Spreads

Spreads

Spreads

Spreads

Spreads

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.

Stocks declined on Wednesday as investors closely watched the federal debt ceiling debate in Washington. The Dow Jones Industrial Average dropped 0.41%, the S&P 500 dipped 0.61%, and the Nasdaq Composite slipped 0.63%. A debt ceiling deal between President Joe Biden and House Speaker Kevin McCarthy progressed to the House floor, with a vote expected later in the day. While analysts anticipate the deal to pass, concerns remain about potential adjustments and the need for more time to reach an official agreement. Investors are also focusing on the upcoming June Federal Reserve policy meeting.

The May trading month concluded with mixed performance. The Nasdaq Composite experienced a 5.8% increase, driven by gains in artificial intelligence-related stocks and technology companies. Despite a temporary loss in month-to-date gains during Wednesday’s market sell-off, the S&P 500 closed the month with a modest 0.3% gain. In contrast, the Dow Jones Industrial Average declined by almost 3.5% in May, primarily due to significant losses in several major companies, including Nike, Walt Disney, Walgreens, 3M, Chevron, and Dow, Inc. Investors are taking precautionary measures ahead of the debt ceiling vote, securing profits before potential market volatility.

Data by Bloomberg

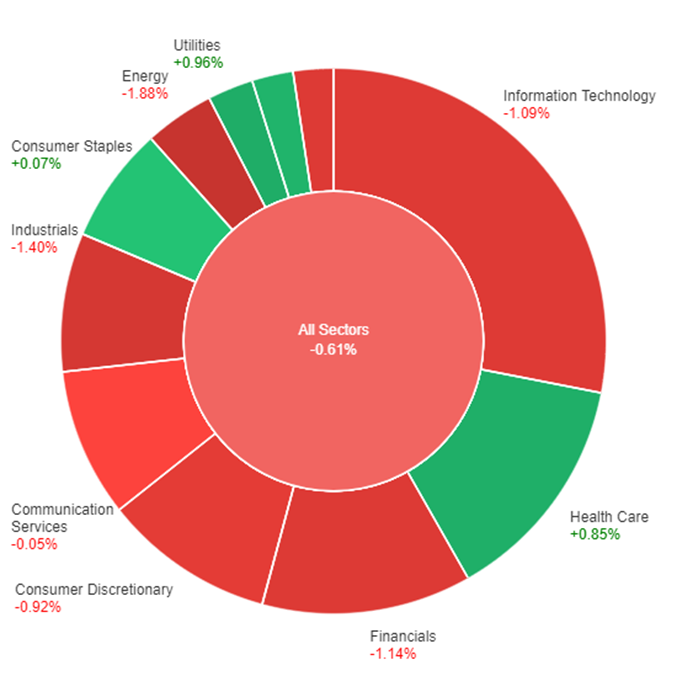

On Wednesday, the stock market experienced a mixed performance across different sectors. The Utilities sector showed a gain of 0.96%, followed by Health Care with a positive movement of 0.85%. Real Estate also saw a modest increase of 0.66%, while Consumer Staples had a slight gain of 0.07%. However, there were declines in various sectors, with Energy being the hardest hit, dropping by 1.88%. Industrials experienced a decline of 1.40%, followed by Financials at -1.14%. Information Technology and Materials both had significant losses, with decreases of 1.09% and 1.12% respectively. Consumer Discretionary also showed a negative trend, declining by 0.92%. Communication Services had a slight decrease of 0.05%. These variations reflect the sector-specific performance and market dynamics observed on Wednesday.

On Wednesday, the dollar index saw a 0.25% increase as EUR/USD declined by 0.56% due to indications of reduced need for rate hikes by the European Central Bank (ECB). Additionally, unexpected growth in U.S. job openings initially boosted the dollar, although concerns about overstating labor tightness and a negative miss in economic data tempered expectations for a June rate hike by the Federal Reserve (Fed). The dollar and yen benefited from derisking flows, while the euro, yuan, and China-linked currencies faced the most significant impact.

The market is closely monitoring the upcoming payrolls report on Friday, as it could influence the timing of rate hikes between June and July. The Fed and ECB are expected to raise rates by 25 basis points (bp) and 50bp, respectively, but the exact timing will depend on economic indicators. The yield curve inversion and hawkish Fed news weighed on banking stocks, although losses were mitigated by less hawkish signals from the Fed. EUR/USD hit a low not seen since March 20, and traders are eyeing a potential retest of 2023’s lows near 1.05. USD/JPY retreated after a brief rebound, and sterling recovered from earlier declines, posting a 0.17% increase.

Key highlights for Thursday include ADP employment data, jobless claims figures, and the ISM Manufacturing Index.

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| EUR | CPI Flash Estimate | 17:00 | 6.3% |

| USD | ADP Non-Farm Employment Change | 20:15 | 173K |

| USD | Unemployment Claims | 20:30 | 236K |

| USD | ISM Manufacturing PMI | 22:00 | 47.0 |

Make informed decisions with the most up-to-date and reliable financial data, exclusively provided by vtmarkets.com.