more bearish outlook for the dollar. Currently, a June rate hike by the Fed is seen as unlikely, and the probability of a 25 basis point hike in July is uncertain, while rate cuts are priced in for later in the year.

Meanwhile, the euro strengthened by 0.7% against the dollar, reaching its highest level in six sessions, supported by rebounding yield spreads and oversold charts. Sterling and risk-sensitive currencies like the Australian dollar also gained ground. However, the yen experienced a 0.4% loss due to declining Treasury-JGB yields and a reversal of the overbought uptrend observed in May.

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| USD | Non-Farm Employment Change | 20:30 | 193K |

| USD | Unemployment Rate | 20:30 | 3.5% |

| USD | Average Hourly Earnings | 20:30 | 0.3% |

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.